Introduction

Welcome to this week's edition of our financial insights. Despite a short trading week, there's plenty to cover, from Bitcoin and Ethereum to currency movements and gold prices. Let's dive in!

Bitcoin Analysis

Bitcoin has shown remarkable stability over the past few weeks, defying resistance and signalling a potential upward trend.

Impact on Ethereum and Other Cryptocurrencies

While Ethereum struggles to gain momentum, it's essential to distinguish between a Bitcoin rally and a broader crypto rally. This distinction influences our approach to cryptocurrency-related stocks and investments.

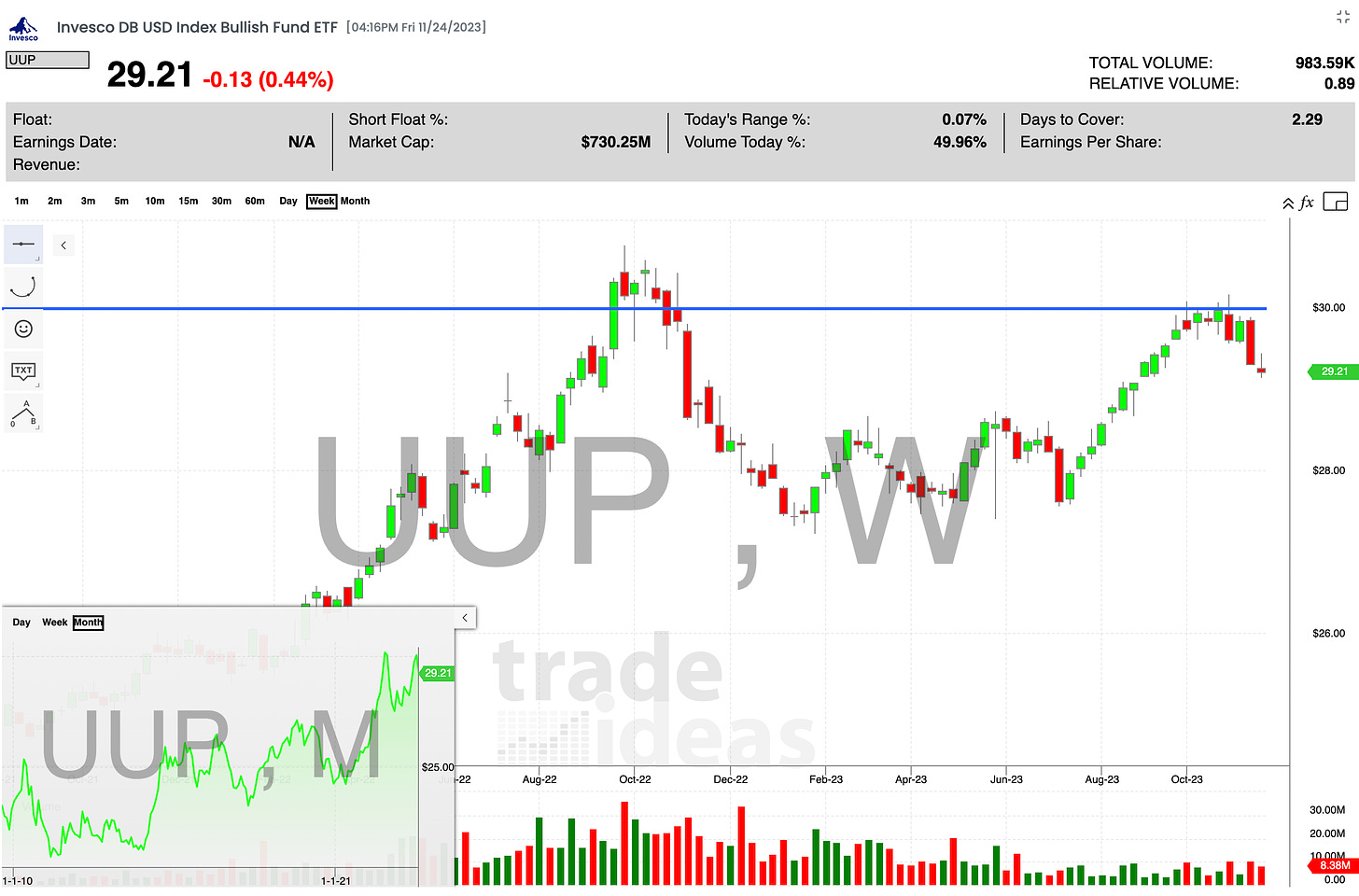

Currency Movements: USD, AUD, CAD

The US Dollar Index ( UUP 0.00%↑ ) shows signs of rest after a decline, while the AUD and CAD present interesting opportunities due to their correlation with petroleum.

Gold Is Shining Bright Again

Gold prices are soaring, and we're closely monitoring the potential for a further rally. The current trends in gold suggest a possibly lucrative phase ahead.

