Stay in the loop

To ensure you never miss out on any exciting developments and the insights I share from time to time, make sure to sign-up for the email updates from the website or click here. I promise no spam, no selling of your data— just a couple of chart-related emails every week.

"I'm glad I'm long on bitcoin. I'm glad I'm continuing to be long on it."

Bitcoin conintues to be strong. As we spoke about Sunday it seems to be shrugging off the issues it had earlier in the week.

This Week in Forex

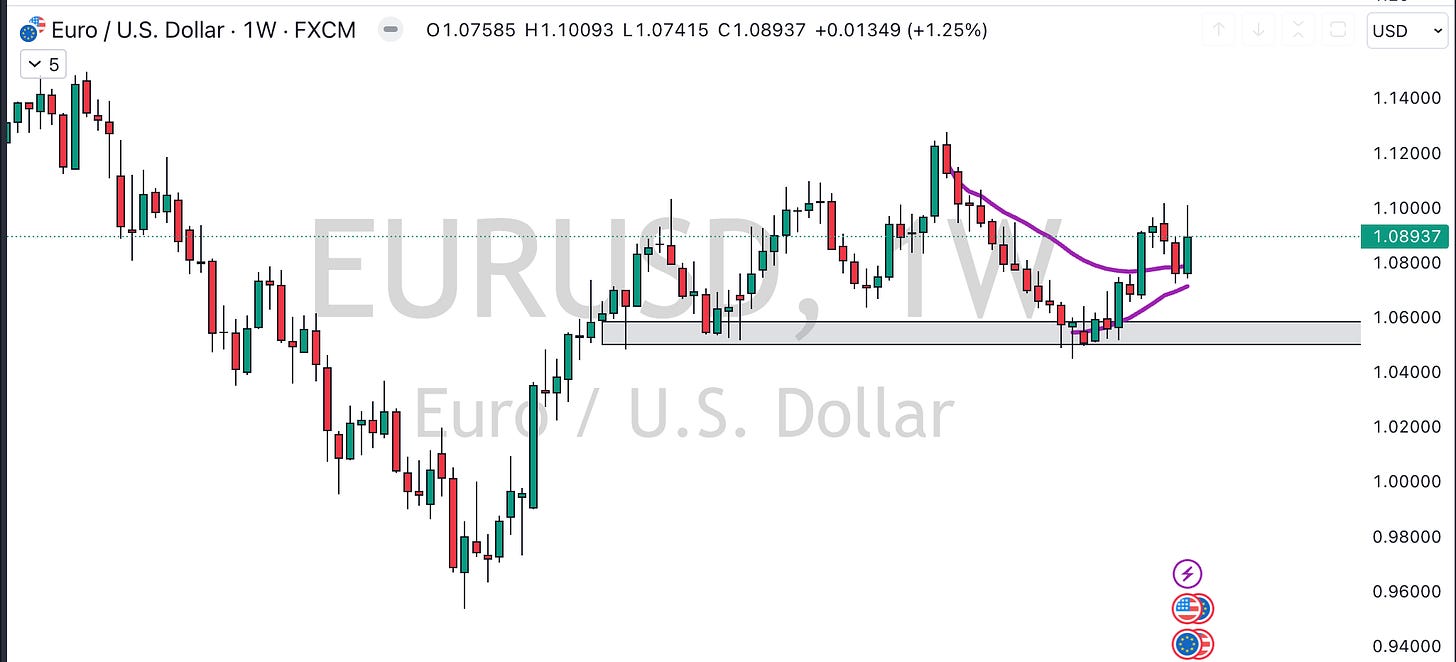

Moving on to Forex, we take a look at the Dollar Index (Dixie). This week has witnessed staunch downside movement in the index, aligning perfectly with our projections from the last video. We observed a rally up until the previous week's high, but unfortunately, the market rolled over without attaining the expected one week rally.

Wondering how I played this? By longing the Euro, just as I had explained in our Wednesday episode.

When navigating the Dollar Index, it's crucial to remember that the index heavily depends on the Euro, despite being a basket of multiple global currencies. This makes it essential to monitor the Euro, which at the moment has created a zone around 1.8 to 1.7, rallying off which presented ample short-term trading opportunities to me.

Two under-the-radar pairs worth studying at the moment are Aussie-Canadian Dollars (Aussie Cad) and Aussie-Yen. They appear receptive to the VWAP from a major high in Aussie Cad, and I'm meticulously examining its pattern as it approaches the anchored VWAP.

On the other hand, the Aussie Yen tells a slightly different story with a down week and a small inside doji candlestick pattern opening up crucial expectations for the next week. This will indeed unveil the future direction of Aussie-Yen, and considering the bear flag that might become more evident on the four-hour chart if it rolls over.

