Welcome folks, to our regular midweek market wrap up where we dive right into chart analysis, navigating the financial landscape of equities, forex, and crypto markets. We'll also discuss potential trading opportunities to watch out for as we approach the end of the week and Christmas. So, let's get straight into it!

Crypto Corner: Bitcoin and Ethereum

The first chart we'll dissect centers around Bitcoin. Recently, the market has suffered a downturn, yet Bitcoin seems defiant, continuing its upward rally. This is intriguing since, traditionally, Bitcoin and the Nasdaq (the QQQ 0.00%↑ ) tend to be correlated. However, this link seems to be weakening, as we're noticing an increase in Bitcoin amidst a Nasdaq sell off. This raises the question: if the Nasdaq manages to bounce back within the week or towards its end, are we likely to seek a boost in Bitcoin?

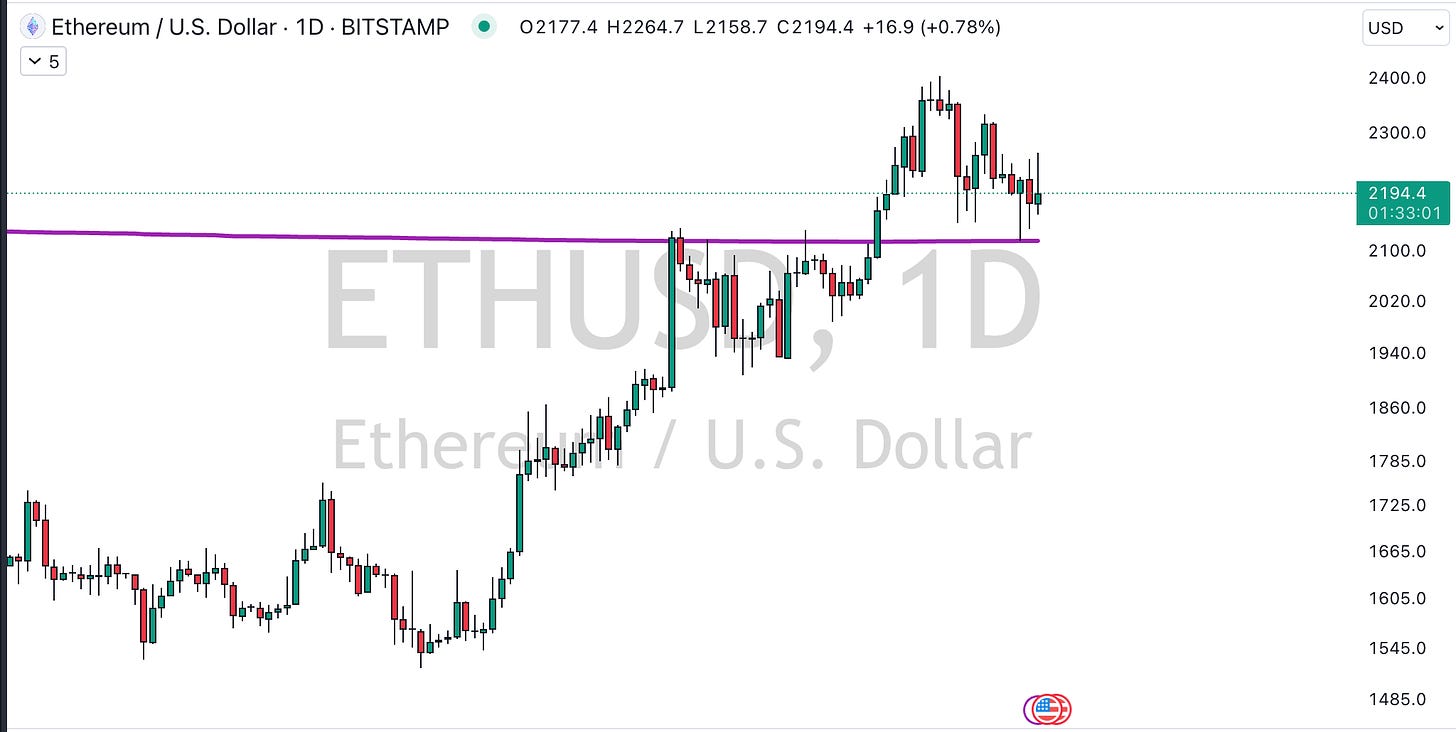

Here's a snippet of the $ETHUSD chart I'm closely watching:

The purple line represents the anchored Volume Weighted Average Price (VWAP) from Ethereum's all-time highs. It's important to note that Ethereum isn't quite there yet, but this anchored VWAP level interests me greatly. Following the retest of this level, it seems like we're witnessing a bounce off it, implying a possible ripple effect from Bitcoin to Ethereum.

Forex Spotlight: The Dollar Index and Aussie Cad

Switching gears to Forex, let's take a look at the Dollar Index (DXY), i.e., the dollar against a basket of other currencies. The Dollar Index is showing a moderate up-tick but has not seen as much of a melt up as I would expect with the market selloff . This points to a decoupling of the usual market trends – an exciting plot twist for traders like myself.

