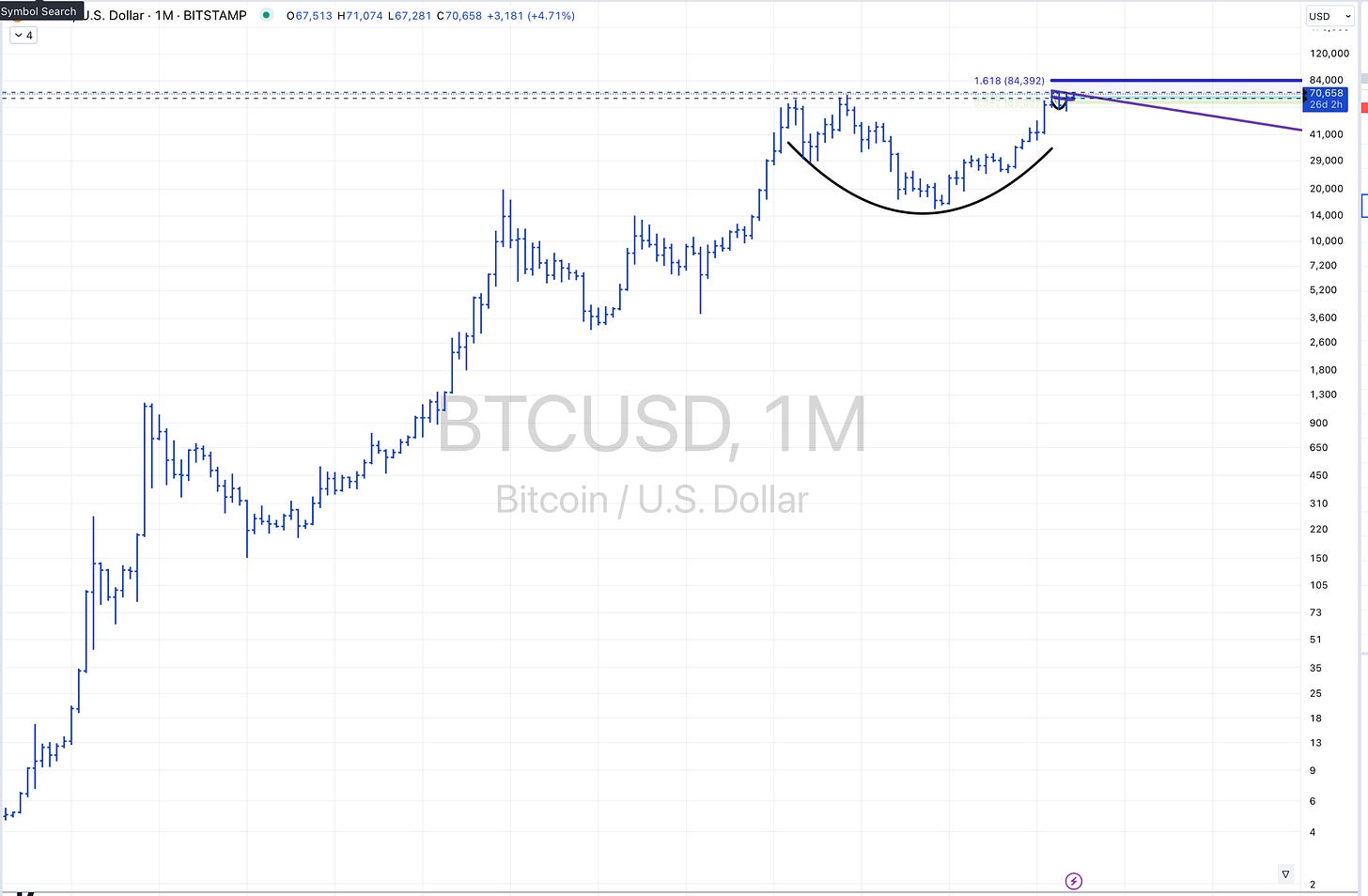

Monthly Overview

Historically, Bitcoin shows a pattern of surging past previous all-time highs followed by significant pullbacks—a trend suggesting potential forthcoming gains when it breaches these peaks. Currently, we're observing what may be the early stages of another bullish run.

