Welcome to this edition of our weekend market report! As we wrap up another trading week and head into the next, let’s delve into key market movements and what to expect in the coming days. If you're keen on getting more such insights, especially algorithmically curated watchlists, don't forget to subscribe to our email updates at Statsedge Trading.

Cryptocurrency Overview: Bitcoin and Ethereum This week, Bitcoin showed resilience with a notable bounce off previous resistance levels, though it still faces some overhead challenges. Ethereum, showing relative weakness compared to Bitcoin, didn’t reach the highs we've seen in Bitcoin’s chart. The meme coin Dogecoin is hinting at a potential bottom formation, but it hasn't made a significant move just yet.

Forex and the Dollar Index (DXY) The Dollar Index faced a rejection at a key resistance level this week, continuing its range-bound behavior. This pullback could signal bullish implications for stocks if the trend persists. On the flip side, the Euro is making a weak recovery, bouncing off a critical anchored VWAP, which might suggest a cautious optimism for traders focusing on EUR/USD.

The Yen’s Volatility The Japanese Yen experienced a massive rally before facing rejection, possibly due to interventions by the Bank of Japan aimed at curbing the currency’s decline. This situation presents a complex dynamic for traders, with potential unwinding of short positions that could influence market movements significantly in the near term.

Commodities: Gold and Metals Gold remains range-bound, stabilizing around the anchored VWAP from its recent breakout point. This stabilization suggests a wait-and-watch approach for potential pullback opportunities. In the broader commodities market, sectors like oil showed a downturn, whereas natural gas recorded gains, reflected in UNG’s price movements.

