The State of Cryptocurrency: The Case of Bitcoin

Starting with Bitcoin, we've seen it hit the 200-day moving average again, only to experience a selloff. Bitcoin remains within a particular range, fluctuating between 31,000 and 25,000. Personally, I've made some short-term trades in this context, grabbing profits where I could, but given its lack of movement, I plan to take some profit soon.

"You got to take, I guess, what the market is giving you because you can't control it. So no need fighting that."

The Forex Outlook

Now, let's steer the discussion towards some currencies that caught my attention.

AUD/CAD: After a bear trap that saw the currency pair dip below a specific low, we've noticed a positive short-term bias. If it can surpass the current resistance zone, I'm prepared to make a good trade in anticipation of a possible upward swing toward the 200-day moving average.

EUR: The Euro is maintaining the long-trade perspective. Despite some market volatility, it has remained above the anchored VWAP from its lowest level. Looking at the weekly chart and considering the double bottoming tail, I believe we may see a continuation of the ongoing relief rally.

USD/JPY: There are clear bullish signs for this currency pair with the formation of an apparent bull flag, coupled with a steady hold of the anchored VWAP. However, increased rhetoric from Japan's central bank about safeguarding their currency value should be a warning to traders to set their stops carefully.

Navigating The Equity Markets

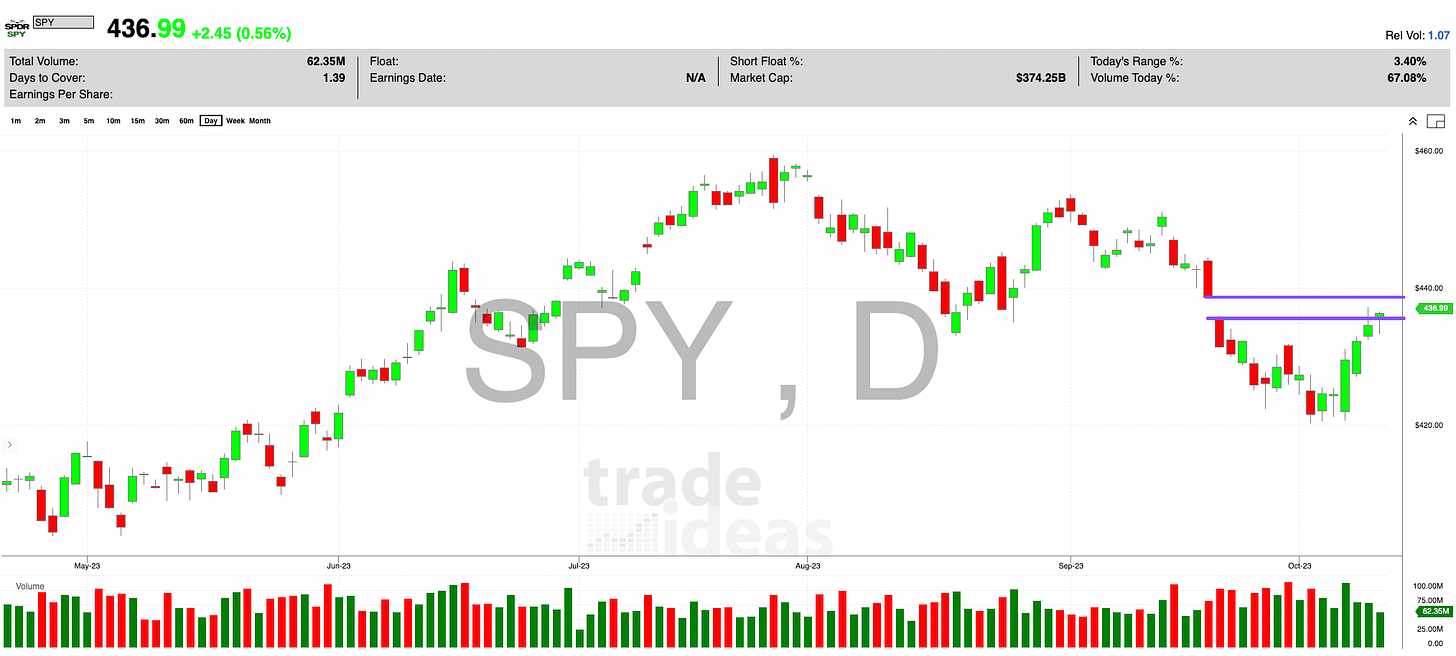

Reviewing the equity sectors, I've found interesting movements with XLRE, TLT, and XLU. Despite being heavily beaten down, these sectors are now experiencing upward movements. A closer look at the individual market charts can provide more insight.

In conjunction, I've been noticing a substantial market-wide short squeeze reflected in these giant bounce-backs. However, there is a contrast – the leaders in tech and AI are showing exhausting signs, whereas the laggards are having a rally. This disparity may reflect a change in the market dynamics, but it's always wise to tread lightly and wait for clearer signals.

Spotlight: Stocks To Watch

As we continue examining the market, I'd like to highlight a few stocks on my watch list:

AESI: This oil sector stock has consistently found support at its VWAP anchored from a significant low. I'm looking forward to a potential continuation after its sharp pullback.

