In my last video, I touched on a phenomenon that piqued the curiosity of many: the flurry of bullish magazine covers and what they might signify for the markets. Given the interest, I've decided to delve deeper into this topic, exploring the so-called magazine cover indicator.

What Is the Magazine Cover Indicator?

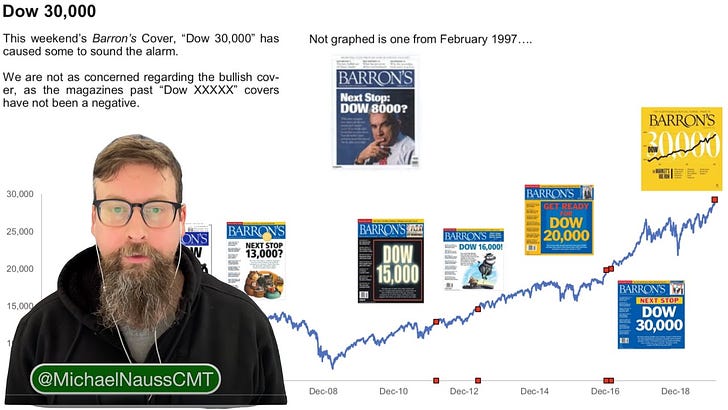

The magazine cover indicator is a concept we learn about in the CMT, highlighting how news covers, be they bullish or bearish, aren't direct signals to trade. Instead, they offer a window into market sentiment. Historical examples abound, from The New Yorker's 1929 cover just before the Great Crash to Time Magazine's depiction of a restrained bull in the 1950s.

The Essence of the Indicator

The core idea here isn't to short the market upon seeing a bullish article or to buy in at the sight of doom and gloom. Markets move on positioning, and when everyone is leaning one way—say, all in on Bitcoin or Nvidia—it signals a potential saturation point. Nvidia serves as a prime example. Its widespread ownership doesn't necessarily herald a reversal, but it suggests the pace of its ascent might slow.

The Professional vs. Amateur Dynamic

As trends mature, professional traders look to offload shares to latecomers. This dance between the pros looking to exit and the amateurs eager to join is a market constant. It's not about deception; it's about distribution. For instance, if Nvidia forms a significant portion of a portfolio due to its appreciation, a fund manager must rebalance, preferably before the trend reverses.

The Lag Effect

The magazine cover indicator also speaks to the lag in public awareness. By the time a trend like Nvidia's surge makes it to print, the market might be nearing its peak. However, this isn't a cue for a blind short strategy but a signal for caution, perhaps to lighten up on positions that have ballooned.

Overbought Conditions

Echoing Brian Shannon, overbought conditions can correct through price dips or sideways movement. This principle underlines my caution when I see a surge in bullish sentiment. It's not a doomsday prediction but a reminder that trends, especially those heavily publicized, may pause or correct.

In Conclusion

While the magazine cover indicator can't be quantified with backtesting, it serves as a qualitative tool for assessing market extremes. It's a blend of humor and wisdom in our trading arsenal, reminding us that when everyone's on one side of the boat, it might be time to consider balancing or even lightening our load.

So, as we navigate these waters, let's keep an eye on the charts and another on the newsstands, ready to read between the lines and act with informed caution.