Bitcoin Analysis Bitcoin continues its downward trend after failing to break out from its all-time high. On the weekly chart, Bitcoin attempted to breach resistance but ultimately failed. We are now below key anchored VWAP levels from the all-time high and a significant low. Unless Bitcoin can retake these levels soon, it may be time to reassess and consider moving on. Ethereum, which has underperformed compared to Bitcoin, might present a short opportunity if Bitcoin continues to decline.

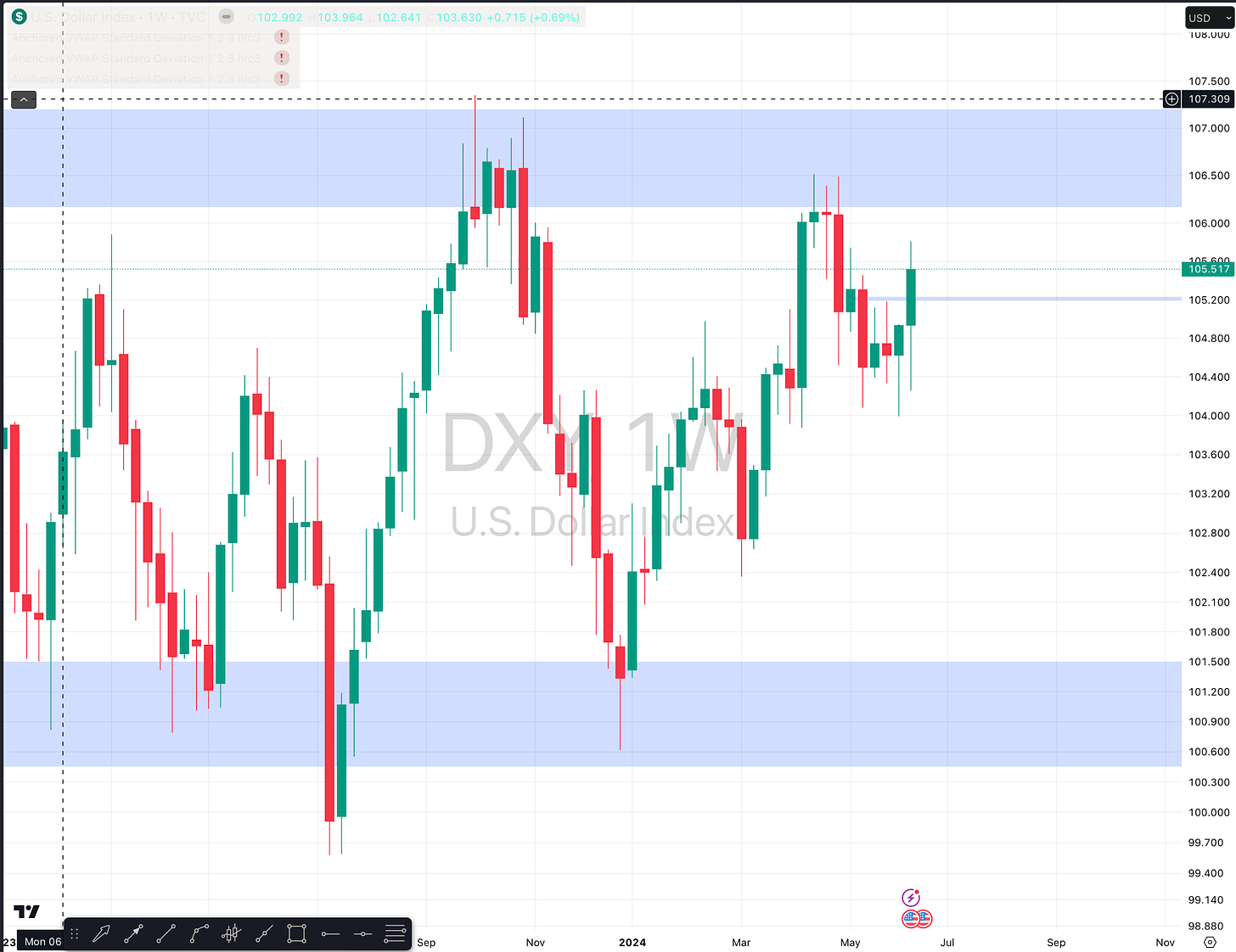

Traditional Currencies

DXY (US Dollar Index): The dollar showed some strength this week but remains within a larger range. A stronger dollar could be bearish for stocks.

EUR/USD: The Euro broke down below major anchored VWAP levels, mirroring the dollar's strength.

AUD/CAD: This pair showed a significant topping tail last week and sold off dramatically. I am short on AUD/CAD, targeting a further decline if it breaks down further from current levels.

Gold and Metals Gold has formed a concerning double topping tail on the monthly chart. On the weekly chart, gold is forming a large base. If this base holds and we see a push higher, it could be bullish for gold. However, if it breaks down below the recent low, we might see a significant pullback. I'm still bullish on gold long-term and will look for buying opportunities if it pulls back.