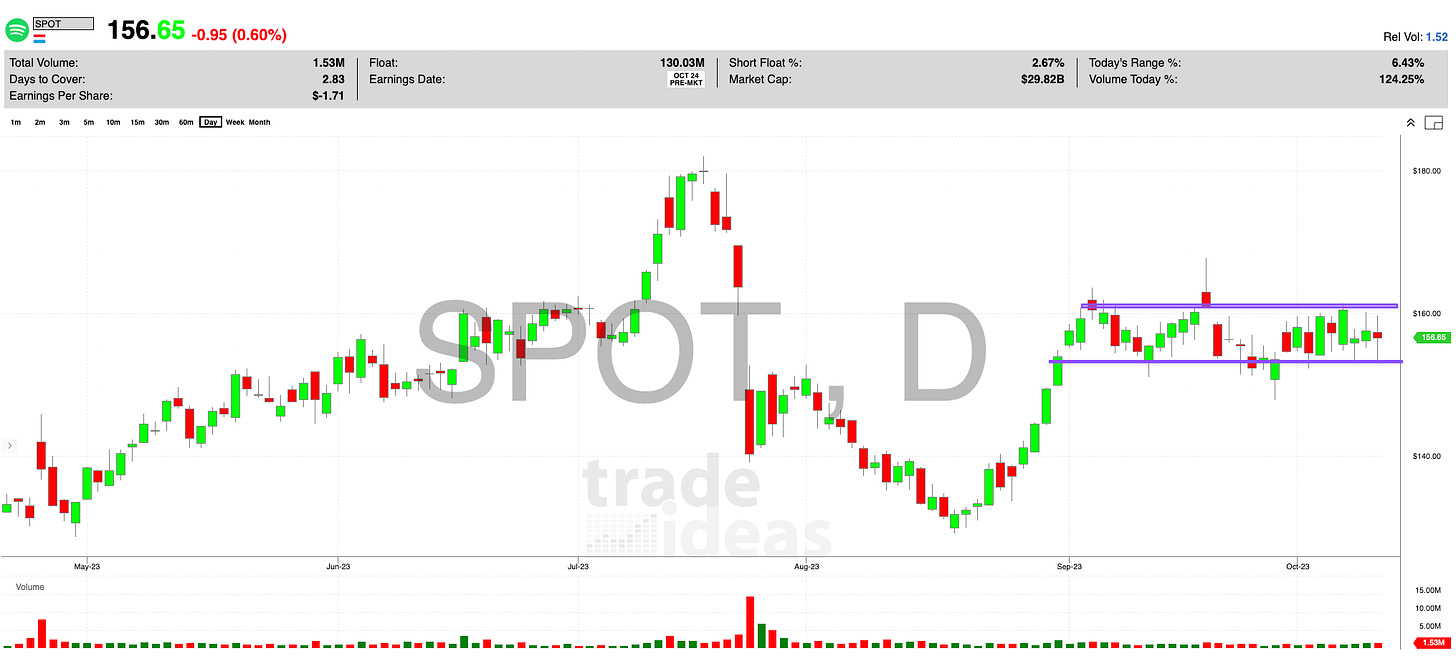

Spotify ($SPOT): Despite being a laggard in the tech sector, Spotify has cultivated a great pattern - tight enough for a breakout play. I'm keen on watching for a close above $160.

