Watch video here: https://youtube.com/shorts/1MmxlRnPcQI

In today's market watch, I'm zoning in on CGEM 0.00%↑ , a standout in the biotech sector that's caught my eye for a few reasons. The biotech industry itself is presenting some intriguing opportunities, and CGEM exemplifies the kind of volatility and potential that makes this space worth watching. For those of you familiar with the rollercoaster nature of biotech stocks, you know the importance of sizing your trades appropriately to manage the inherent risks.

The Technical Perspective

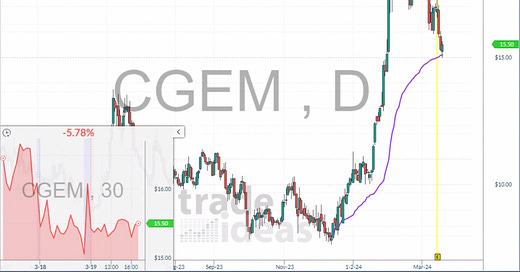

What's particularly interesting about CGEM is its recent pullback to a significant technical level. The purple line you see on the chart represents a pullback to a major anchored VWAP (Volume Weighted Average Price), marking a substantial swing low for the company over an extended period. This is a critical juncture that could indicate the stock's next move.

Building a Trading Plan

For those who have delved into our trading plan course, you've seen firsthand how I construct a trading plan for situations exactly like this. The course, available at a special introductory rate HERE, walks you through the process of creating a trading plan tailored to your trading style and objectives. It's a resource I highly recommend for anyone looking to refine their approach to the market.

The Strategy for CGEM

CGME's journey from $10 to $20 in a short span is nothing short of impressive. Now, as it retraces to the anchored VWAP around $15, I'm on the lookout for a bounce. This level is pivotal. A close below $15 signals that my thesis is incorrect, and it's time to reassess.

Final Thoughts

The next few days will be crucial for CGEM. I'll be watching closely to see if we get the rebound off this key level that I'm anticipating. For those interested in following along or learning more about building a robust trading plan, visit www.statsedgetrading.com. The insights and strategies shared there could be the edge you need in navigating the complexities of the biotech market and beyond.

As always this is just what I am doing with my money and not advice to anyone.