So another GME 0.00%↑ and AMC 0.00%↑ pump and dumb came and went. Pumpers got a bit of exposure, hedge funds got rich and retail got left holding the bag.

New traders would be lamenting either missing the trade or, even worse, still praying to get their money back. When you have been trading for a while, you take moments like this and always think, “Who are the winners, and who are the losers.”

The losers in this one are easy. People who fell for the hype, FOMO and conspiracy. Some winners will be hedge funds that traded logically and market makers that sold overpriced call options to the chases.

There is one player I think a lot of people are overlooking, that is a place that profits every time a degen places a market order out of FOMO.

HOOD 0.00%↑ tailers directly to the same group of trades that will be trading the latest crypto and meme stock rally.

Like any good trade, we need the chart to confirm our thoughts about the story. I am a technical trader first and foremost, so any shower thought like the above needs to be broken down into a plan based on what the technicals show.

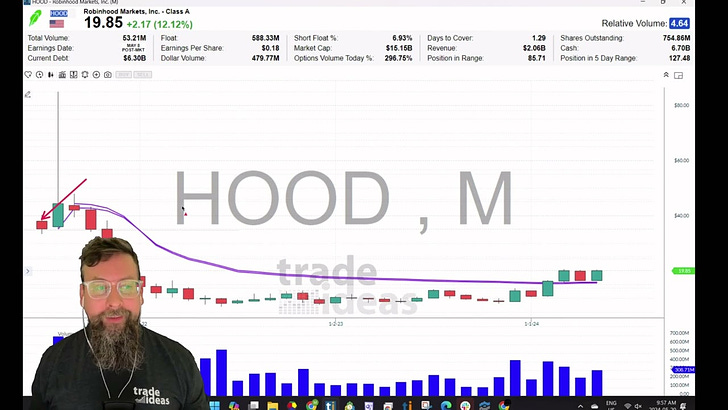

Zooming out to the monthly chart and looking at some basic fundamentals, we see that after its early sell-off, we had around two years of sideways action under the AVWAP from the IPO.

This AVWAP shows us where the average investor has been price-wise since the company became public. Our being over this for three months is a good sentiment indication.

We combine that with a strong cash position and positive earnings giving us confidence that unlike what happened with GME 0.00%↑ AMC 0.00%↑, HOOD 0.00%↑ will not issue shares to dilute our position.

Last week is had a soild green candle, engulfing the last few weeks of action and moving us off the AVWAP from the IPO, closing at highs.

On to the daily chart we see a breakout of a downtrend line along with 450% normal volume showing increased interest from buyers on Fridays session.

Lastly, it’s time to plan the trade. I see short-term support at $19.5 and resistance at $20.5. This is why the art will come in. I need to see how the price reacts at either of these 2 levels in order to play my entry. A stop would be the worst case under the last swing low at $15.

I write all this to show the process that happens on every trade and to show after all this, there might be no trigger to take a trade off of, or it could be a loser. No amount of perp can control the outcome once the trade is entered, so I focus on risk-reward. If this trade does not work, I will be out quickly. If I am right, we could see $30 and $40 in time.

If you like this type of deep-dive content, make sure you let me know and follow along.