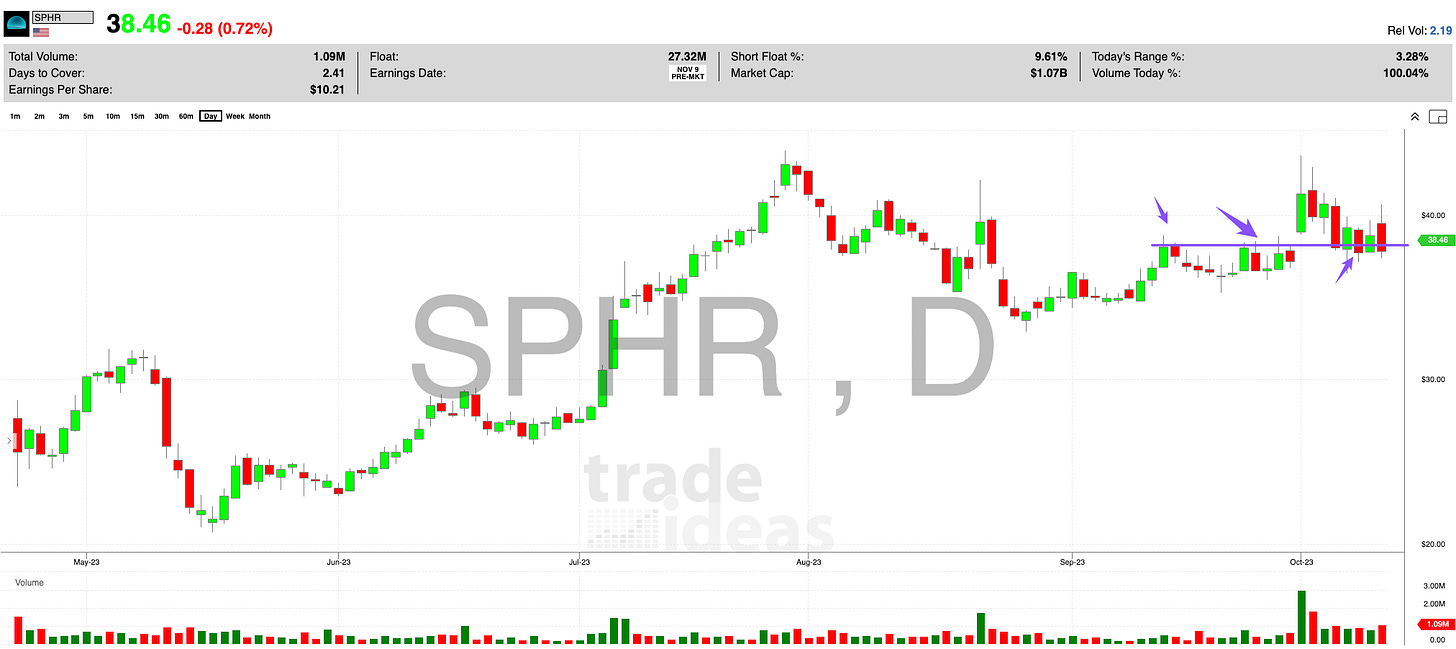

MSG Sphere (SHPR): The recently IPO-ed Sphere could be one to watch. This stock is particularly interesting. After positive news from a YouTube concert, it's pulled back and is currently holding a gap. With a short float of 9%, if the stock breaks above the $40 mark, it could warrant closer attention.

VTEX: A promising VWAP play anchored from a significant low filled with volume, VTEX could potentially shine with an increase above $5.

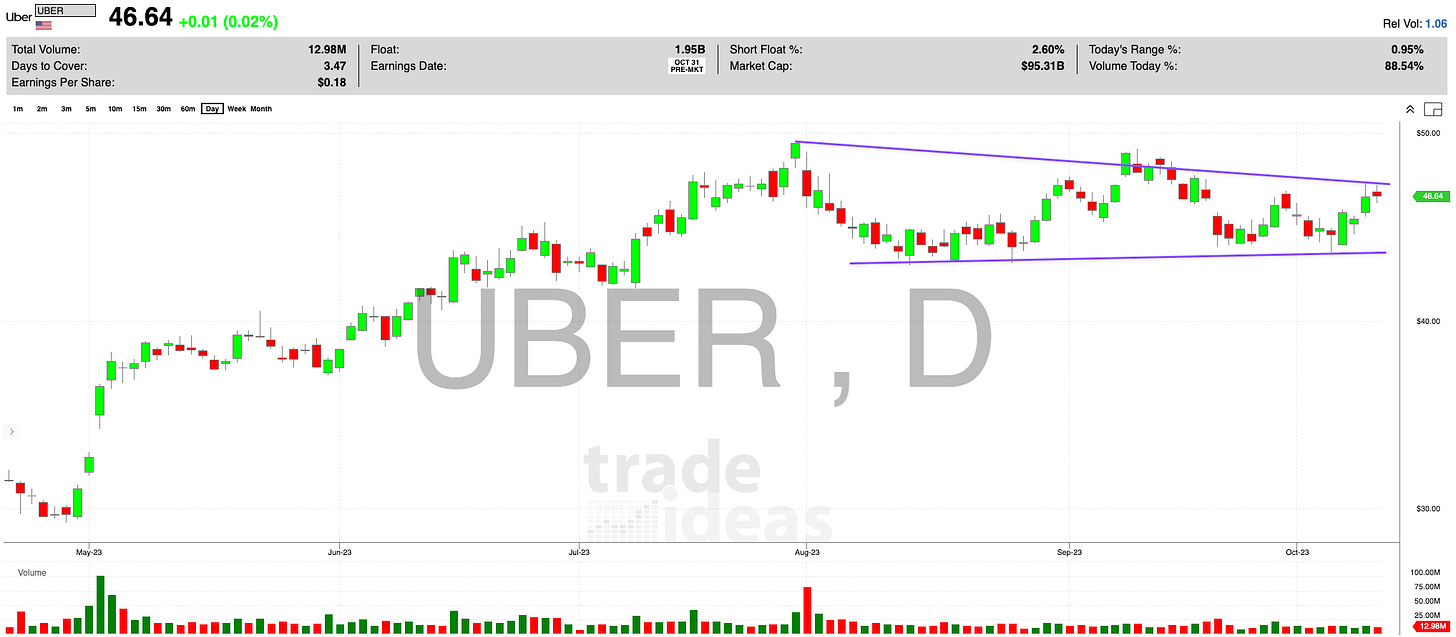

Uber: A traditional and possible cup-and-handle pattern forms on Uber's chart. The stock has shown recent strength, holding its ground. With a weekly resistance break, it may begin challenging for new highs.