Welcome again to the weekend edition of our Market Wrap-Up! I'm Michael Nauss from Statsedgetrading.com

Today, we have quite a few charts to scrutinize, and we'll delve into overall trends and weekly charts. It's time to fasten your seatbelts because we have an extensive road ahead of our breakdown.

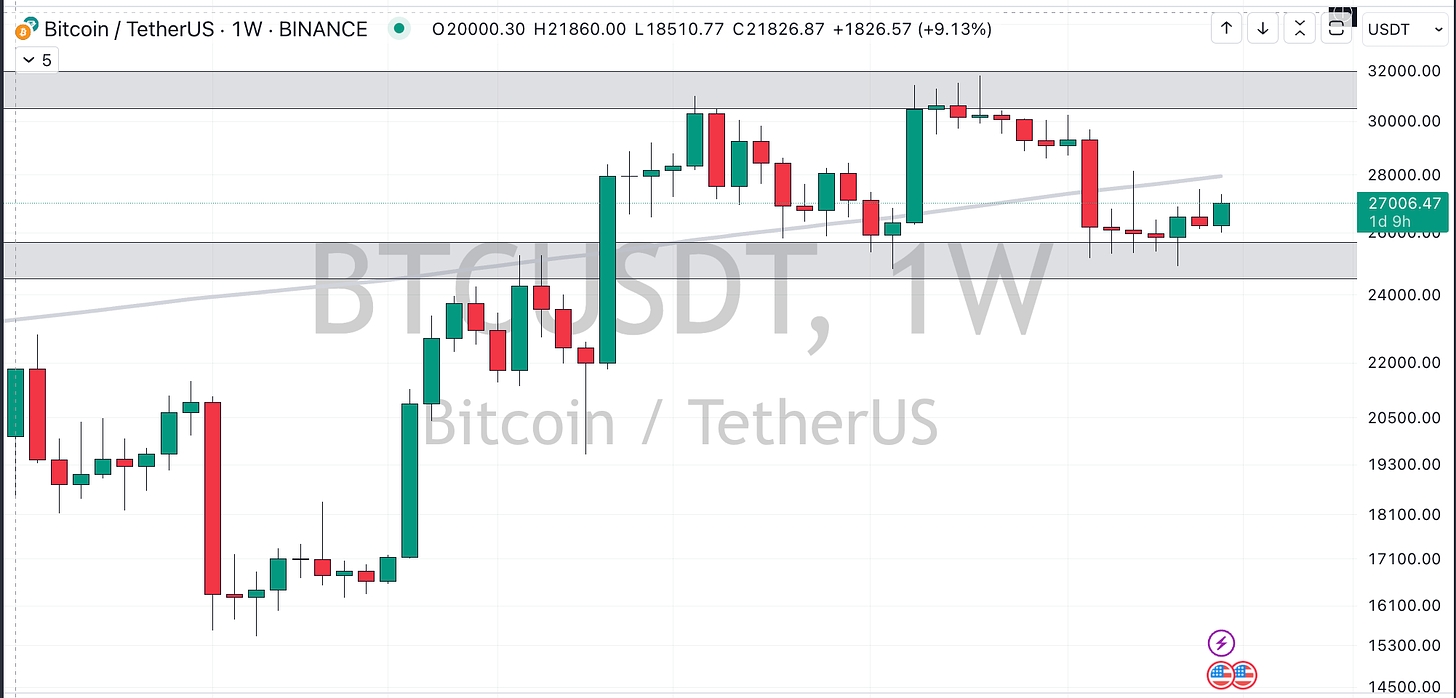

Bitcoin Market Analysis

Let's get the ball rolling with Bitcoin.

An intriguing aspect of its current situation is the six consecutive months it has been confined between a distinct high and low. It's virtually stuck in this zone and indicates a time of inaction unless you adopt a more aggressive approach, actively trading crypto, and closely analyzing short-term changes.

Bear in mind, however, that while Bitcoin remains stuck in its range, it leaves little room for trading. Best to wait for the range to resolve.

