If you’re interested in trading with an edge, I encourage you to check out StatsEdge Pro at StatsEdgeTrading.com. There, you can also sign up for the free email list to receive videos like this directly in your inbox.

Bitcoin and Crypto: A Cup-and-Handle Formation?

Starting with Bitcoin, the monthly chart is showing signs of a potential cup-and-handle pattern, which is promising. We saw a strong rally followed by some sideways consolidation—a pattern similar to what we’ve seen in gold before it broke out. While Bitcoin is holding steady, Ethereum and other altcoins are showing relative weakness, solidifying Bitcoin’s position as the leader in the crypto space.

Gold and the Dollar: Key Levels to Watch

Gold continues to perform well, with a consistent pattern of consolidation followed by new highs. The weekly chart shows a lot of sideways action recently, but the overall trend remains bullish.

The dollar had an interesting month as well, bouncing off a key support level and rallying throughout the week. However, I’m cautious about the dollar's continued strength and will be watching for potential shorting opportunities if it begins to falter.

Equities: S&P 500 and Sector Insights

The S&P 500 had a strong month, reversing from a significant dip to close near its highs. On the daily chart, we’ve been in a consolidation phase for the past two weeks, and it looks like we could be setting up for a breakout. I wouldn’t be surprised if we test the all-time highs soon, given the current market conditions.

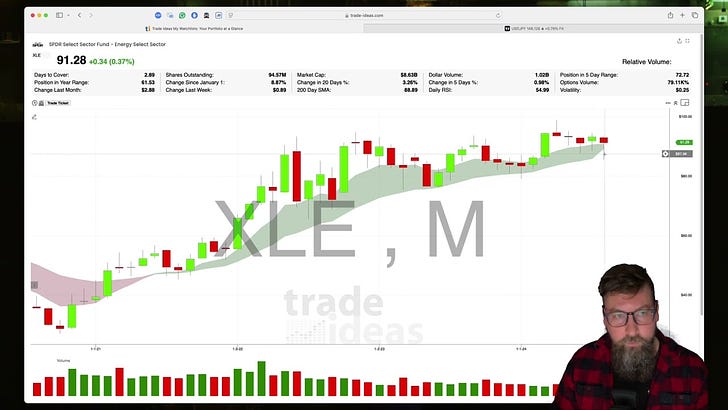

In the energy sector, XLE has shown resilience, with consistent buying pressure whenever it dips into a certain range. This could signal a potential breakout if we can move past the current downtrend.

Key Trade Ideas

One sector that caught my attention is semiconductors, particularly Intel (INTC). Despite the broader market strength, Intel has shown relative weakness, but it’s nearing a key level that could offer a good risk-reward setup. I’m considering a discretionary trade here, buying on a breakout with a stop under recent lows.

Final Thoughts

As always, these insights are based on my trading strategies and algorithms. If you want access to the full list of trading opportunities I’m watching, make sure to check out StatsEdge Pro. Members will also receive a detailed email summarizing the key setups to watch as we head into the next trading week.

Thank you for tuning in, and if you haven’t already, consider signing up for the free email list at StatsEdge Trading to stay updated on all the latest content. Until next time, happy trading!