First Up: Bitcoin Analysis

Bitcoin, has been behaving like a broken record. It's been stuck in a range with occasional explosions in either direction.

From personal observation, I've held the view that I will not aggressively go long until we're over the $31,000 mark, and vice versa, holding back on shorts till we slip under $25,000.

AUDCAD: A New Entrant in the List

AUDCAD is a relative newcomer to my watch list. Its recent emergence was a result of interactions with a client who is vested in this pair. Ozzy CAD denotes Australian dollars (AUD) and Canadian dollars (CAD), both petro currencies which traditionally trade with oil.

Interestingly, this cross pair eliminates the oil factor. Recently, it failed to sustain a low and was followed by a strong rally, pointing towards a potential bear trap. Echoing the old adage, “from failed moves comes fast moves”, the presence of a strong failed move points towards a potential fast move.

The Dollar Dilemma: Euro Dollar

Talks about the dollar often lead to the Eurodollar. A look at the Euro Dollar offers hints about the dollar's position. A pattern of continuous uptrend followed by a potential evening star pattern emerges. An evening star pattern involving a strong green candle, a candle of either reversal or indecision and then a red candle down indicates that we may be approaching a near-term top.

Stocks and Sectors: A Quick Look

Shifting focus from currencies to stocks, this quick overview reveals an interesting correlation. Bonds and stocks, despite traditional behavior suggesting otherwise, are on the rise together. Amid this, energy reported a pullback while consumer discretionary and technologies were rising.

This visible rotation truly signifies the lifeblood of a bull market.

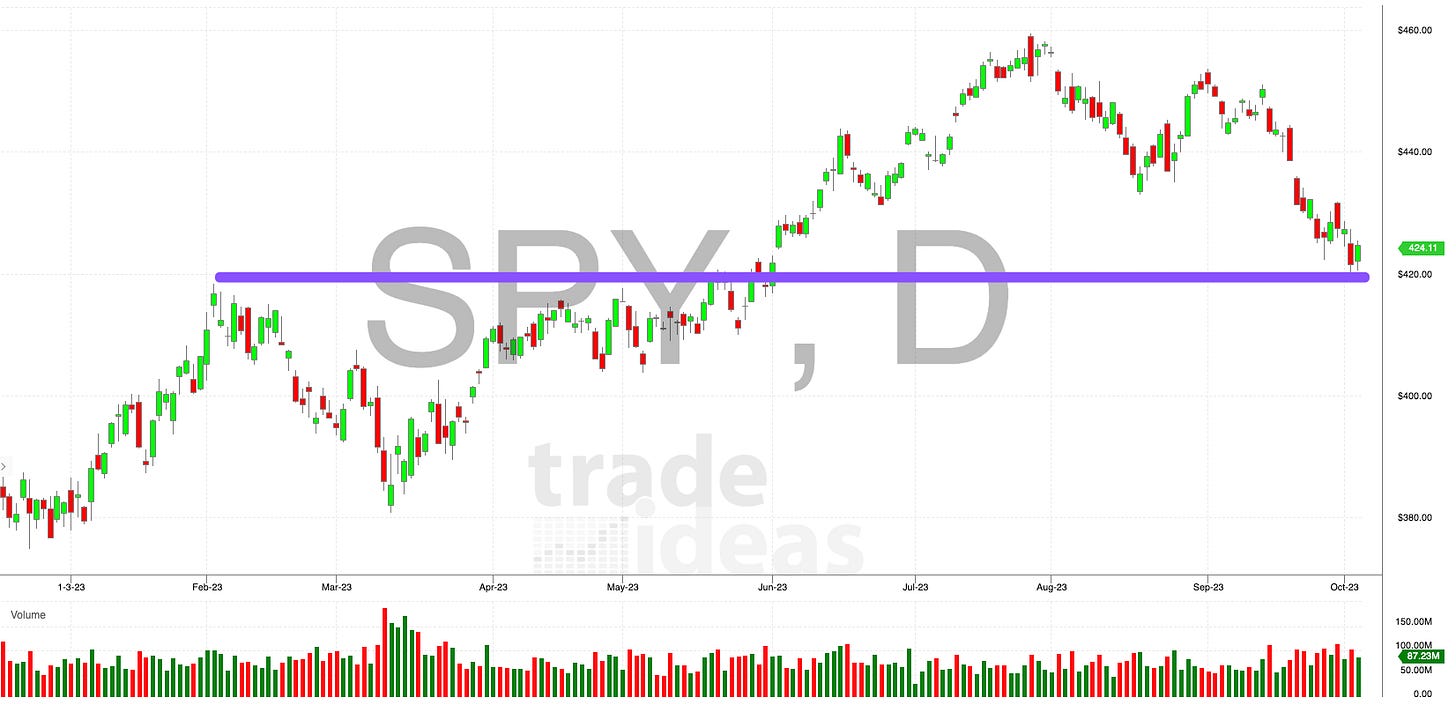

Looking at the S&P 500's 420 area, a point of intense observation for many, expect a technical Harami pattern. The Harami pattern signals a potential price reversal, but things may not be as straightforward.

