Welcome back! I’m Michael Nos from StatsEdgeTrading.com, and each weekend we review the markets and look ahead to what’s coming. This week had plenty of action, so let's dive in.

Fed Rate Cuts: Don’t Panic

There’s a lot of fear around Fed rate cuts, but historically, they’ve actually been bullish. In fact, the market is up 80% of the time a year after a cut. So, don’t buy into the doom and gloom.

Bitcoin: Waiting on a Breakout

Bitcoin is shaping up for a potential breakout from a cup and handle pattern. If it can break above 68,000-69,000, it could rally hard. I’m holding a small position and will add more if we see a confirmed breakout

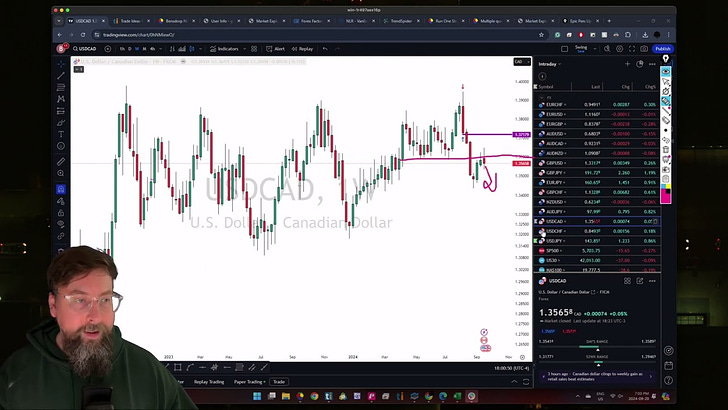

Dollar and Gold: What’s Next?

The Dollar Index is testing support again, and I’m expecting a potential breakdown. Gold, on the other hand, hit a new all-time high this week, and silver could follow. Both remain solid plays.

Stocks: Tech Slows, Industrials Shine

While tech stocks lag, industrials, homebuilders, and materials sectors are hitting new highs. Nuclear energy is also on the rise after news that Microsoft is licensing a nuclear plant for its AI operations.

Discretionary Pick: UNG (Natural Gas)

My pick for next week is natural gas (UNG). I’m already in the trade after a recent dip, and I like the setup after this week’s breakout on strong volume

.

That’s it for this week! For more algorithm-driven picks and insights, check out StatsEdge Pro at http://statsedgetrading.com

.