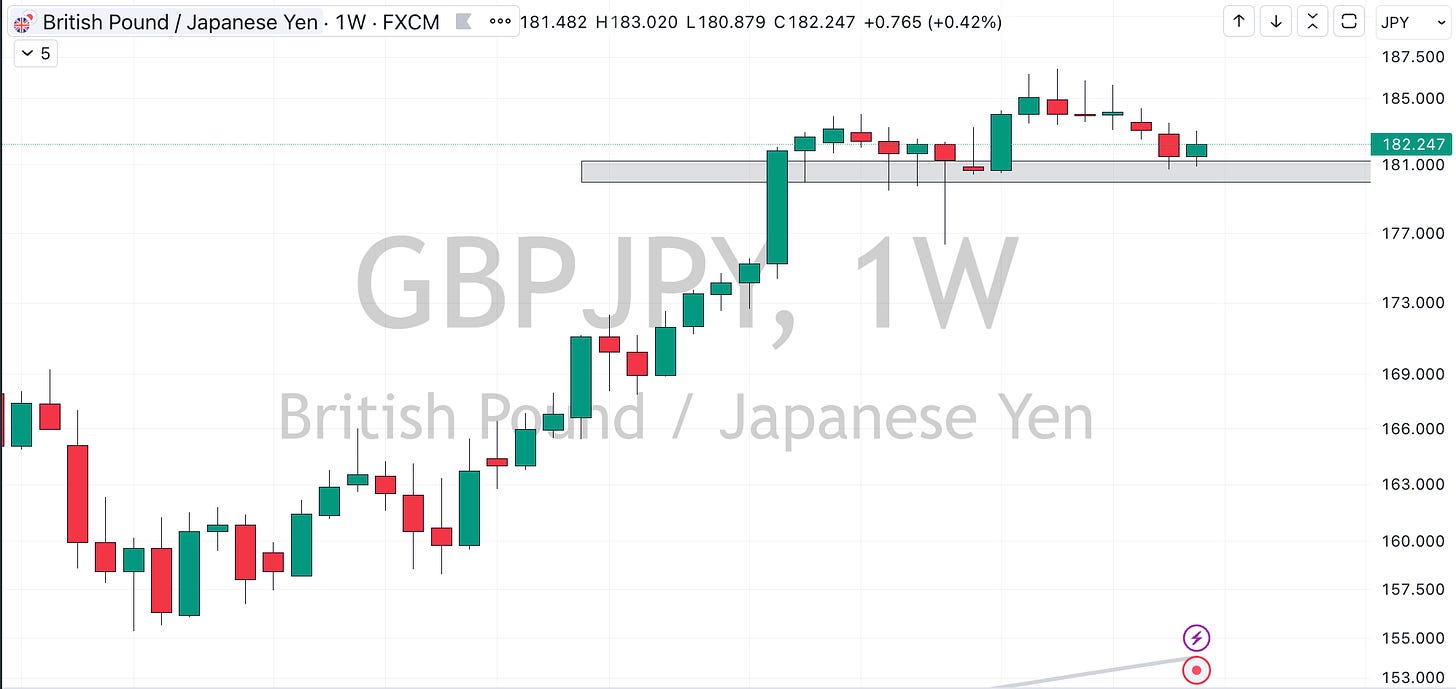

Forex Market Analysis: Pound Yen and Aussie Yen

Next in line is our analysis of the Forex market, specifically the pound yen.

Upon observation, I find the pound yen's slow pullback to the zone where it previously rebounded intriguing. I'm keen to see if we'll get a bounce like we did with the Aussie yen. It's important to note that the relative weakness in pound yen and the slight increase with Aussie yen could indicate a rollover in pound yen if the Aussie yen's increase fails. If the support breaks, we can anticipate a downward movement and observe if a bounce occurs following this breakout.