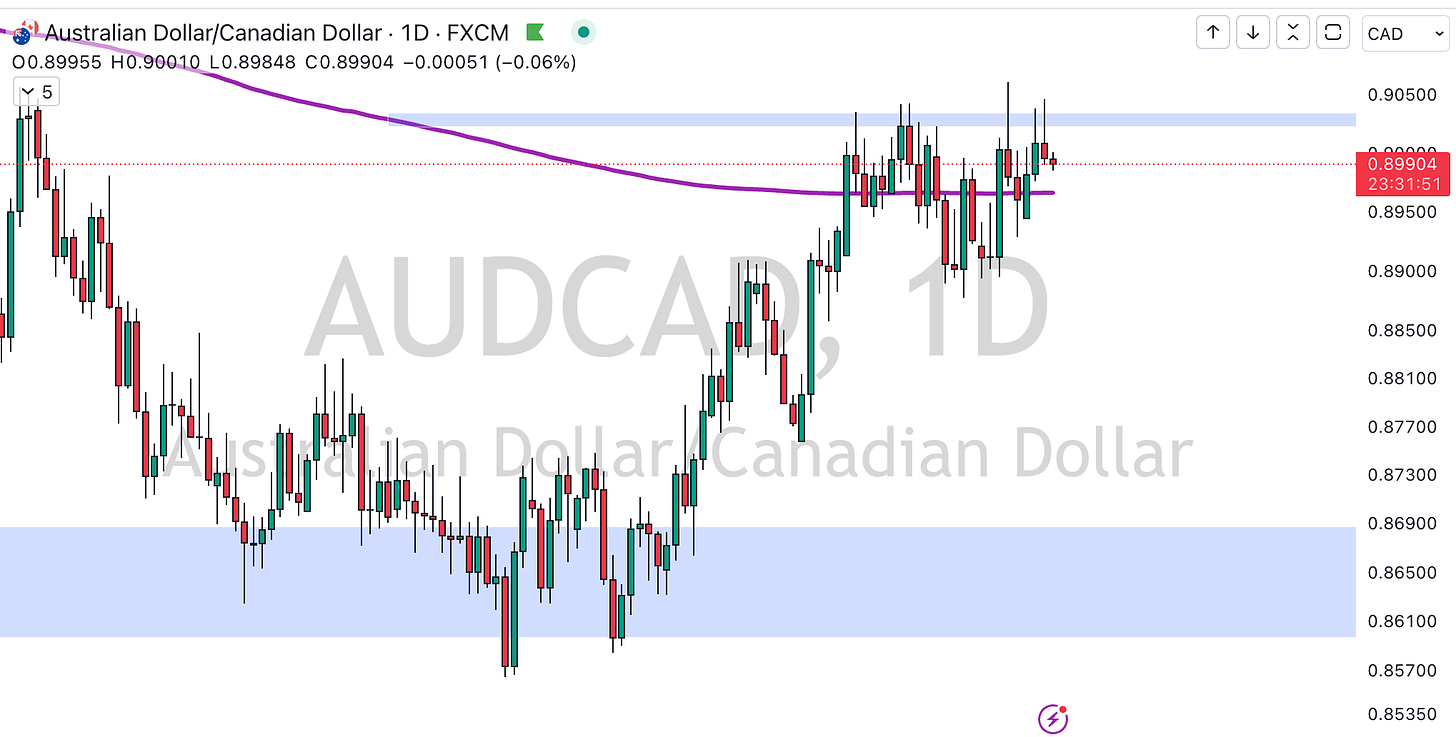

Speaking of interesting Forex pairs, let's have a look at 'Aussie Cad' (Australian dollar / Canadian dollar), which has clearly defined levels and potential for setback opportunities.

As per the chart, there's a pronounced bullish continuation breakout trend on Aussie Cad that holds promise for potential quick wins.

Commodity Check: Gold and Silver

Over on the commodities side, I've been keeping my eyes peeled for movements in Gold and Silver.

For Gold:

The Gold market is relatively quiet. However, I'm closely tracking a tight range here and aiming to pounce if we see a solid breakout.

In Silver's case, on the other hand, there's been a strong drive upwards, and despite today's sell-off, it still ended pretty strong. Silver is definitely a commodity worth watching for potential relative strength.