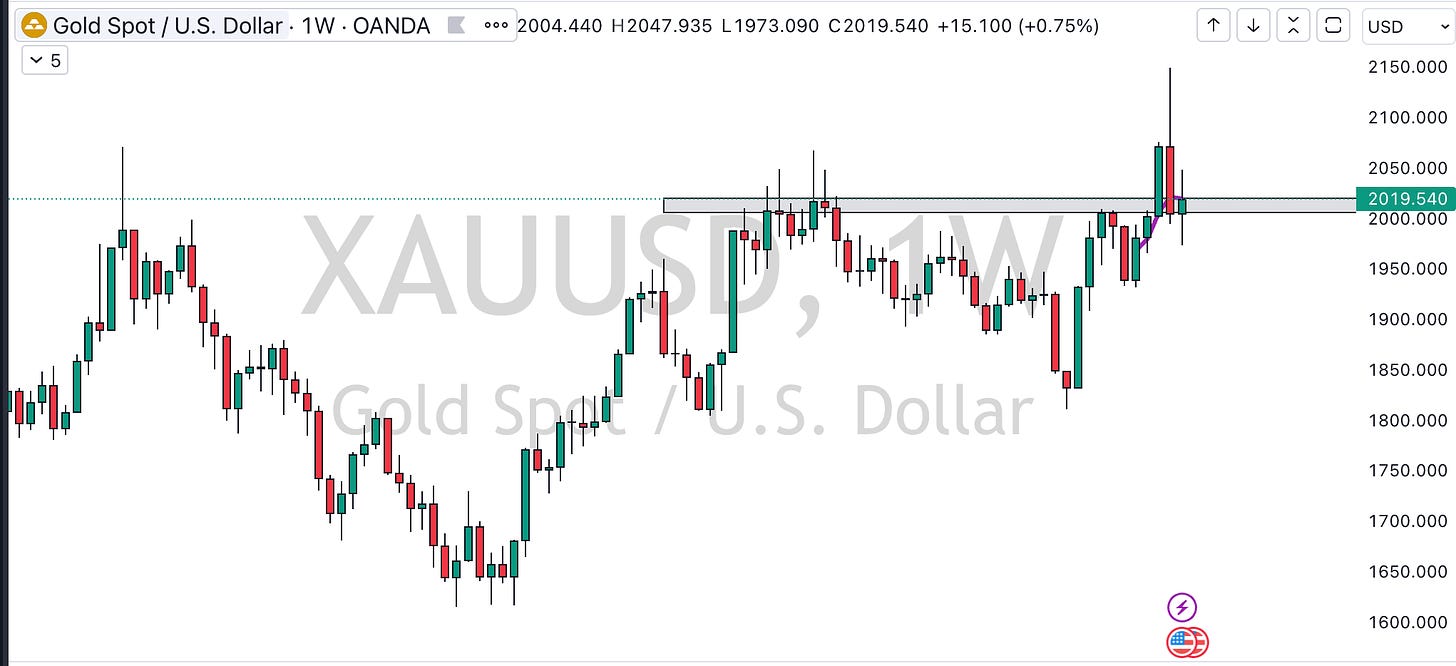

Spotlight on Gold

Shifting our focus to gold, we observed a massive downtrend last week and further selling-off into the week's lows. However, gold managed to recover, leaving us in a period of indecisiveness.

An area that can reinforce the continuation case is the spot holding the prior week's closes. Provided it maintains that level and starts pushing upwards, that might signal an uptrend. Looking from the perspective of the monthly chart, the focus is on the cup and handle pattern that might break higher.

Equity Updates

In the equities segment, I rely extensively on Trade-Ideas for equity scanning, trading, and maintenance of watchlists. This week, the solar sector intrigues me with its sustainability despite minor downfalls in spy securities today. This divergence between the general market and solar sets us up for the next set of interesting events to explore in the coming week.

The two important charts that cannot be overlooked when discussing equities are the S&P 500 (SPY) and Mid Cap Index (MDY). SPY has experienced a promising breakout, while MDY is closing in on a formidable resistance zone. If mid-caps decide to take a breather, it's safe to anticipate a similar move from large caps as well.

The small-cap index (IWM) seems likely to hit resistance at the $200 level, and a similar scenario is anticipated for the tech-heavy Arcturus ETF (Arc). The energy ETF (XLE) has been pulling back to the 80-85 region, with the last two candles signaling potential bottoming and subsequent rebound.

https://x.com/MichaelNaussCMT/status/1735790040104517846?s=20

Stocks to Watch

Certain stocks pique my interest, such as HCC 0.00%↑ , URBN 0.00%↑ , BEAM 0.00%↑ , and GPCR 0.00%↑ . HCC, a coal mining stock, has shown a promising uptrend. It's linked to our observation about energy ETFs, making it a potential ripe for benefits if energy moves higher.

Urban Outfitters' resistance at the cup and handle pattern makes it worth monitoring. Beam is another stock to watch with a 20% short float and significant potential if it breaks through the $30 resistance. Lastly, we have GPRC, a pharmaceutical company stock that has returned to the anchored VWAP from its major low, showing signs of potential upswing.

Wrapping Up

That's a wrap on this week's market update. I hope you found it enlightening and engaging. Enjoy your weekend off the screens!