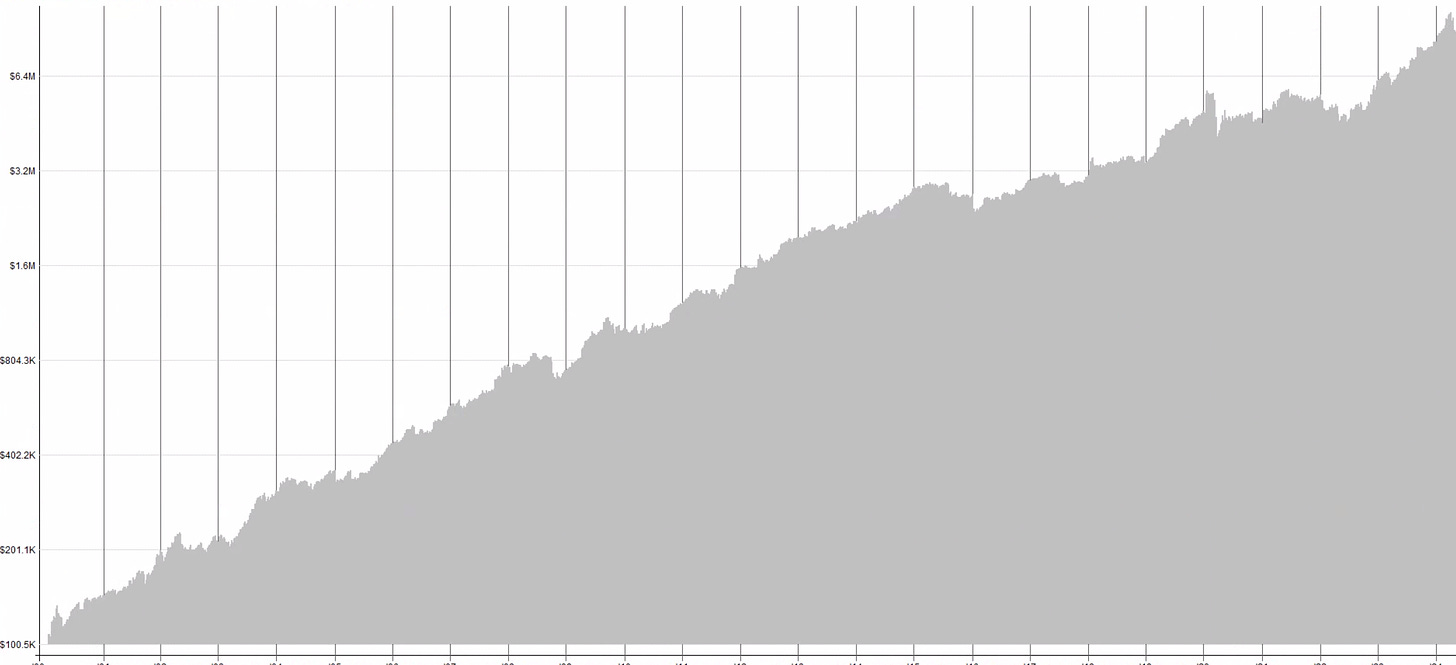

Let’s chat quickly about adding decestion to our systematic trades. We have had a few triggers from our pullback algo (returns pictured below) that I think help with a good learning lesson about how to I add my “trader mind” to my systems.

As you can see from the returns they are pretty good netting an average of 25% per year with a 20% max drawdown. But of course not perfect with some unprofitable periods like any system. I always attempt to smooth these returns some with my techinal analysis skills and keeping an eye on the markets.

Let’s look at 2 trades that triggered over the last 2 weeks one I took and one I passed on for some of my thought process.

Trade 1: MNKD 0.00%↑

This one triggered on friday where the market was selling on the candle with the blue arrow under it. Let’s focus on 2 things.

It bleed through the algo entry price closing with a nice wick showing some buying comming in later in the day.

Second is what the market was doing at the time selling off and closing at lows shown by this highlighted selloff candel in the SPY 0.00%↑ .

If you combine these 2 it seems reasonable to think there is more of a chance that this has come buyers in it.

Trade 2: CAG 0.00%↑

Let’s look at the one I skipped just today with CAG. This is the polar opposite of the one above if you look at the points I made above.

Check out the intraday chart where it sliced through the price only trying to bounce for a second intraday. Also very important to note that on this day the SPY and QQQ up over 1.5%.

This is all talked about in the statsedgepro trading room if you are a member make sure you check it out and if not give it a try in the button below. We combine backtested statistical edges with techinal analysis common sense to make simple trading decisions.

Question, since I am new here, the likely answer is older post, however, I've noticed you reference a few securities which are not on the current Pullback/Breakout/Monthly list, such as MNKD or am I missing something ? jss

Not sure where to leave this comment about moving the chat to another place. Substack is hard to use and I would be pleased if you relocated the chat to someplace that could be easily found and followed