Analyzing Market Movements: A Focus on Cryptocurrencies and Traditional Currencies

Bitcoin: This week, Bitcoin continued to navigate around its prior highs, exhibiting some choppy behavior. The scenario suggests caution; traders should look for a decisive break in either direction before making substantial commitments.

Ethereum: In comparison to Bitcoin, Ethereum shows relative weakness, struggling even to approach its all-time highs. This trend makes it a less favorable option for those bullish on cryptocurrencies.

Euro USD: The Euro has shown some resilience, bouncing off a critical support level marked by an anchored VWAP from October 2023. The currency's slight recovery against a weakening dollar may indicate emerging opportunities in forex markets.

Gold and Silver: Gold has demonstrated strength, rebounding significantly this week and suggesting further potential upside. Silver, however, continues to exhibit relative weakness, akin to Ethereum's performance compared to Bitcoin.

Utility Stocks and Market Sentiments

The notable performance of utility stocks, typically seen as defensive investments, might suggest a cautious approach by large institutional investors. This move could imply anticipation of market volatility or a correction phase ahead.

Future Substack Product

On top of access to a private discord and a private video going through every stock on my algos, we will start with the market risk model below.

SPY is still in yellow or warning mode, but the trend remains on track. This leads me to be cautiously optimistic.

What to Watch Next Week

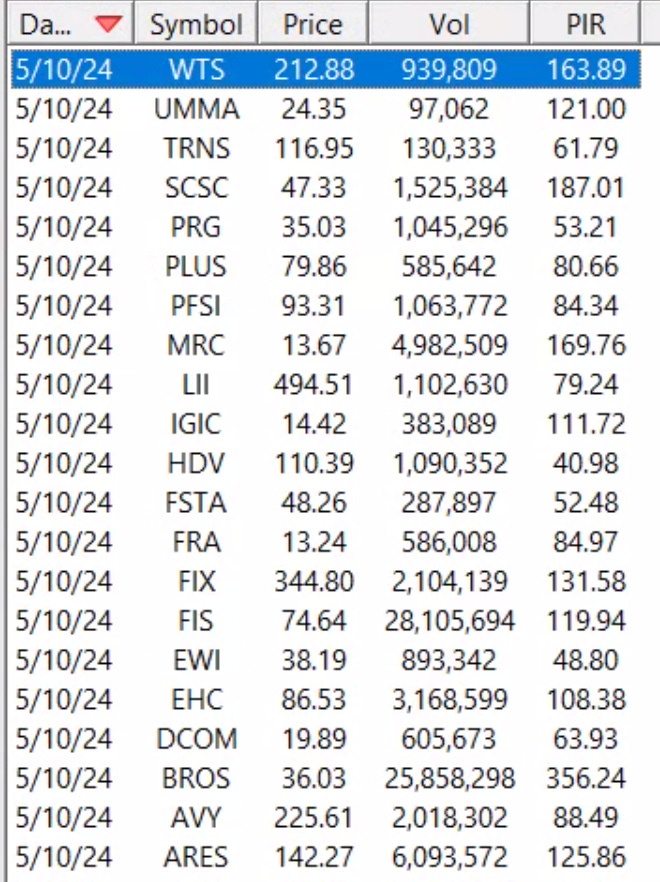

Weekly Breakout Stocks: This is a weekly breakout algo that looks for strong breakouts in strongs I really like ARES 0.00%↑ and BROS 0.00%↑

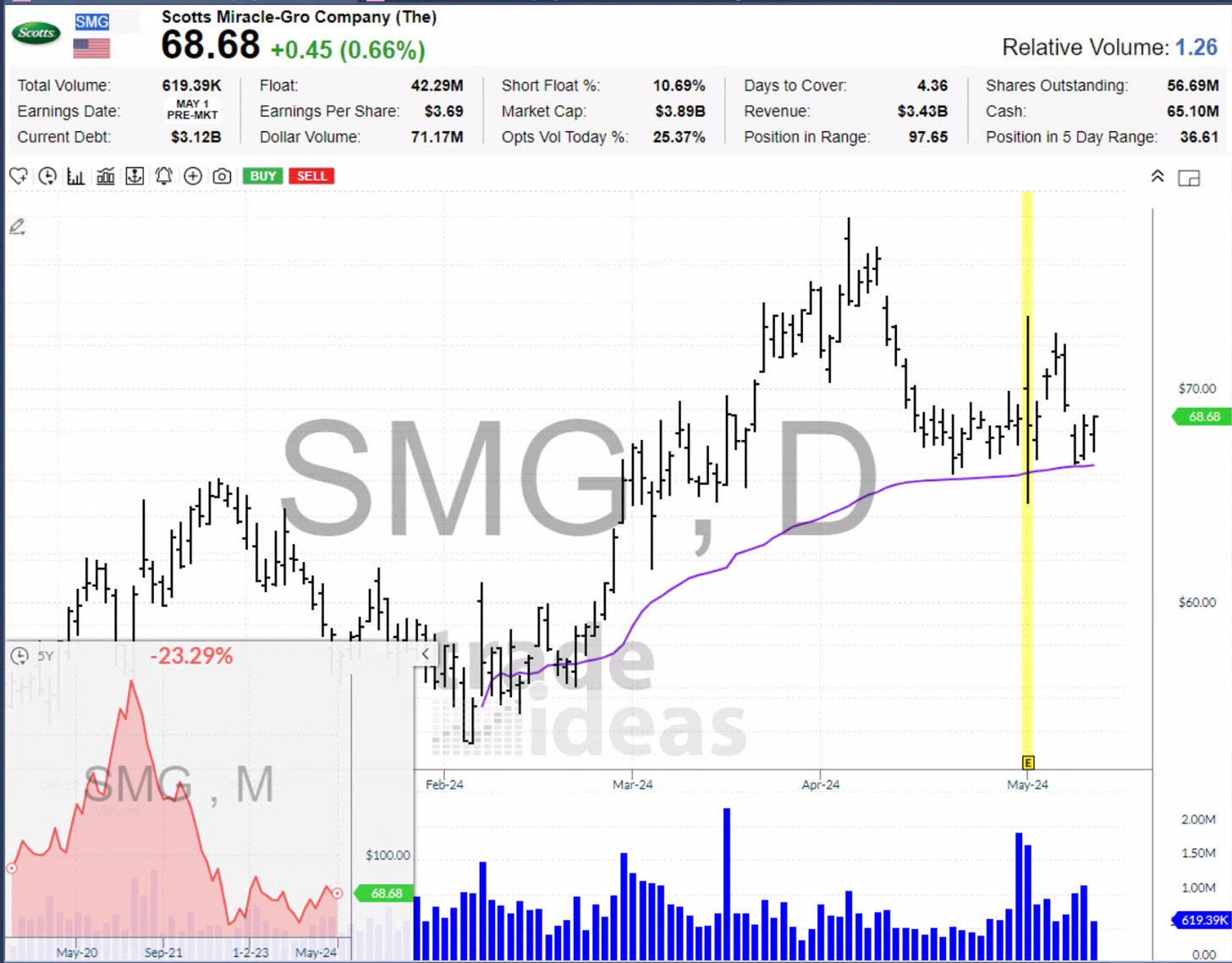

AVWAP pullback: This is a more tactical algo that is looking to time pullbacks to hold for a few days to a week. I am focusing on SMG 0.00%↑ here

If this extra content interests you, then make sure you subscribe for when we go live.