This weekly analysis is equally important to day traders and swing traders. It provides a wider perspective on market activity and helps us identify potential opportunities. If you want to receive these insights directly to your email, subscribe to the mailing list at www.statsedgetrading.com. Rest assured, your emails are safe with us!

Exploring the World of Cryptocurrency

Let's begin with a segment on cryptocurrencies, starting with the most popular one, Bitcoin. The main highlight here is Bitcoin's impressive rise and the rewards it has brought so far.

A couple of other cryptos to keep an eye on are Chain Link and Ripple. As of now, both are facing off with the anchored VWAP from all-time highs, and their outcomes can be quite interesting depending on the broker.

Here's a tip: I usually avoid cryptos like Dogecoin that are far from their anchored VWAP level. This strategy helps filter out coins that are overpriced and nearing their average high.

In the World of Traditional Currency

Whether you're a forex trader or not, the Dollar Index is an important indicator. After four weeks of a downward trend, we are approaching a crucial level. Last week, even though we saw a small bounce, it was weak. However, it's interesting to note that as the dollar was bouncing, so was the stock market.

The Euro-USD pair showed a possible falling trend, following triple bottoming tails, which indicates an underlying strong bid in the currency pair. The currency pairs Aussie-CAD and AUD-JPY also showed an interesting trajectory.

A Look at Stocks

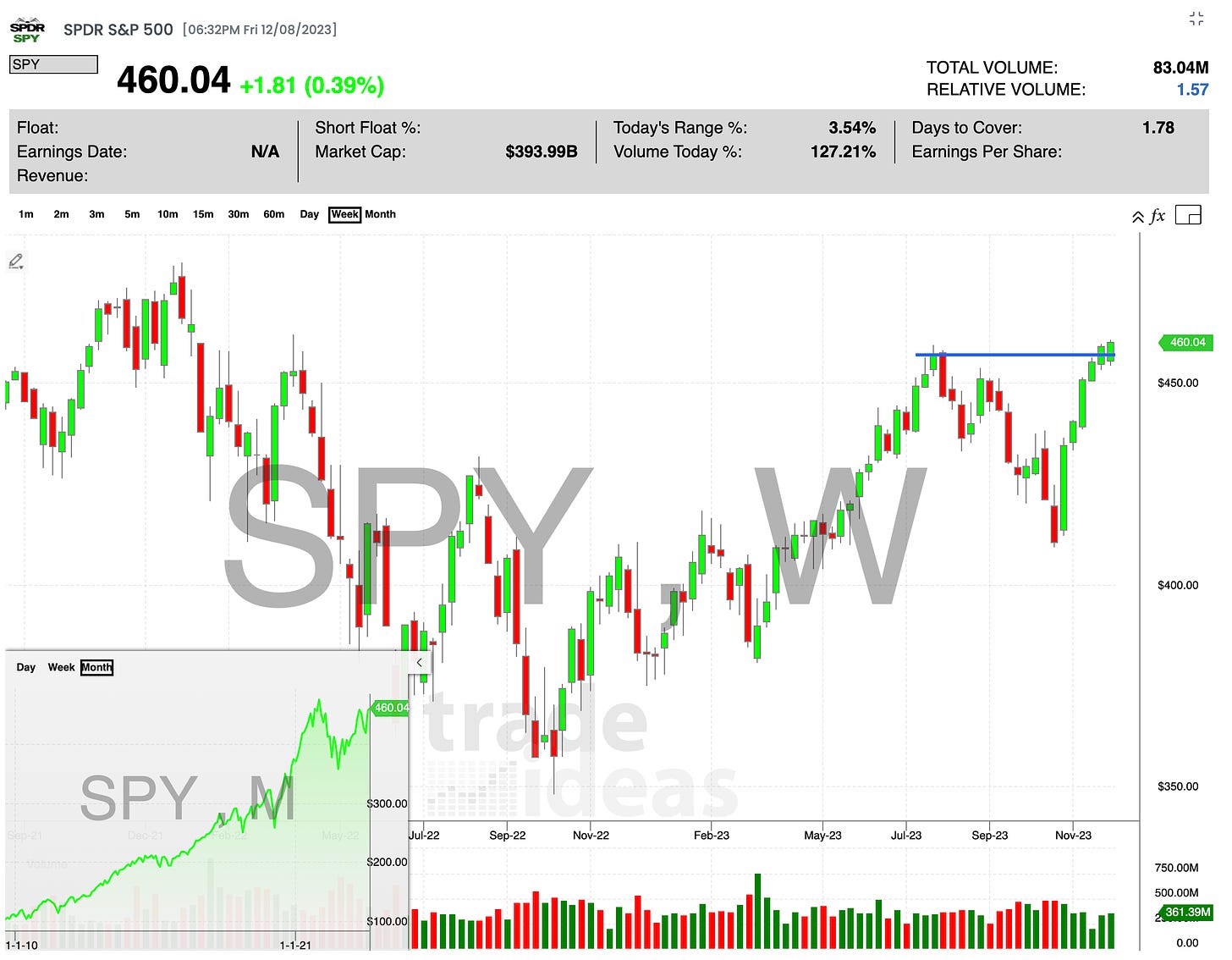

Regarding stocks, we saw a breakout in the S&P 500 this week. This signals possible follow-through action for the coming week. Meanwhile, RSP, the equal weighted version of the S&P 500, shows that the rally is a wide market phenomenon rather than isolated activity in tech giants.

If you're interested in semiconductor stocks, then you'll be glad to know that they look promising, especially with MDY (a mid cap ETF) showing strong holding patterns. Similarly, ARKK Innovations Fund is showing some potential concerns as it approaches six weeks into a resistance zone.

Closing Remarks

And those are the main highlights of this weekend's Market Report. In summary, all signs point to a healthy market scenario, with most indicators showing potential opportunities for gains.

To top it off, always remember this handy tip from me:

It's time to sign off, but if you're interested in more detailed, mid-week updates, do consider subscribing to www.statsedgetrading.com. The world of trading is unpredictable, exciting, and full of opportunities, so it's always good to stay informed.

Until next time, switch off your screens and have a relaxing weekend, traders! Happy trading, and see you next week.