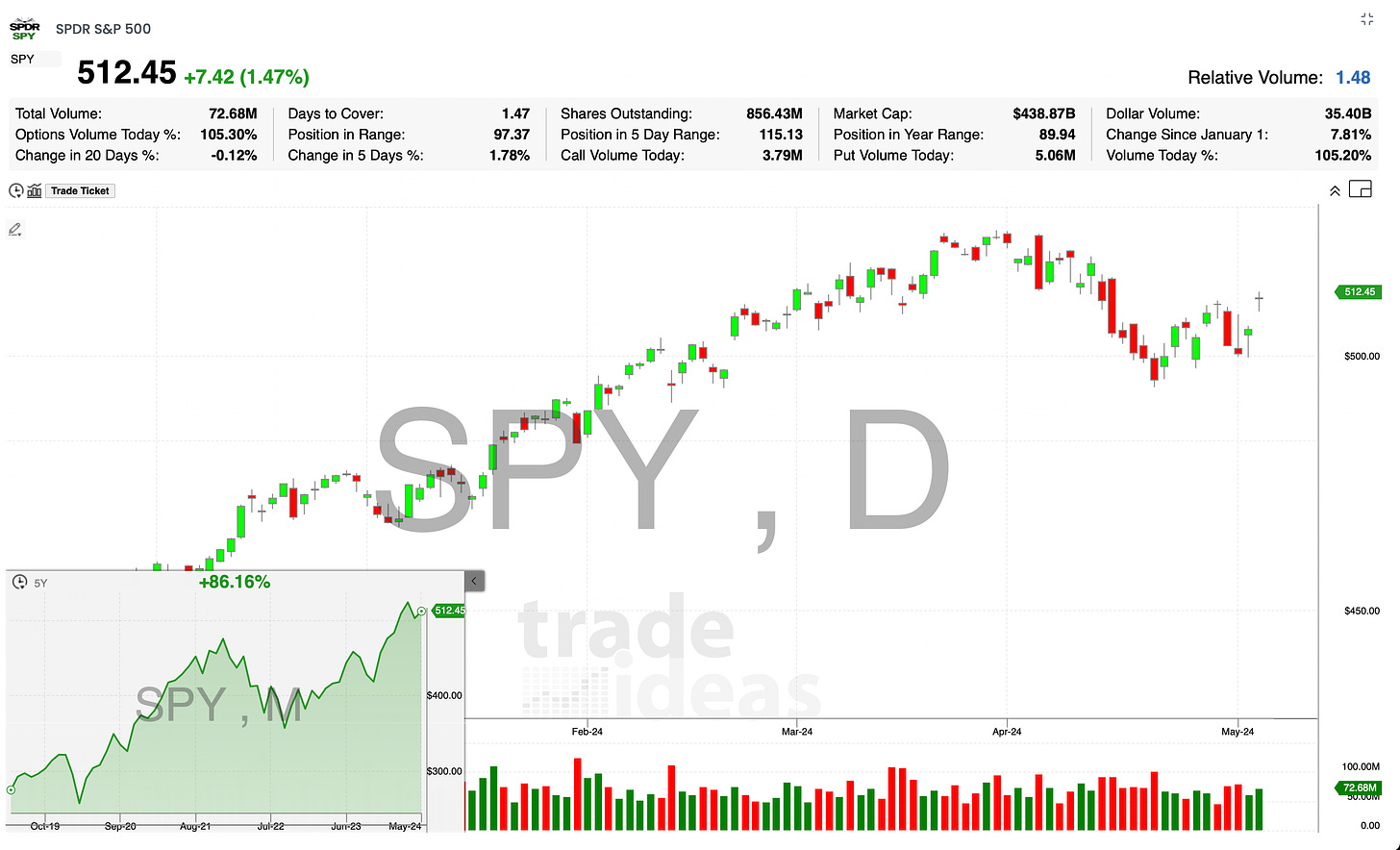

Equity Markets: S&P 500 and Sectoral Analysis The S&P 500 demonstrated strength, recovering towards the week's end with a robust bottoming tail. Mid-caps mirrored this pattern, suggesting a cautious recovery. However, the small-cap index (IWM) lagged, indicating ongoing weakness in smaller companies.

Sector Highlights: Energy and Metals Natural gas, represented by UNG, rebounded strongly, suggesting a speculative play around the $14-$15 support area. The solar sector also hinted at a possible recovery, ideal for traders looking for bounce plays in renewable energy stocks.

Special Mention: Uranium and Chinese Markets Uranium stocks, particularly those tracked by the URa ETF, showed a strong week, consolidating above key support levels. This might foreshadow more buying activity if the breakout persists. The Chinese market, as indicated by ETFs like FXI and KWEB, also showed signs of a breakout, potentially offering new opportunities for growth-focused traders.

Emerging Picks and Algorithm Insights Soon, this with be fleshed out and the product will include a special video going over the symbols just for subscribers.

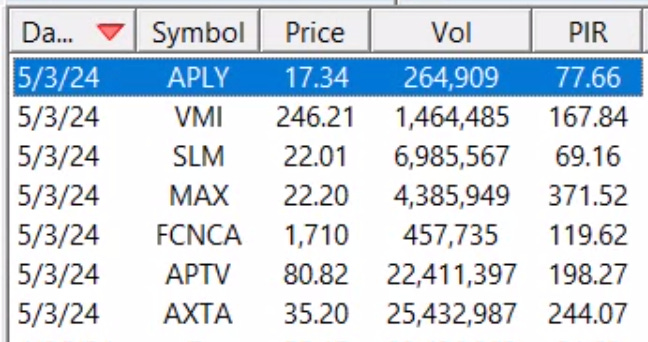

Weekly Breakout Strat:

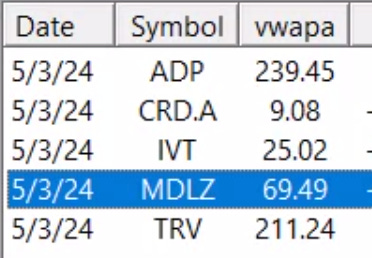

AVWAP pullback Algo

Conclusion

As we navigate these varied market conditions, it’s crucial to stay updated and agile. Whether you're trading cryptocurrencies, forex, commodities, or stocks, understanding the broader market context can significantly enhance your trading strategy. Subscribe for more detailed insights and to receive our algorithmically curated watchlists directly in your inbox.

Thank you for joining this week’s market overview. Have a great trading week ahead!