Riding the Bitcoin Rollercoaster

Bitcoin's recent performance had a bit of a twist, where we witnessed a run-up that's been ongoing for a considerable period. Despite wishing I had bought in more when we broke this area, the trend has proceeded fabulously.

"Yesterday's selloff was followed by a sharp reversal today, taking us right back to these highs. If things pop out of this range, I may look to get involved more."

Scrutinizing the Dollar Index

Moving onto the "Dixie" (DXY/Dollar Index), it recently fell drastically after the CPI print release. Interestingly, the market picked up simultaneously, highlighting the lingering inverse relationship. This relationship is crucial to monitor if you're trading in stocks - the dollar sells off, and stocks rally, and vice versa.

Looking at Forex and Gold

Coming to the forex market, any pullback, for instance in Euro/USD, is a potential buying opportunity for me. Dollar-denominated currencies like Dollar/Yen offer the possibility of a short, given the dollar's weakness and Yen's ongoing lack of strength.

Gold presents an unusual scenario as it didn't rally when the dollar was weak, indicating some relative weakness here.

"I expected some more push on gold. Unless we can get some more strength going in the next few days, I may have to bail on my gold position."

Equities Overview

Shifting gears to equities, it seems like there's not much to do - and that's completely acceptable. As an experienced trader, I've been building my long position since our previous low and plan to ride the trend while retaining my portfolio of stocks.

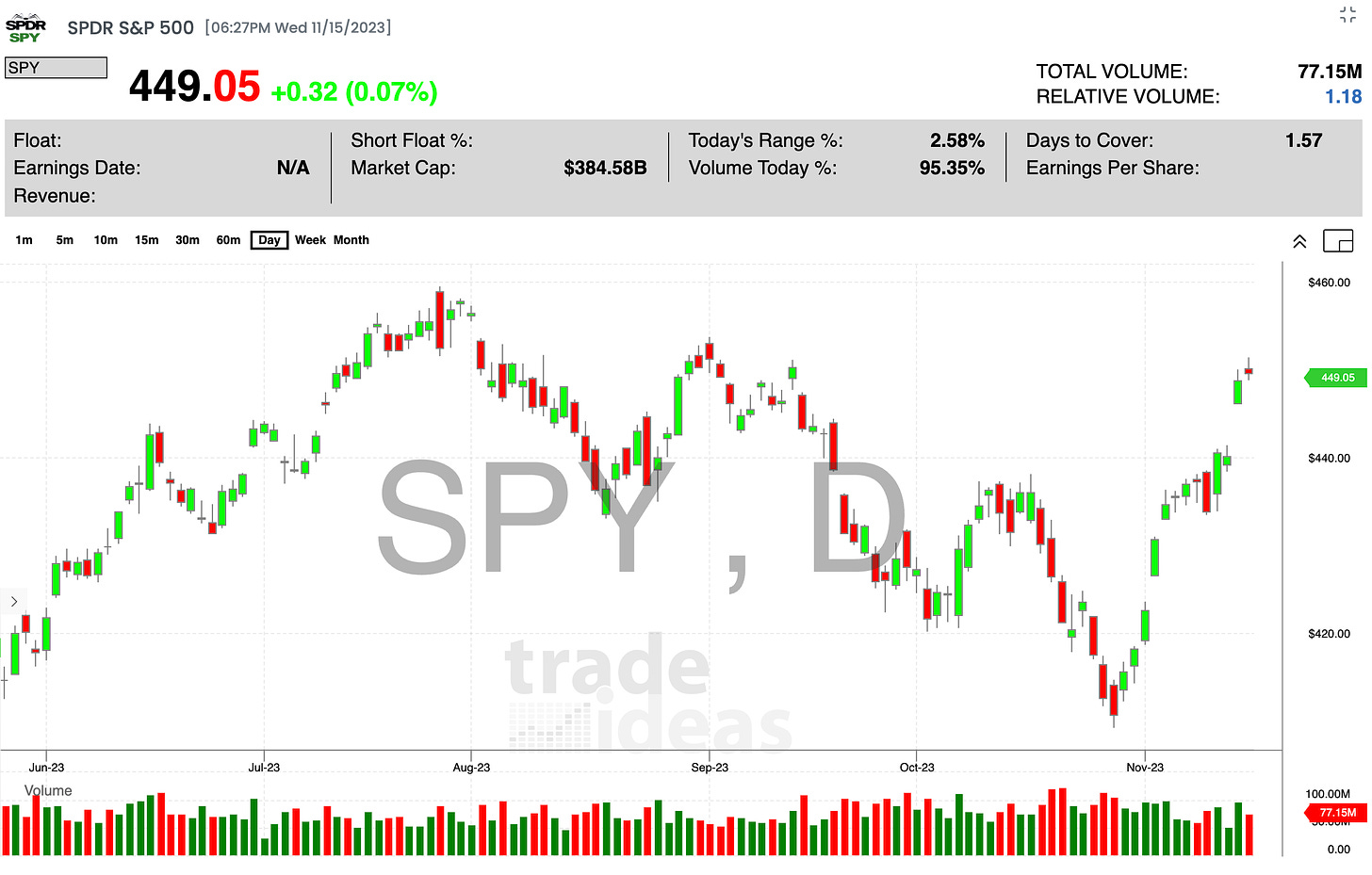

SPY 0.00%↑ , for instance, exhibited an absolute rip and a substantial jump on the CPI print. Its run seems to suggest a few days of rest. However, there's no reason to be bearish on this market.

Tech's Bullish Run

XLK, the tech sector, just hit a new high. Surviving a bull market is key to weathering a bear market. Russell 2000's 5% gain challenges the idea that only big companies support the market. Turn off the news.

Bottom Line

As a swing trader, my strategy thrives on when the market is in an uptrend, and my chosen names are working. By monitoring them daily, I can spend time innovating new strategies, backtesting things, creating videos, and overall becoming a more sophisticated trader by exploring other markets.

The key takeaway here is not to rush or FOMO; have a clear plan and stick to it. Stay tuned for my future videos where we'll keep you posted on the pulse of the market dynamics. And remember - always trade safe.