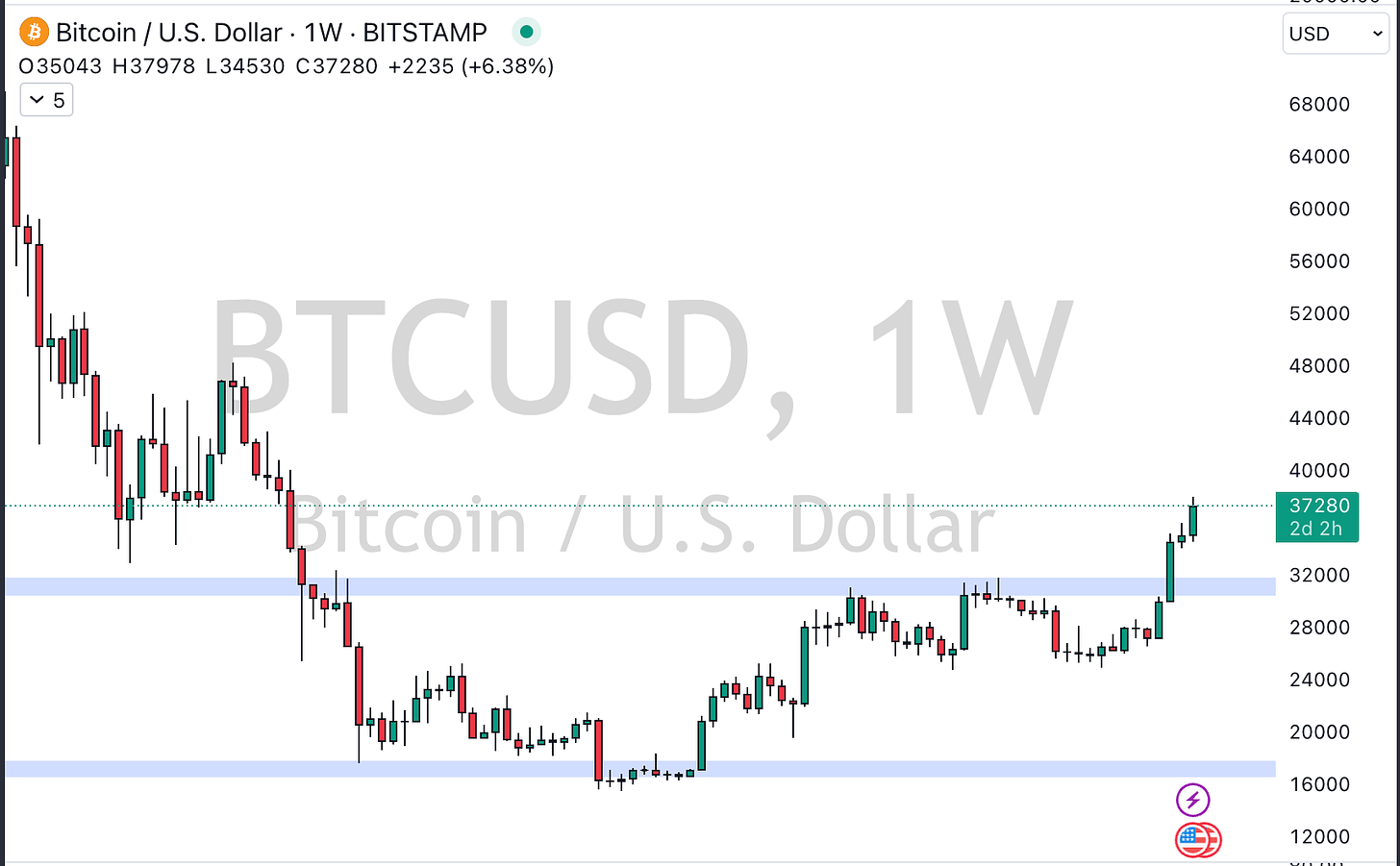

BTC/USD Weekly Analysis

We're starting with the BTC/USD pair. Currently, it's hovering around the 36k/37k zone, marked by a Fibonacci retracement. Despite a recent breakout, a prominent topping tail suggests potential volatility. Full disclosure: I own Bitcoin, which may colour my analysis. Keep an eye out for resistance, even in a bullish trend.

