Welcome to the Friday Market Finale, where we recap the week's movements across Forex, crypto, metals, and stocks, and explore some ideas for the week ahead. This week had its share of market activity, and I'm highlighting a few key trends to keep an eye on, along with a potential trade idea from the algorithms we run at StatsEdge Pro.

Weekly Wrap-Up:

Forex: The DXY (Dollar Index) found support around the 100-101 level for the fifth time, prompting a bounce. However, this area is weakening with each test, suggesting a possible breakdown soon. I'll be watching for signs of a rollover to initiate a short in dollar pairs or a long in opposing currencies.

Crypto: Despite recent market noise, Bitcoin's cup-and-handle pattern remains intact. We saw some volatility, but the weekly candle closed near breakeven. I’m holding a small position and waiting for a breakout before adding more exposure. Ethereum is lagging, while Solana displays relative strength, showing a similar cup-and-handle formation.

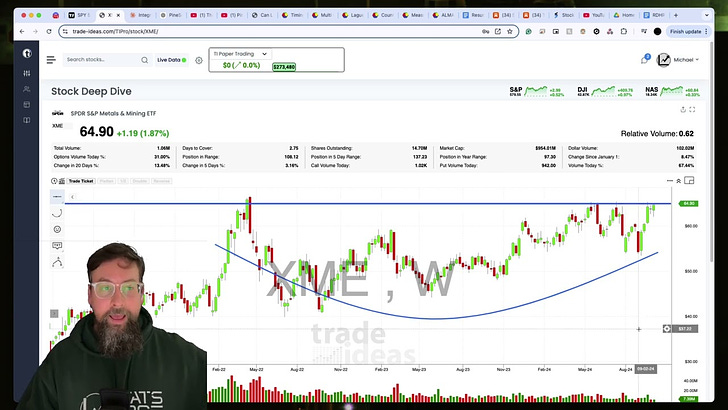

Metals and Mining: The XME ETF, which covers metals like gold, silver, copper, and aluminum, is showing promise. A breakout above long-term resistance around $66 could signal a move higher, making this sector worth watching.

Regional Banks: The KRE ETF is coiling nicely after retesting previous breakout levels around $52-$53. It’s setting up for a potential breakout

.

Bonds: The TLT ETF is pulling back to a key anchored VWAP level, which could offer a buying opportunity if support holds.

Algorithm Pick: Trend Continuation Setup

This week’s featured trade idea comes from our trend continuation scan. The setup involves a stock in a strong uptrend, recently experiencing a pullback. If the price breaks above key levels, it could trigger a continuation play. With a short interest of 27%, a breakout could fuel a short squeeze, driving prices higher

.

Key Takeaways:

Monitor sectors showing relative strength, such as metals and regional banks.

Be cautious with the Dollar Index as it tests support levels.

Stick with stronger assets in crypto, like Solana, while remaining cautious with underperformers.

Look for trend continuation setups where there's a potential for a short squeeze.

Stay tuned for more detailed analysis and trade ideas as we head into the new week. For more in-depth insights, visit StatsEdgeTrading.com.