Market movements around popular levels are rarely clean.

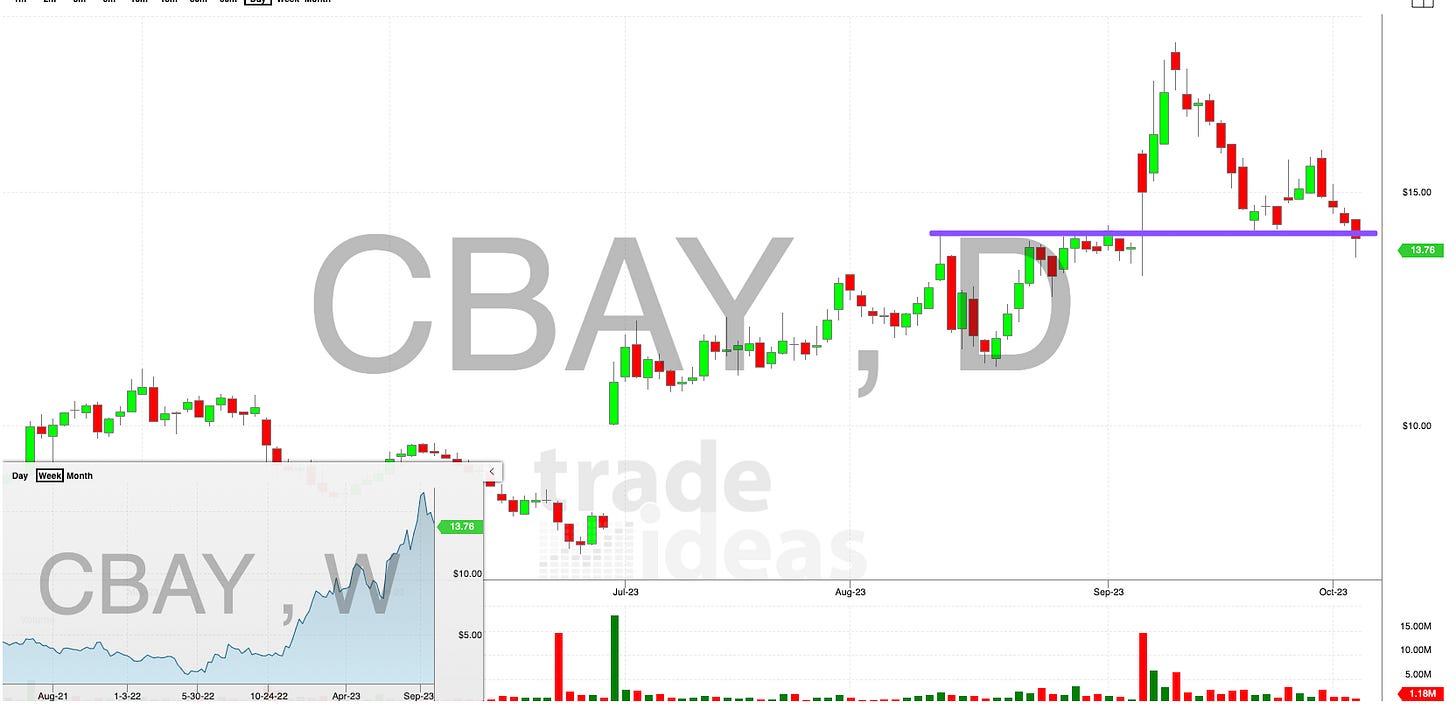

While there could be potential for a bounce back from the 420 area, I expect some choppiness. Personally, I've let go of my short positions around the 420 area and am now more positioned long. A few stocks that caught my eye include $VNT, $RELY, and $CBAY, among others.

Watchlist: https://www.trade-ideas.com/Cloud.html?code=a8735b7652d6d8b66c6a7d16eadb7484