The Dollar Index: The Key

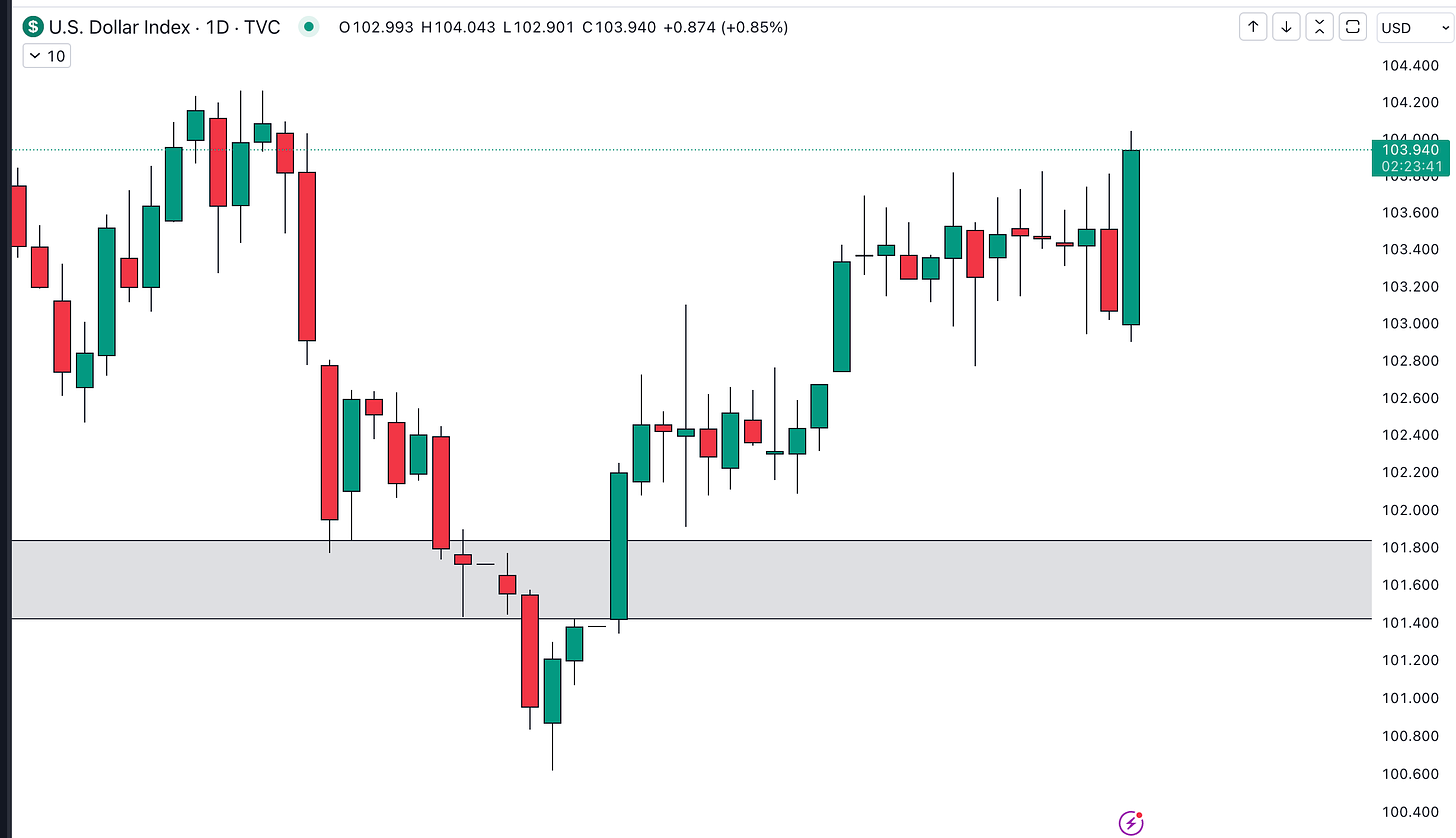

The dollar index presents a choppy and volatile landscape, zigzagging sharply in recent weeks. This volatility seems to have little impact on stocks, which continue their upward climb unaffected.

Pulling back to assess the bigger picture, the dollar suggests a potential bounce within an overall downtrend. Monitoring multiple timeframes will be key to discerning future moves. When the picture clears, trading opportunities in the dollar and dollar-denominated assets may emerge.

Potential moves in the British pound also warrant attention, as cable readies itself for the dollar's next power play. A dollar breakout could set up favorable pound shorts targeting supportive technical levels.

Commodities like gold show promise if held at current support points. Sustaining these zones could provide springboards to future upside. Alternately, failing to hold support could foreshadow sharp declines. Dynamic risk management adaptable to rapidly changing conditions is key.

While unprofitable tech remains mostly muted, profitable market sectors continue gathering momentum. Leading large-cap indexes hit new highs while mid and small caps gear up for their own rallies after consolidation periods.

Savvy traders will watch for sector rotations and the awakening of today's laggards. Bull markets tend to lift most ships eventually as leaders extend hands to struggling ships. Patience and proper timing of entries remains essential as the market map continues unfolding.