Watch Video Here

Hello, folks! You've probably heard the age-old debate among stock investors - should we buy stocks when they are making new highs or when they have dipped? Today, we're diving deep into financial data from the past few decades to provide some much-needed clarity to this debate, and settle the argument once and for all!

Backtesting: A Peek into the Past

To debunk the myth, I've conducted backtesting from 1980 up to 2023, a comprehensive timeframe spanning incredibly varied market conditions. This backtesting focuses on the performance of the top S&P 500 stocks based on their year range and involves rotating these stocks monthly. In simpler terms, you own whatever was at the high end of its year range the previous month.

This method offers a unique insight into the potential profitability of investing in stocks setting new records vs. the ones showing a slight dip.

What Does the Data Show?

Now, let's imagine if you had $100,000 to invest back in 1980. What if we decided to use the traditional strategy of simply holding onto the S&P 500? The chart above illustrates this strategy, depicted by the red line, which shows this investment approach would've turned your $100,000 into a cool $3 million by 2023.

Let's compare this to the alternate strategy mentioned earlier of owning the stocks at the high end of their yearly range each month. This approach, represented by the green line, astonishingly turns the same $100,000 into a staggering $30 million by 2023!

These results clearly indicate that contrary to popular belief, investing in robust stocks pushing their yearly acme tends to yield a significantly higher return.

The difference in return is remarkable:$100,000 -> $3 million (Buy and Hold - S&P 500)Vs.$100,000 -> $30 million (Rotational Model)So, How Do I Find These Stocks?

If you're now curious about how to find these high-flying stocks for your portfolio, don't worry, I've got you covered. All you need to do is head over to Trade-Ideas (Use STATSEDGE to save yourself 15% off at checkout) to pick up a copy.

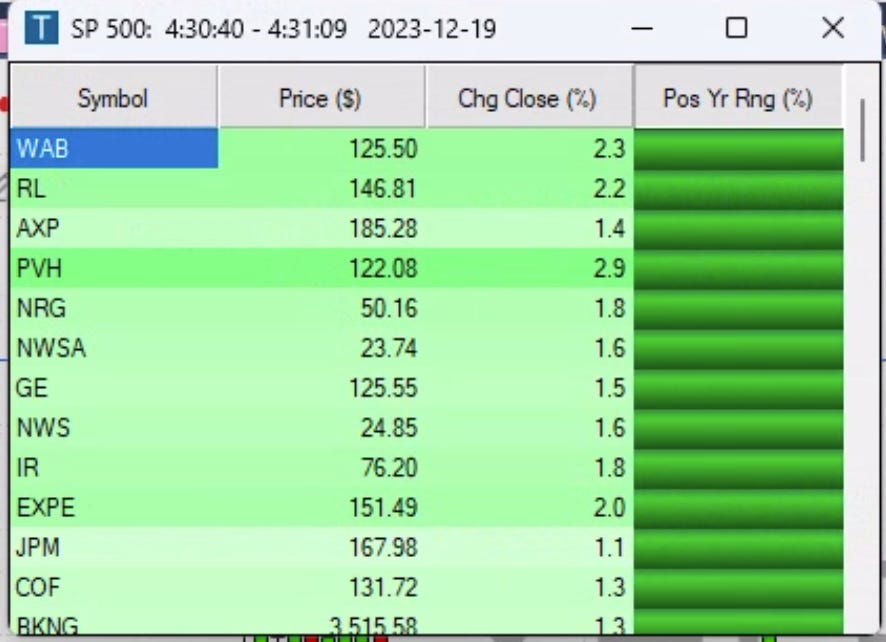

Inside you'll find custom trade ideas crafted to meet your investment profile. Moreover, it offers a scan tool that sorts the S&P 500 stocks by the ones closest to their yearly highs, simplifying the process of identifying potential additions to your portfolio. Add that scan here

To quote the great Warren Buffet:

"Wide diversification is only required when investors do not understand what they are doing."

The key takeaway is that focusing on strong names, in the long run, will outperform focusing on weak names. Buy low, sell high is a dangerous saying. Buy high and sell higher seems to offer much more alpha.

It's time we bask in the joy of the greens and leave the reds behind. Happy investing!

Great analysis

Thx for Sharing !!