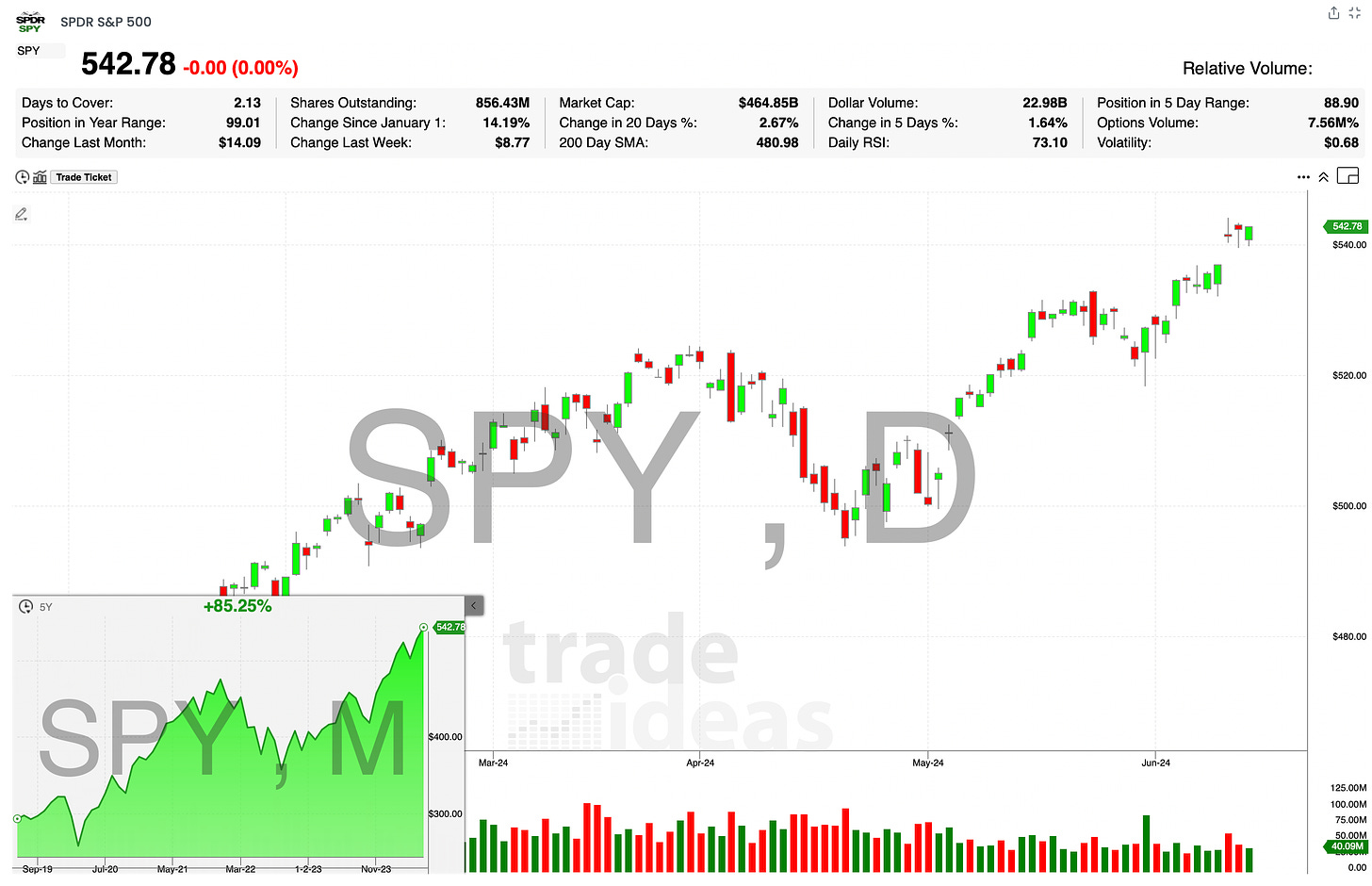

Stock Market Overview

S&P 500 (SPY): The daily chart shows a gap up followed by sideways movement. With a holiday next week, market activity might slow down. Despite a strong week overall, midcaps (MDY), small caps (IWM), and micro caps (IWC) showed weakness, indicating a heavy reliance on big tech stocks like Nvidia for market strength.

Sector Analysis: No particular sector stood out this week, but the disparity between large-cap tech and other sectors is notable.

Stock Picks

GFL Environmental (GFL): Identified by the breakout algorithm, GFL is breaking out of resistance with a strong weekly close.

Best Buy (BBY): Highlighted by the anchored VWAP pullback algorithm, BBY is holding support from its earnings gap.

Aemetis (AMTX): Needs to reclaim the anchored VWAP level quickly on Monday after breaking below it.

Melco Resorts & Entertainment (MLCO): Holding support around $7-$8, potentially pushing back up to $9.

Conclusion This week has been challenging, with significant movements in Bitcoin and some weakness in various stock sectors. Ensure you stay updated by signing up for our email list at StatsedgeTrading. Thank you for joining us, and enjoy a break from the screens after this wild week.

Thank you for tuning in, and we'll catch up next week!