Ethereum's Market Position

Ethereum is gaining interest, hinting at a possible trade shift. However, its struggle with resistance makes me cautious about this 'catch-up trade'.

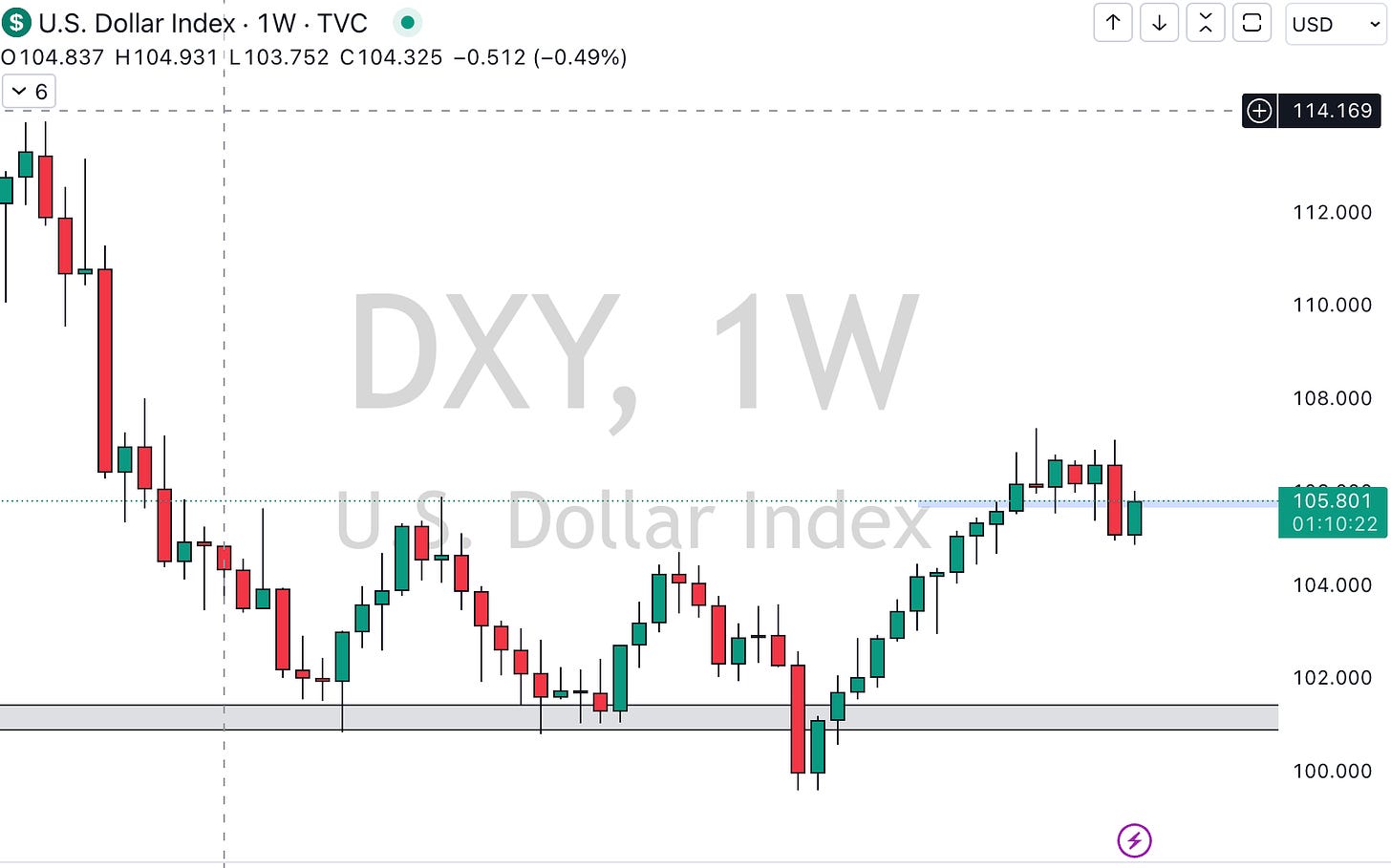

Dollar Index and Currency Pairs

Last week's sell-off in the dollar index led to a rally, but it didn't close the gap, raising questions about its sustainability. If the dollar weakens, consider the euro or pound.

