Welcome back to our weekly market wrap-up, where we explore potential market movements and trading opportunities in crypto, FX, and the stock market. Whether you're new here or a returning reader, we hope to provide you with valuable insights to inform your trading week ahead.

Crypto Overview: Bitcoin and Ethereum

Bitcoin has been battling a significant resistance point from its past peak, showing little movement despite the volatility. The Commitment of Traders report indicates small speculators are highly active, suggesting caution. Ethereum, on the other hand, shows relative weakness as it hasn't reached new all-time highs, unlike Bitcoin.

Precious Metals: Gold and Silver

Gold remains strong despite some recent pullbacks and is currently in a consolidation phase. Silver shows relative weakness, struggling to break through key resistance levels, making it a potential candidate for shorting if looking to trade precious metals.

Forex and Dollar Index (DXY)

The Dollar Index is currently range-bound, making it a prime time for scalping strategies in forex trading. The EUR/GBP shows a significant rejection at a potential breakout point, hinting at bearish opportunities in the short term.

Stock Market Insights

The S&P 500 showed a robust bounce this week, potentially marking a bullish trend if it can reclaim the anchored VWAP level. Meanwhile, small caps (IWM) remain weak, suggesting a cautious approach if considering investments in smaller companies.

Emerging Opportunities: MSOs and China Stocks

MSOS 0.00%↑ , related to marijuana stocks, appear to be in a stage one accumulation phase, indicating potential trading opportunities. Chinese markets and stocks like Alibaba and JD.com are showing signs of bottoming, which could present favorable setups for those looking to invest in ADRs.

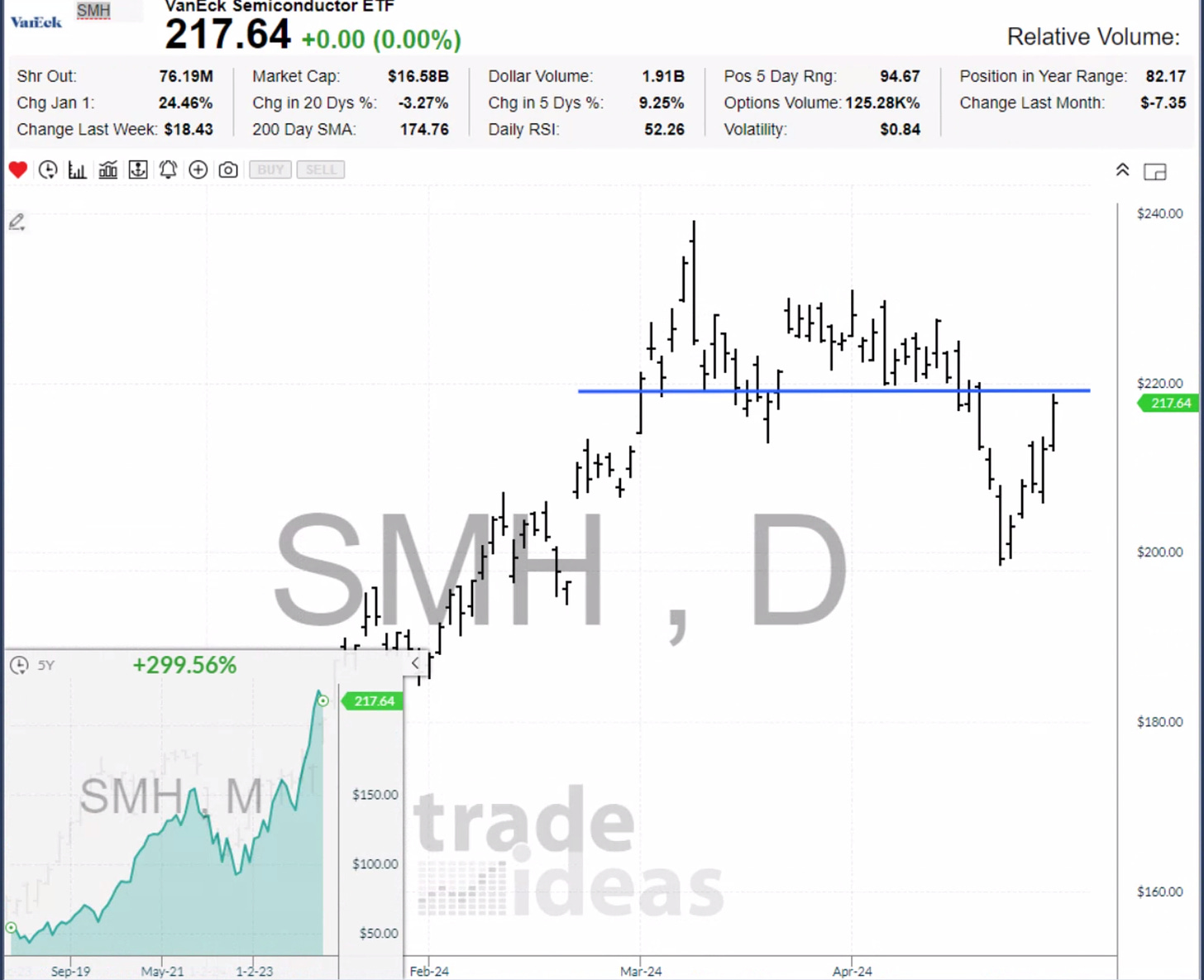

Sector Spotlight: Semiconductors and Solar Energy

The Semiconductor sector ($SMH) has shown some recovery, but faces resistance ahead. The solar energy sector, represented by Tan, is heavily beaten down but could be setting up for a reversal, presenting a high-risk, high-reward scenario.

Backtesting and Algorithmic Insights

Our backtesting results indicate a positive outlook for weekly breakout systems, especially in current market conditions. We will continue to refine these systems to offer subscribers actionable trading strategies based on historical data and technical analysis.

Weekly Breakout: DAVE 0.00%↑ GREK 0.00%↑ LRN 0.00%↑ NBBK 0.00%↑ TRIN 0.00%↑

AVWAP Bounce: CWST 0.00%↑ ENTA 0.00%↑ PFG 0.00%↑ RYAN 0.00%↑

Conclusion

As we delve back into regular market analysis following a brief hiatus, we encourage traders to approach the market with renewed vigor but also with caution. Monitoring key resistance and support levels across various assets will be crucial for successful trading in the coming week.

Stay tuned for more detailed analyses and ensure you're subscribed to our newsletter for exclusive updates and trading strategies. Happy trading!