Welcome back to Quant Wisdom Wednesday! Today’s post is a bit of a rant but with an important message for all systematic traders: trust your system. I've historically been a terrible day trader when using discretion, but I’m working to change that by developing and trusting my fully systematized trading strategies.

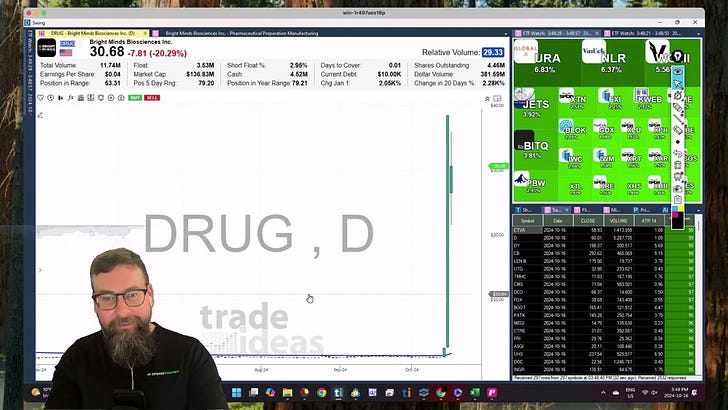

Recently, a wild stock called $DRUG shot up from $2 to $40 without news—just some Reddit or Discord pump. My system flagged a buy around $22, and despite my nerves, I followed the system. Sure enough, $22 turned out to be the low, and the stock started to rise. But what if it hadn’t? What if it had tanked further?

The key takeaway here is that, as a systematic trader, you have to trust your process, even when it feels like the worst time to place a trade. Whether the trade is a winner or loser in hindsight, following your system is the only way to ensure long-term success.

Key Lessons:

Follow the System: After thorough testing, let your system guide your trades, even when it feels risky.

Manage Risk: Ensure that losses are within your risk tolerance, and don't second-guess the system.

Capture Outlier Gains: The biggest wins often come from trades that feel the most uncomfortable.

If you’re working on building systems like me, trust the process, and if you need a solid framework, check out what we’re doing at StatsEdge Pro.`