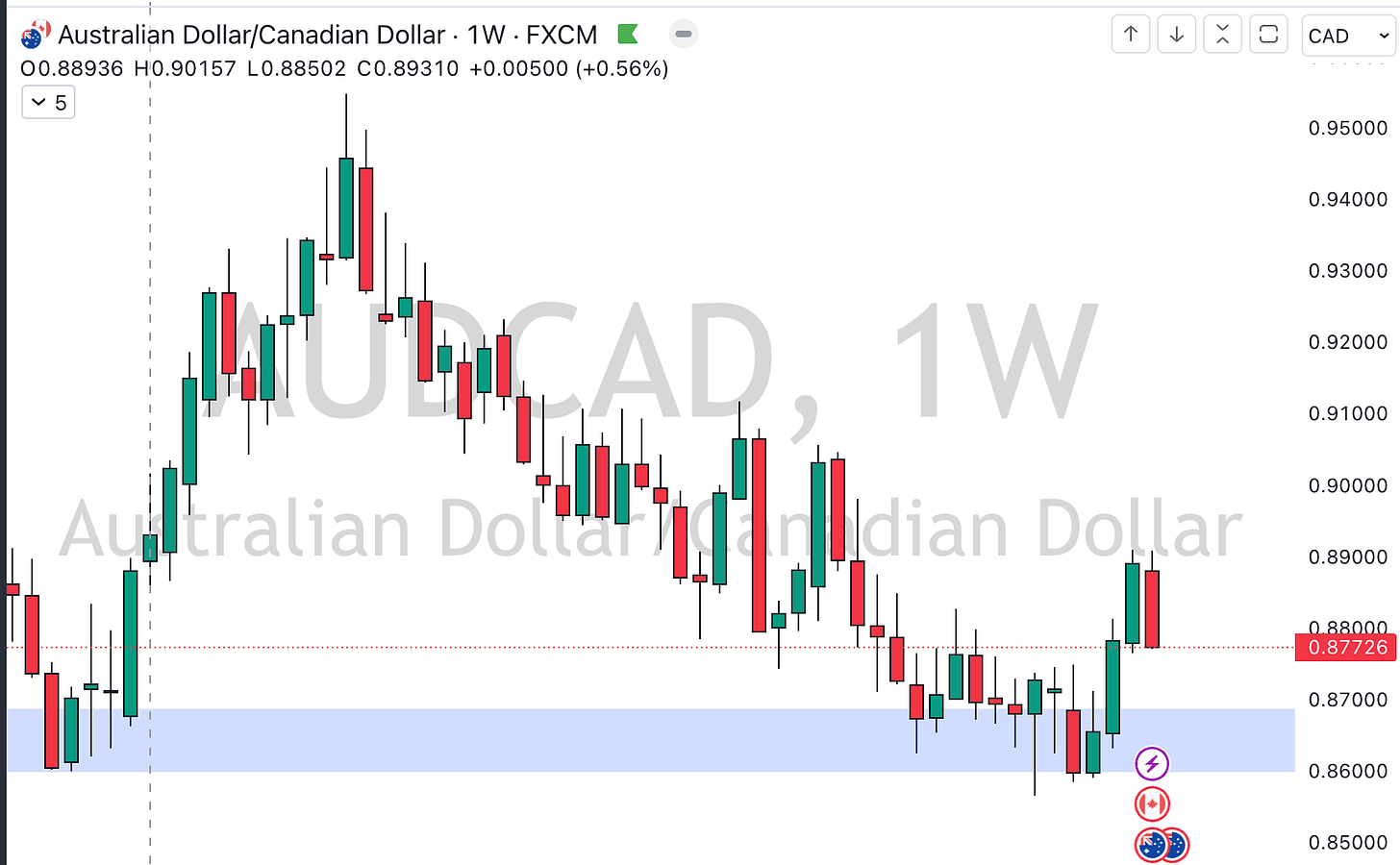

$AUDCAD is an interesting pair, being two petro currencies. It's a safer trade, removing the petrodollar risk.

For the Euro Dollar, it's almost a mirror image of the Dixie, and I'm currently long on it for a short-term play.

Stock Market Insights

The technology index XLK 0.00%↑ hit an all-time weekly closing high. Given its market influence, it's worth your attention.