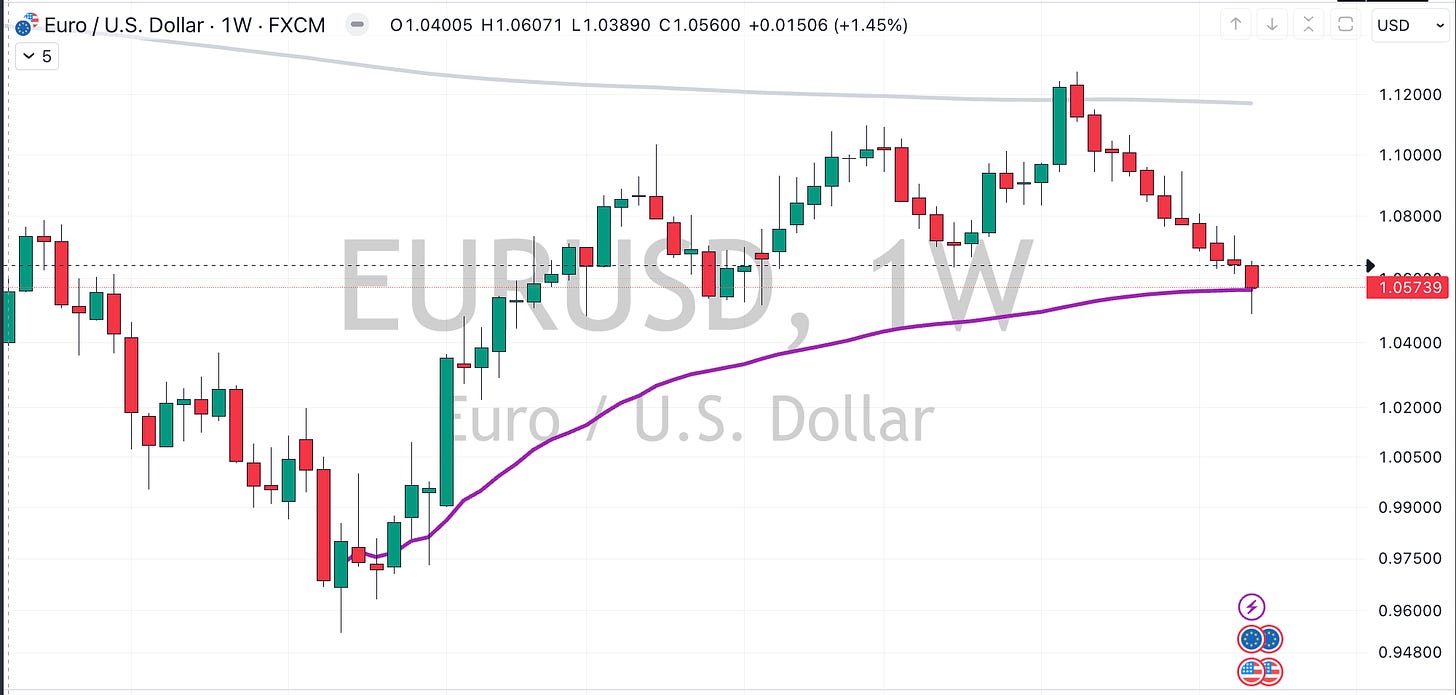

Forex Market Analysis: Euro Dollar

On the other hand, the Euro Dollar is experiencing a different dynamic where we're eleven weeks into the support for anchored VWAP from a notable low, simultaneously lining up with the support zone dating back to March. Given this situation, there's potential for a relief bounce. We're not necessarily looking at a complete recovery, but rather a minor push-up.