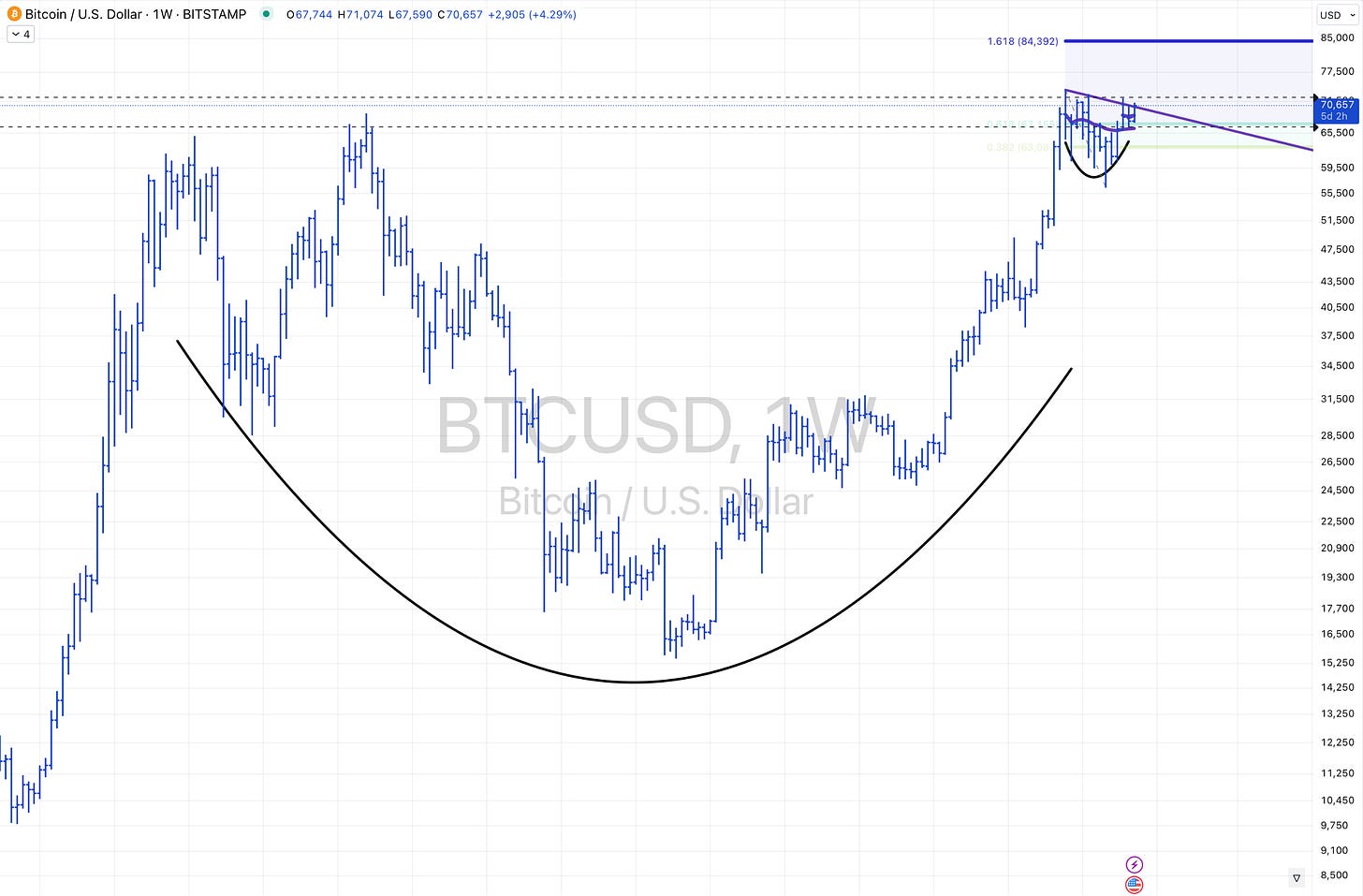

Weekly Analysis

On the weekly chart, Bitcoin displays a large cup formation, suggesting a consolidation phase as it digests overhead supply. This pattern has been evident since March, with Bitcoin now challenging these levels mid-June. The formation hints at possible upward movement once it successfully breaches this resistance.

