Welcome to our special edition of the midweek Market wrap-up, where we delve deep into the monthly charts, offering a fresh perspective on the market's movements. Whether you're a short-term trader or someone who holds onto trades for weeks, zooming out to view the broader picture can provide invaluable insights.

The Monthly Chart Phenomenon

I love zooming out to monthly charts. It takes a few minutes once a month to ground yourself with a longer-term trend.

Even for those who trade in the short term, taking a step back to observe long-term trends can be enlightening. It's like stepping out of a forest to see the trees. This perspective can be relaxing and informative, helping traders make more informed decisions.

The Crypto Landscape

Bitcoin has shown a significant monthly bar but could be nearing some resistance. On the other hand, Ethereum hasn't shown much movement, suggesting that Bitcoin remains the stronger player in the crypto sector.

The Dollar Index and Its Implications The DXY, or the dollar index, has shown some interesting movements. After three consecutive months of growth, it might be time for a revision or pause. This index, which compares the dollar to other major currencies, can provide insights into global economic trends.

The World of Equities Equities have shown some interesting patterns, with some stocks breaking out and others holding steady. For instance, the XLF, representing financials, indicates that big banks might be on the move. On the other hand, solar stocks, represented by TAN, have been less promising.

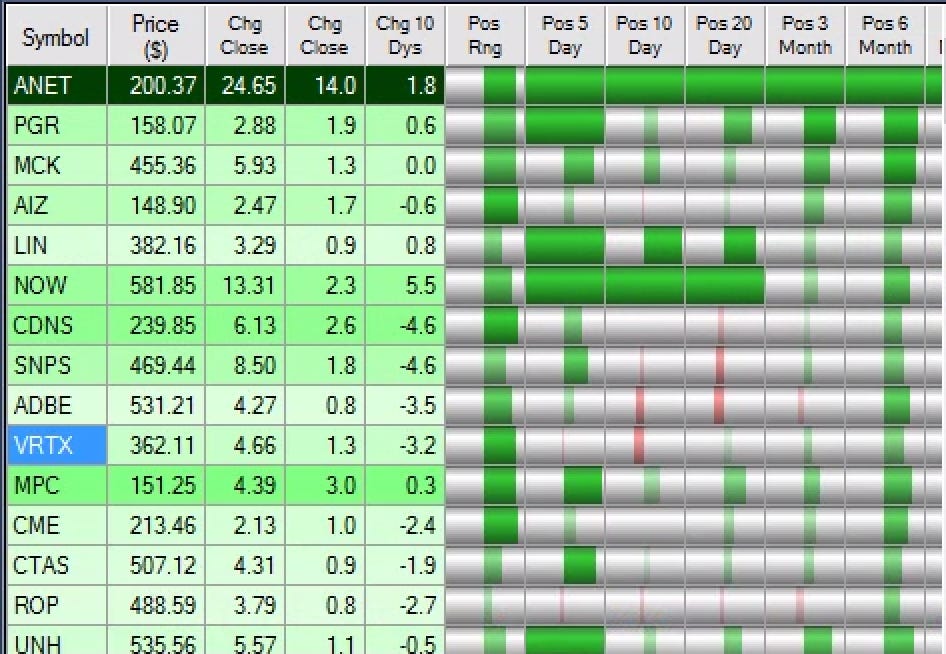

The Power of Algorithms in Trading Using algorithms like Trade Ideas can help traders identify potential investment opportunities. For instance, looking at the top names in the S&P 500 can provide insights into which stocks might be worth watching.

Conclusion: The monthly charts provide a unique perspective on the market, allowing traders to see broader trends and make more informed decisions. Whether you're looking at crypto, equities, or the dollar index, understanding these trends can be the key to successful trading. Stay updated, and always be ready to adapt to the ever-changing market landscape.

Note: Always conduct your research and consult with a financial advisor before making any investment decisions.