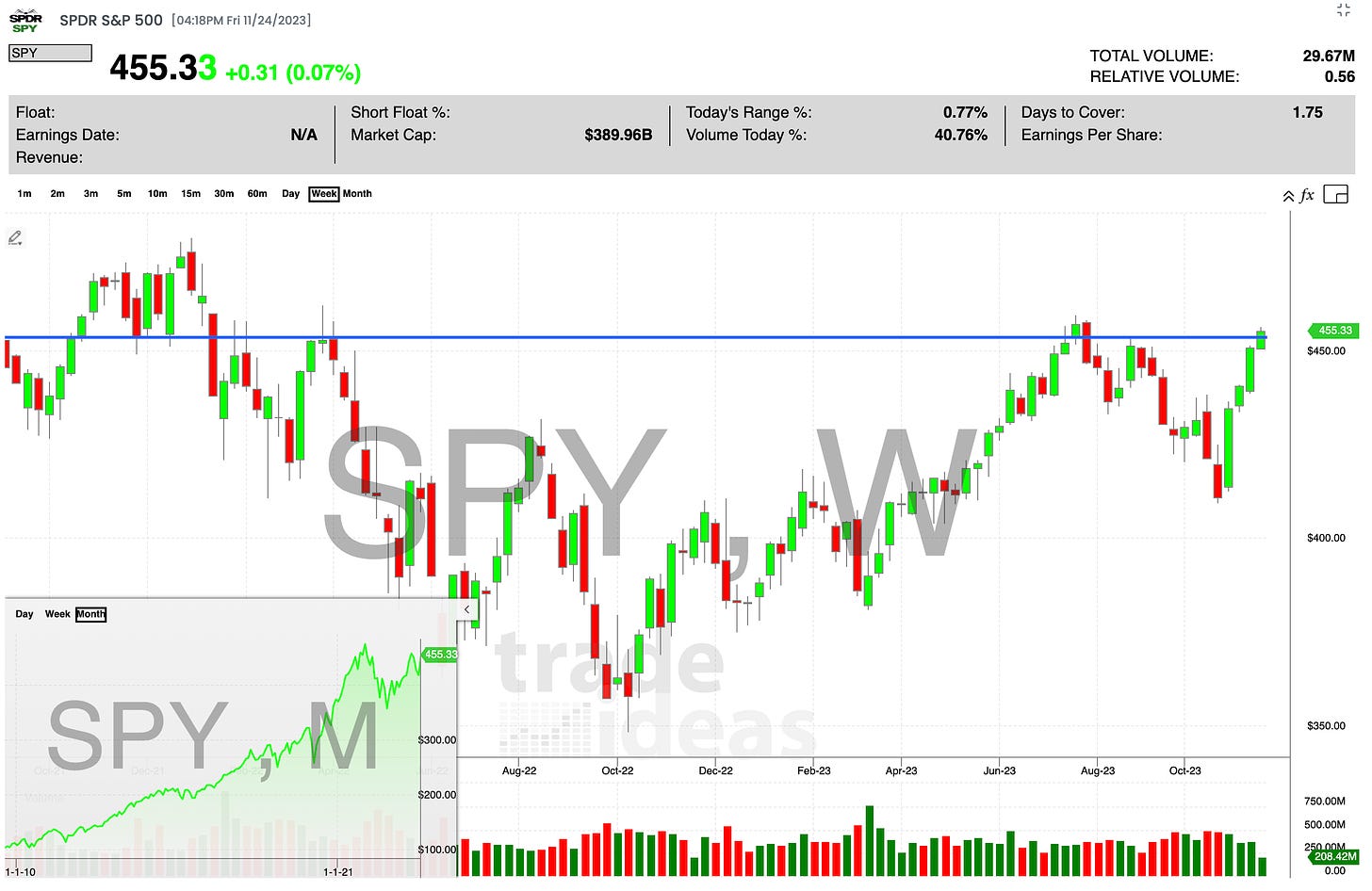

Analyzing the S&P 500 and Other ETFs

We're observing a potential breakout in the S&P 500, with mixed signals from other ETFs like IWM, KIE, SMH, and others. It's a time for cautious optimism in these markets.

Energy Market Overview

Strength in the Uranium ETF (URA) contrasts with the downtrend in Natural Gas ETF (UNG), highlighting divergent trends in the energy sector.

Trade Setups and Opportunities

We're eyeing several potential trade setups, including companies like Blink Charging and Beyond Meat. Our focus also remains on previous winners like Elf, AFL, and Duolingo.

Closing Note

Thank you for joining me this week. Remember, it's essential to balance screen time with breaks. Next week promises more activity and insights, so stay tuned.

Quote of the Week

"Success usually comes to those who are too busy to be looking for it." — Henry David Thoreau