Equity Analysis

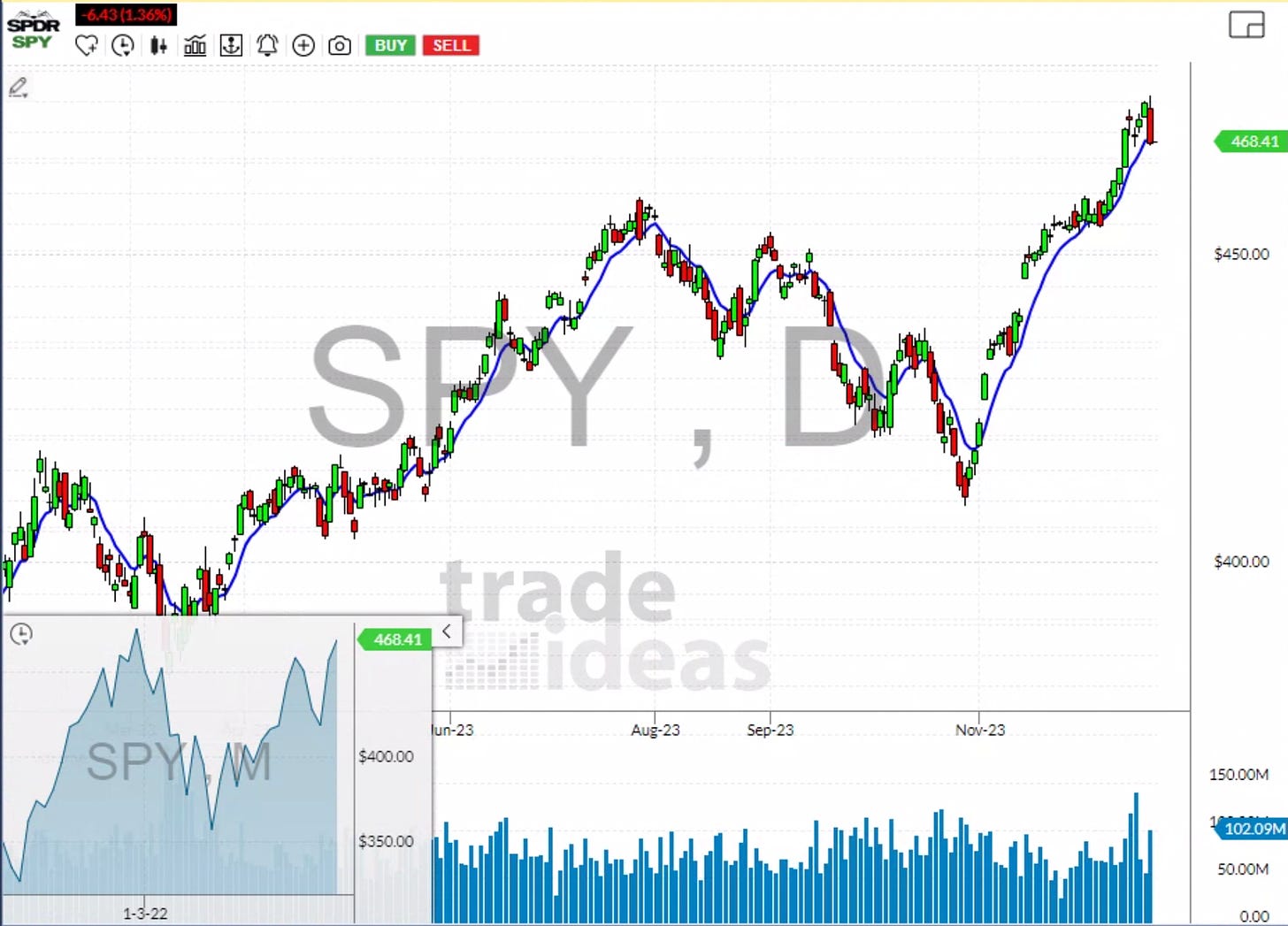

A brief look into the dynamic world of Equities shows a bearish sentiment in the market, triggered by a slight pullback. On the flip side, it's worth noting that even the slightest drop seems to trigger alarmist "stock market crash" trends on platforms like Twitter, painting a picture of investors eager for a sharp downturn to avail buying opportunities.

This is precisely where we have to keep an open mind and potential for a possible resurgence of buyers.

Going down the scale into mid-caps and small caps, both sectors portray some resilience, managing to hold steadily in their breakout range despite the bearish undertones.

Next, we look at two interesting indices: the US-focused USO and FXI, the Chinese ETF. We notice an intriguing counterpoint – despite a broader market sell-off, USO is showing some relative strength, while FXI is leading the downward trend, adhering to ongoing geopolitical concerns in China.

Trading Strategy: The Anchored VWAP Pullback

"The anchored VWAP from Ethereum's all time highs. Now, I've talked about this a little bit earlier where when I was buying this breakout right here, I was very interested in this level because we were stuck below that anchored VWAP from that all time highs."

One of my favorite trading strategies involves the 'anchored VWAP pullback'. This involves setting up an anchored VWAP line on a chart (Trade Ideas is an excellent software to use for this) and looking for stocks that pullback into specific zones denoted by the VWAP.

In this dance between bearish and bullish signals, the anchored VWAP pullback method gives us a go-to trading strategy for spotting powerful upward trends as long as the broader market trend stays favourable.

Sign Up and Stay Tuned

Eager to catch a wrap up of how these scenarios play out for the rest of the week? Make sure to sign up at statsagetrain.com, where I'll send you timely emails with my latest market analyses and potential trade ideas.

I truly appreciate your ongoing support, likes, shares, and feedback.