Weekend Wrap Up

Hello, everyone! Michael Nauss CMT here from statsedgetrading.com. As usual, we're taking our weekly look at the markets - regardless of the season - to discuss potential setups and scrutinize charts across crypto, stocks, and forex.

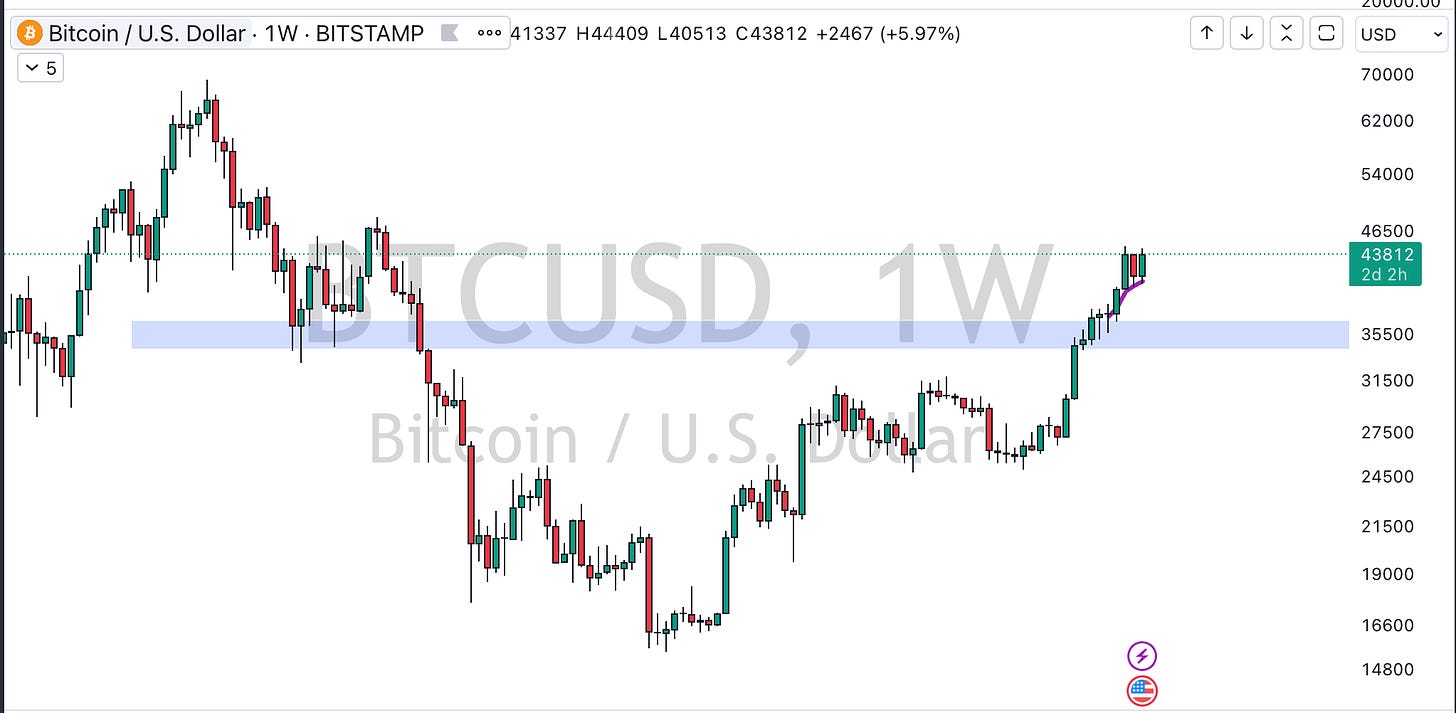

Bitcoin Breakout?

Bitcoin showed a positive trend this week, just what you hope to see for a potential breakout. Specifically, we witnessed a strong green day followed by an inside red day and then another sizeable green day. This sequence, sometimes called a "red bar ignored" or "doji sandwich," often precedes bullish moves.

My stop is below recent lows, but I may add more exposure if we decisively push above the current range. This would be an instance of "pyramiding up" - taking a core position early in a new trend with additional smaller positions to manage risk if the move continues.

Ethereum Reversal

I'm watching the anchored VWAP line on Ethereum drawn from the all-time highs. It has flip-flopped between resistance and support. A break above recent highs would signal a potential trend reversal and re-entry point for me.

Forex Fundamentals

The US dollar index logged another down week, lining up with my prediction of an imminent sell-off. We're now entering a demand zone where a bounce could shift the landscape across assets.

Gold continues to show promise after substantial breakouts. I did take a long position on today's move. However, I'm also monitoring equities for an evening star topping pattern that could change the gold thesis.

Equities Eyeing Highs

In stocks, the S&P 500 is extremely close to record highs. I'm on watch for a potential evening star reversal pattern though before chasing new highs.

More confirmation comes from mid-cap and small-cap breakouts this week in addition to momentum in metal mining stocks.

Some names I'm watching for pullback entries next week are CRISPR Therapeutics and ChargePoint.

That wraps up this weekend's analysis! Enjoy your holiday downtime and we'll reconnect on Tuesday. As always, please subscribe for ongoing email updates from statsedgetrading.com.