In today’s post, we’ll explore when—and why—you might intervene with algorithmic trading systems, as well as the potential benefits and risks of doing so. Using my pullback algorithm as an example, I’ll walk through my decision-making process when the system signals an entry, but specific market conditions make me reconsider.

Key Points:

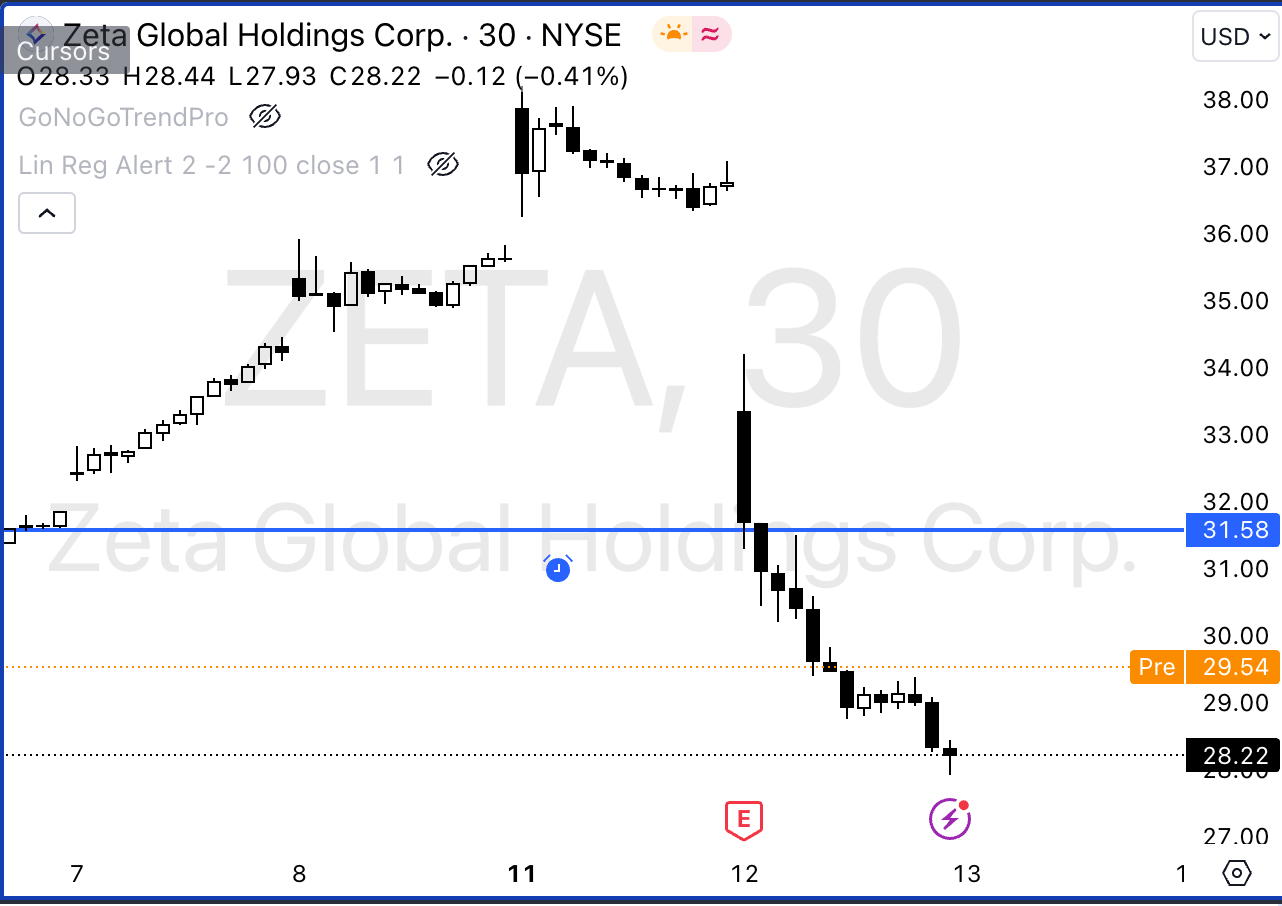

System Overview: Every weekend, I set up my strategies for the week using my StatsEdge Pro algorithms. Alerts notify me of key price levels, allowing for consistent, systematic trading.

Intervention Example: Recently, my system triggered an entry alert on Zeta after a pullback, but a post-earnings gap down made me cautious. I decided to wait and assess the market response instead of following the algorithm’s entry price precisely.

The Trade-Off: By waiting, I risk missing a profitable move if the stock quickly rallies, but I also reduce the chance of entering into unnecessary volatility. With any intervention, it’s essential to balance risk and reward consciously.