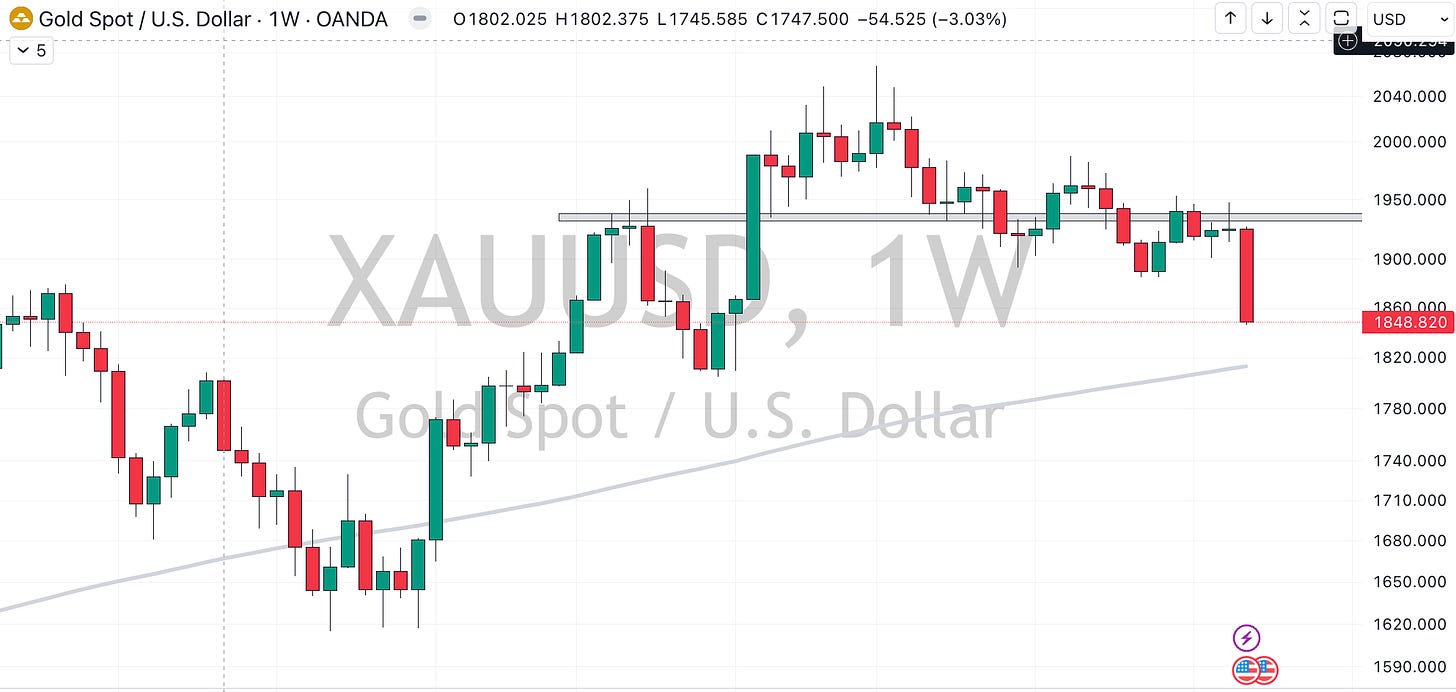

Gold Market Analysis

Our final stop in the currencies market is gold.

Gold broke down hard this week resolving that AVWAP Pinch.

Also Silver appears to be holding up marginally better than Gold, and it'll be interesting to see how this dynamic develops over the next few weeks.

Equities: The S&P 500

Moving on to equities, let's revisit the 'granddaddy' of them all, the S&P 500.

Interestingly, the zone I signified last week is still in play, with a breakout followed by a hammer candle that suggests some buying activity towards the end of the week.

Equities: JET’s

Airline ETF sold off hard the last few weeks ending at support. Looking to see if we get a bounce into next week.

A Scrutiny of Trades

As we head into the new week, I'm keeping a close eye on a selection of trades which might bear fruit depending on the mood of the market.

AVAV: A watching brief as it returns to $110 where it previously rebounded.