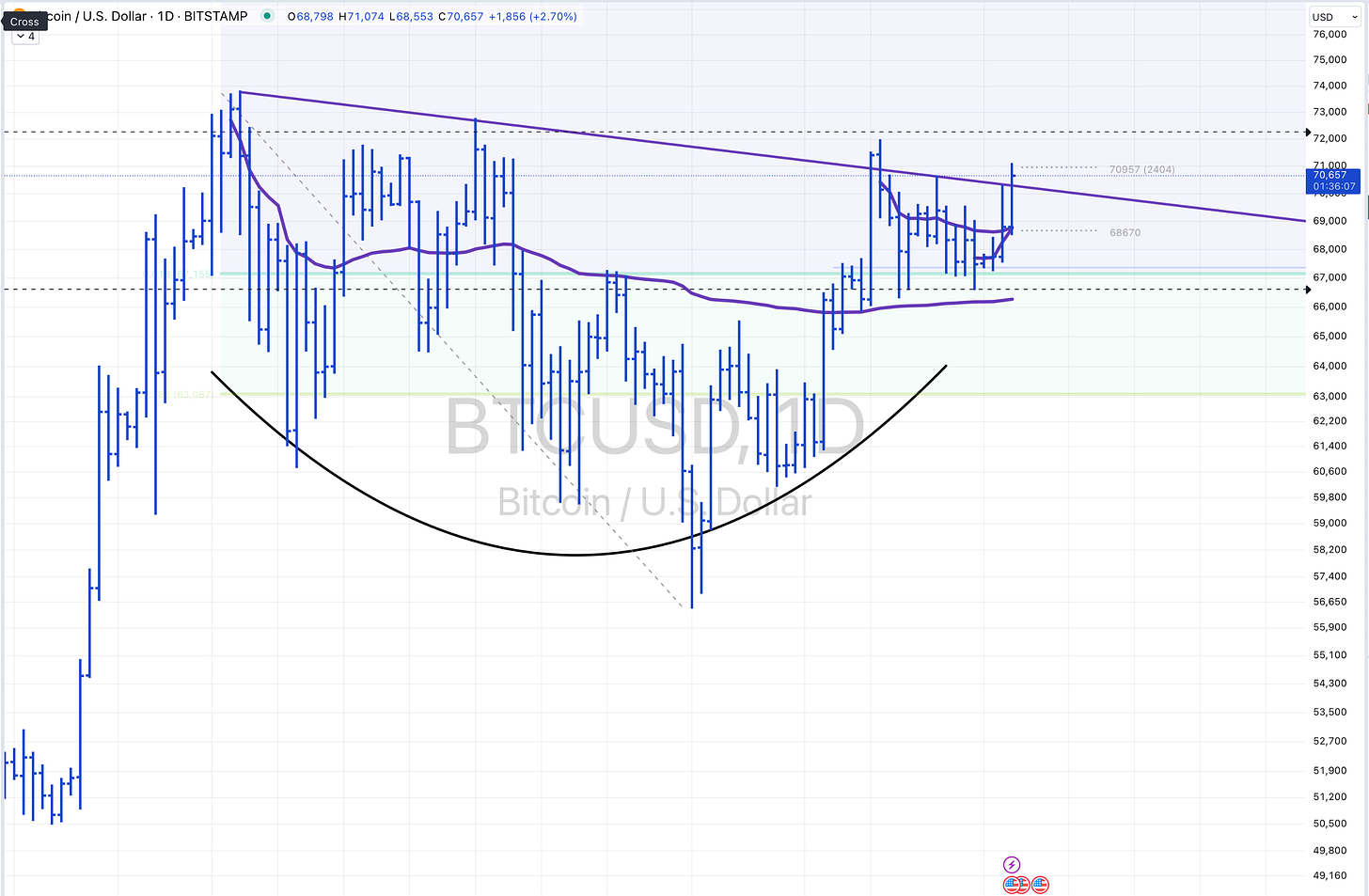

Daily Observations

The daily setup reveals a smaller cup-and-handle formation, indicating a buildup for a potential breakout. This pattern aligns with Bitcoin's historical behavior following the resurgence of meme stock activities, such as recent movements in GME, which often correlate with spikes in Bitcoin investment.

Investment and Strategy

My recent strategy involved capitalizing on these patterns by investing as Bitcoin surpassed the anchored VWAP from a previous high. Observing these movements, I've set a Fibonacci target around $85,000, based on the projection from its recent low to high. This target is conservative compared to more ambitious predictions but fits a short-term trading perspective.

Broader Market Impact

Expanding on Bitcoin's potential surge, I've also invested in Coinbase, anticipating that its fortunes will align closely with Bitcoin's market movements. Given Coinbase's role in the crypto market, any significant Bitcoin rally could positively influence its stock value.

Risk Management

It's crucial to approach these predictions with caution. My stop-loss is set at $66,000—any drop below this could invalidate our bullish outlook, signaling a need to reassess the market's direction.

Hi Michael,

I read your thoughts on Bitcoin with interest, its good to get a Tradfi trader's thoughtful perspective.

Coinbase could be a valuable addition to the portfolio given the promise of alt-season in Bitcoin's setup (and Ethereum's rebound). Nonetheless, I am rather bearish on the company itself, which seems to combine the worst aspects of crypto (zealous and unhinged right wing ideology) with the more staid habits of tradfi.