What Is Sector Rotation?

Sector rotation is a financial theory suggesting that not just one sector can sustain a bull market indefinitely. Over the past year and a half, we've seen a bull market largely driven by semiconductors and AI. While these sectors have been pivotal in rallying the markets from downturns, for a bull market to sustain itself long-term, capital needs to flow across different sectors.

This concept is something I've been discussing for weeks, highlighting potential sectors where money could start moving next. The idea is simple: as some sectors like semiconductors (represented by SMH) have led the market recovery, portfolio and hedge fund managers will eventually need to rebalance their holdings to manage risk and exposure.

The Mechanics of Sector Rotation

Imagine a scenario where a fund manager has a significant portion of their fund in semiconductors, and it triples in value. Suddenly, a disproportionate amount of the fund is tied to one sector, increasing risk. To mitigate this, the manager would likely sell some of those semiconductor holdings and invest the profits into other sectors, thus rotating the sectors within their portfolio.

This process is crucial for maintaining a balanced and diversified portfolio, especially for funds that are mandated to be fully invested or maintain a certain level of market exposure. It's about taking profits from one area and reallocating them to another, potentially undervalued, sector.

Real-Time Sector Rotation

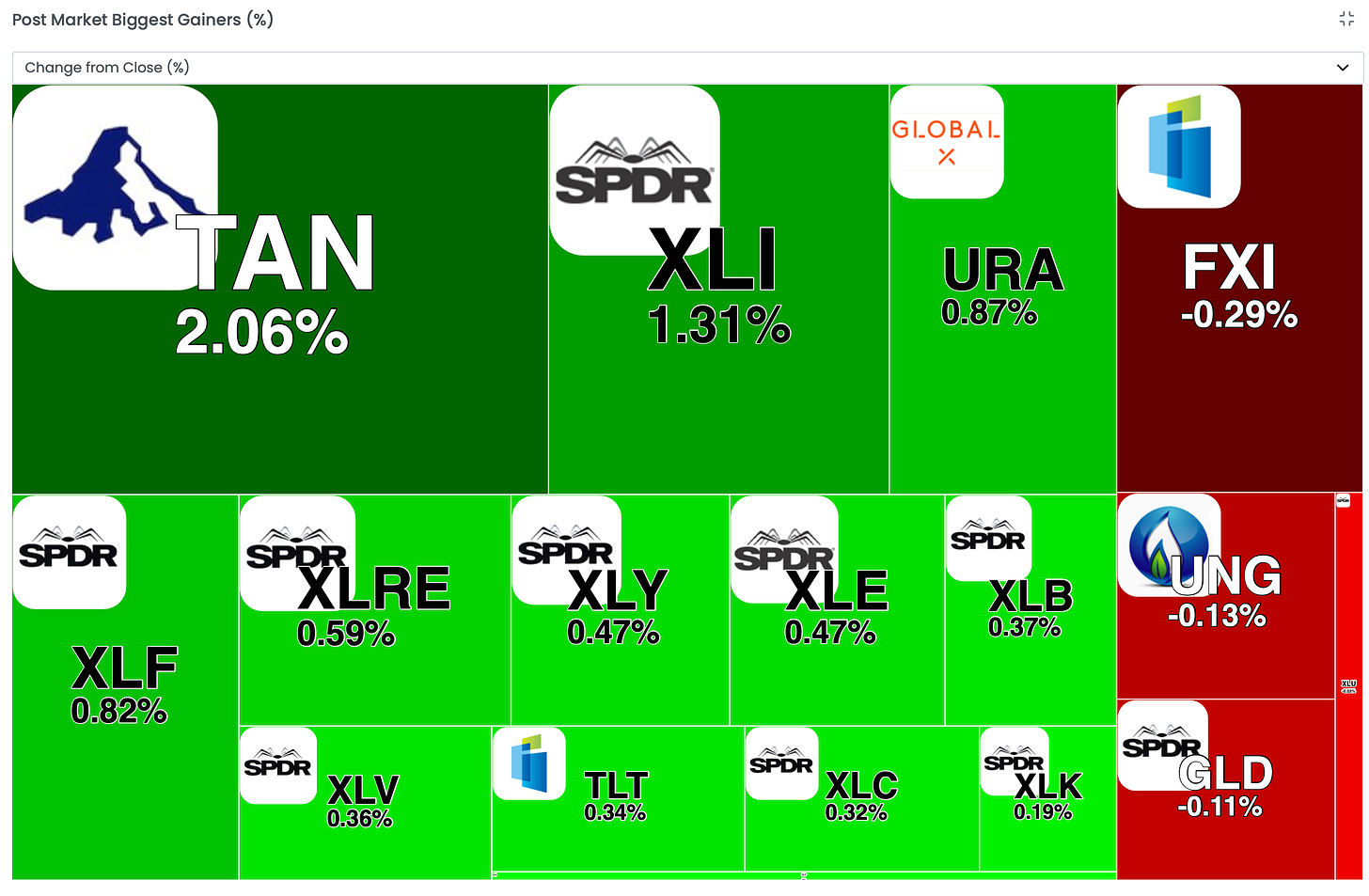

Today, as I record this, the S&P 500 (SPY) has hit new all-time highs, but not due to semiconductors, which are not at their peak. This indicates that other sectors are driving the market upwards. For instance, gold has shown significant movement, suggesting that money is rotating out of semiconductors and into commodities like gold and energy.

How to Spot Sector Rotation

Using tools like Trade Ideas, I monitor which sectors are up or down daily. This helps identify where the market might be rotating next. For example, uranium (URA) is showing strength, holding a massive support zone and pushing upwards, indicating a potential area for investment.

The Importance of a Trading Plan

Whether you're a beginner or a seasoned trader, having a trading plan is crucial. At statsedtrading.com, we offer a free trading course and an advanced trading plan course. The latter walks you through creating a personalized trading plan, covering everything from entry and exit strategies to risk management

Conclusion

Sector rotation is a fundamental concept for understanding market dynamics and maintaining a balanced investment portfolio. By identifying and capitalizing on these rotations, traders can potentially enhance their returns and mitigate risk. For those looking to dive deeper into creating a structured approach to trading, our trading plan course at statsedtrading.com is an invaluable resource.

Stay tuned for this weekend's market analysis, where we'll delve into the weekly charts and discuss the latest market movements. Don't forget to sign up at statsedtrain.com to get all the updates directly to your inbox.

Thank you for tuning in, and I look forward to continuing this journey with you.