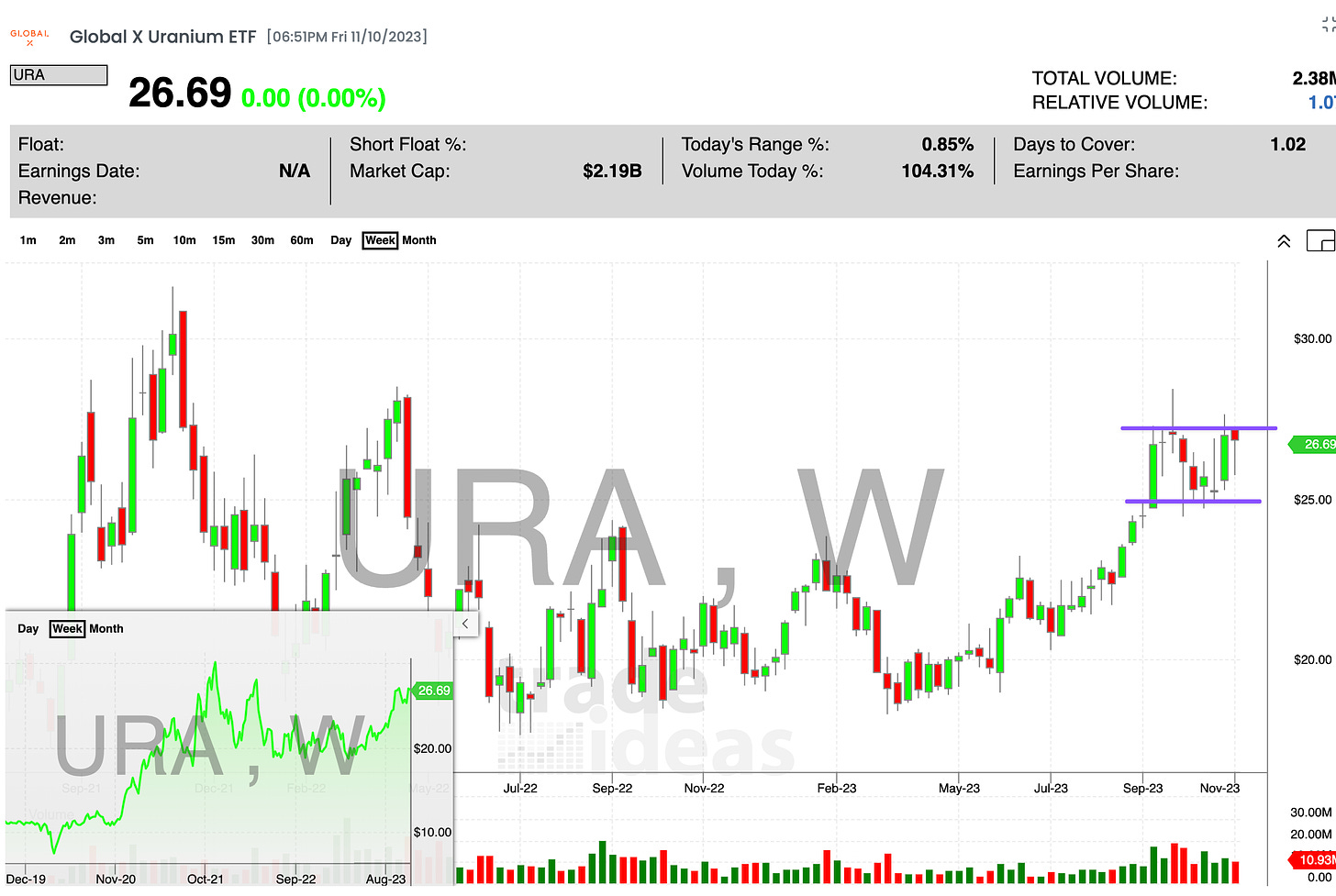

In commodities, the URA 0.00%↑ uranium ETF shows promise, and oil (USO) is approaching a potential breakout zone. Keep an eye on oil stocks for opportunities.

Watchlist for Next Week

Adobe: Showing a 'kicker pattern' with breakout potential at $600.

DraftKings: Despite recent pullbacks, watch for a breach above recent highs.

VRT: Strong base and high return potential.

UEC: Look for a break above resistance at 550.

Remember, bear markets drag down strong names, but bull markets lift them. Stay tuned for more insights and don't forget to sign up for our daily emails and check out our free trading course at www.statsedgetrading.com.

Happy Trading!