In times of market insanity, it's easy to feel overwhelmed by the chaos. The big players—hedge funds, mutual funds, and other large institutions—are forced to navigate the storm, staying invested due to mandates, regulations, or simply the sheer scale of their operations. They can’t just pull out of the market and wait for calmer seas.

But as retail traders, we possess a unique and powerful advantage: the ability to step aside, go to cash, and wait out the volatility. Unlike institutions, we aren't bound by the same constraints. We have the freedom to convert our portfolios into cash or cash equivalents at a moment's notice.

This flexibility gives us the power to avoid unnecessary risks during turbulent times. We can sideline our funds, preserving capital and taking the time to evaluate the market from a position of safety. When the dust settles, we can re-enter the market with a clear strategy, capitalizing on opportunities with a fresh perspective and intact funds.

However, our advantage as retail traders extends even further when we approach the markets systematically. As systematic traders, we don’t rely on gut feelings or subjective interpretations of the market's direction. Instead, we rely on data-driven strategies that have been tested across different market environments. We know with a high degree of confidence where our strategies perform best.

This knowledge empowers us to be highly selective about when and where we deploy our capital. In volatile markets where our strategies might struggle, we can step aside and conserve our resources. There's no need to force trades in unfavourable conditions simply because we're invested—something that institutions often have to do.

By knowing when to be in the market and when to step aside, we can focus on trading in environments that provide the most favourable odds for success. Large institutions simply don’t have this luxury. Their sheer size and the mandates they operate under often force them to maintain exposure, even when the odds are stacked against them.

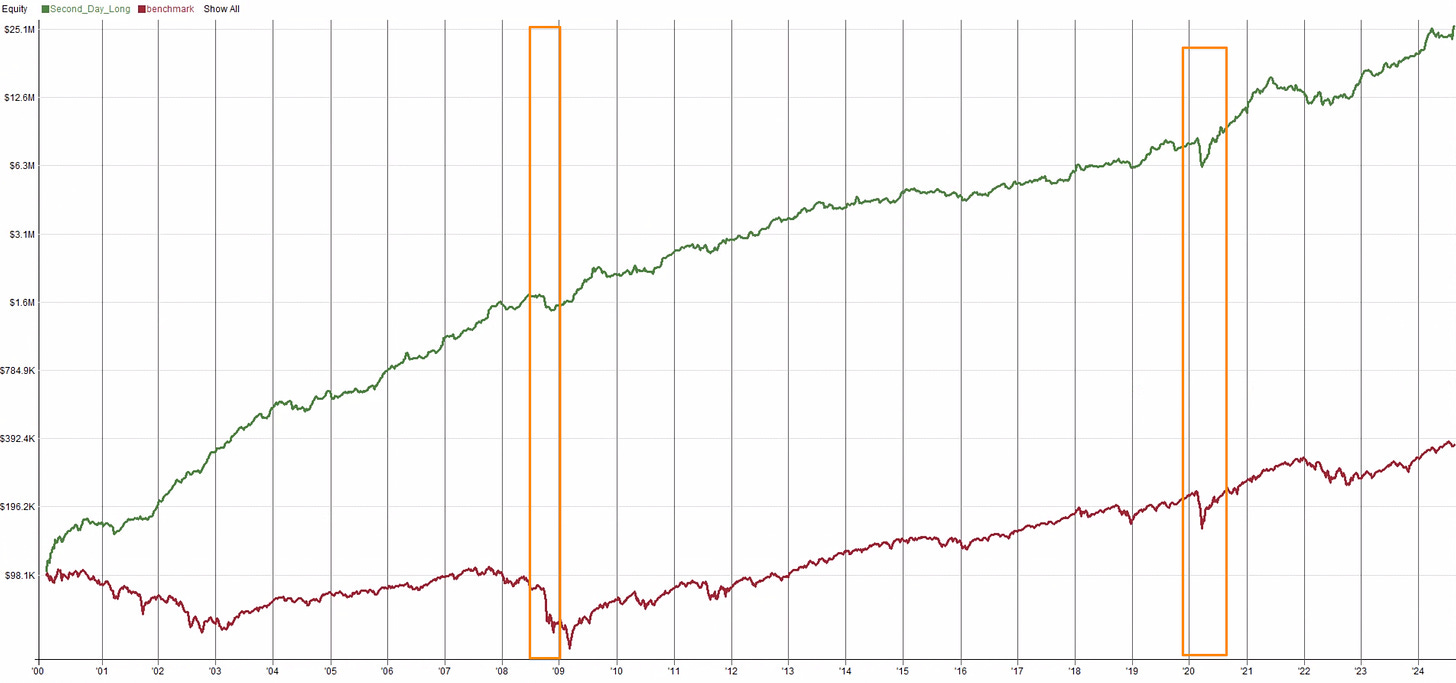

Let’s take a look at one of the algos I am currently running personally and with StatsEdgePro and how it reacted to swift sell-offs. I have chosen this algo because this particular one performs well in bear markets but struggles if there is a quick and volatile spike in the market.

I have highlighted two areas. The first was the rapid sell-off of 2008, and the other was the 2020 covid crash. Although in both cases, we had a swift recovery, the drawdowns would be uncomfortable at the time. The question we need to ask ourselves if we are ok with missing some of the upsides in return for missing some of the downsides.

In essence, our agility and our systematic approach are our strengths. The ability to go to cash isn’t just a defensive move—it’s a strategic advantage that allows us to survive and thrive. So, next time the markets are volatile, remember that sitting on the sidelines isn’t a sign of fear; it’s a smart use of the flexibility and knowledge we have as systematic retail traders. We don’t just avoid the storm—we wait for the right conditions to set sail.