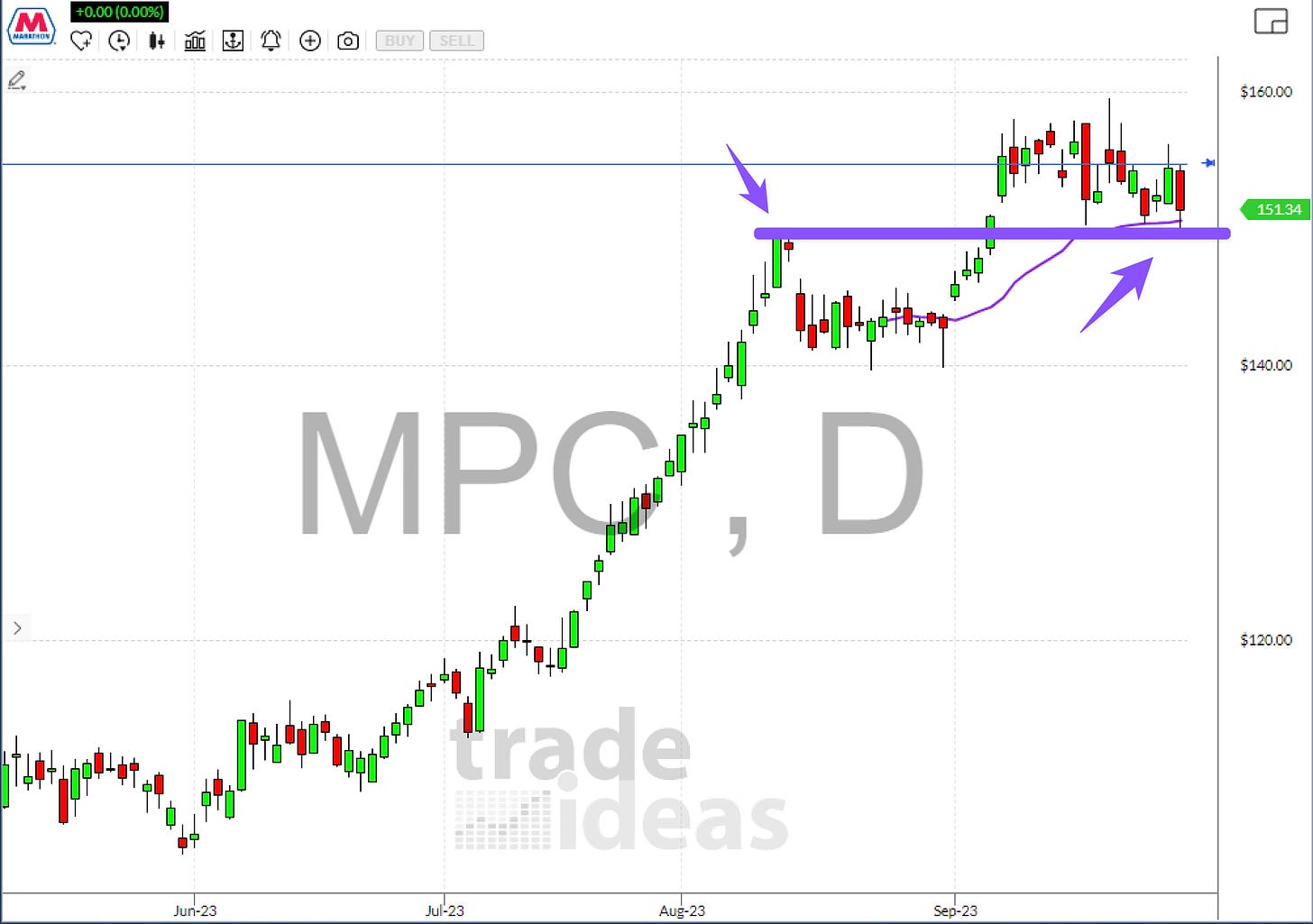

MPC: With a small setback in energy this week, can MPC bounce back?

LHX: One of the few times we see opportunities in a changing trend.

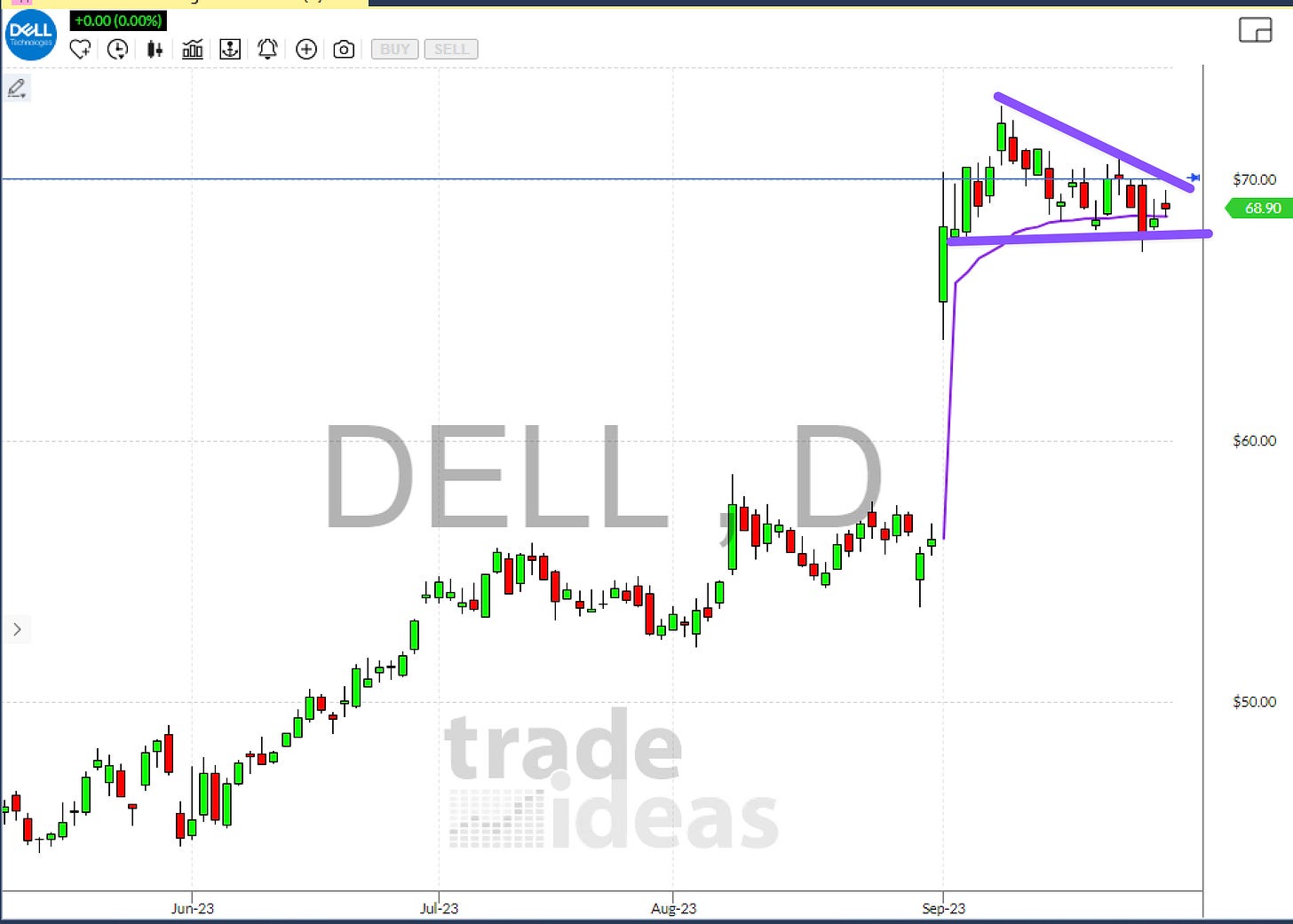

Dell: Could post-gap push-ups spell a continued rise?-SPHR: Will a break out of the anchored VWAP pinch mark the start of an uptrend?

SHPR: With an 8% short float price action is getting very tight here. Looked cool in vegas

Watchlist: https://www.trade-ideas.com/Cloud.html?code=851086fb5d75e4d8db27bbf41bd95b69