Please note the trading plan course introductory price is going away this time next week. If you need help building your trading plan check it out here. https://www.statsedgetrading.com/trading-plan-course

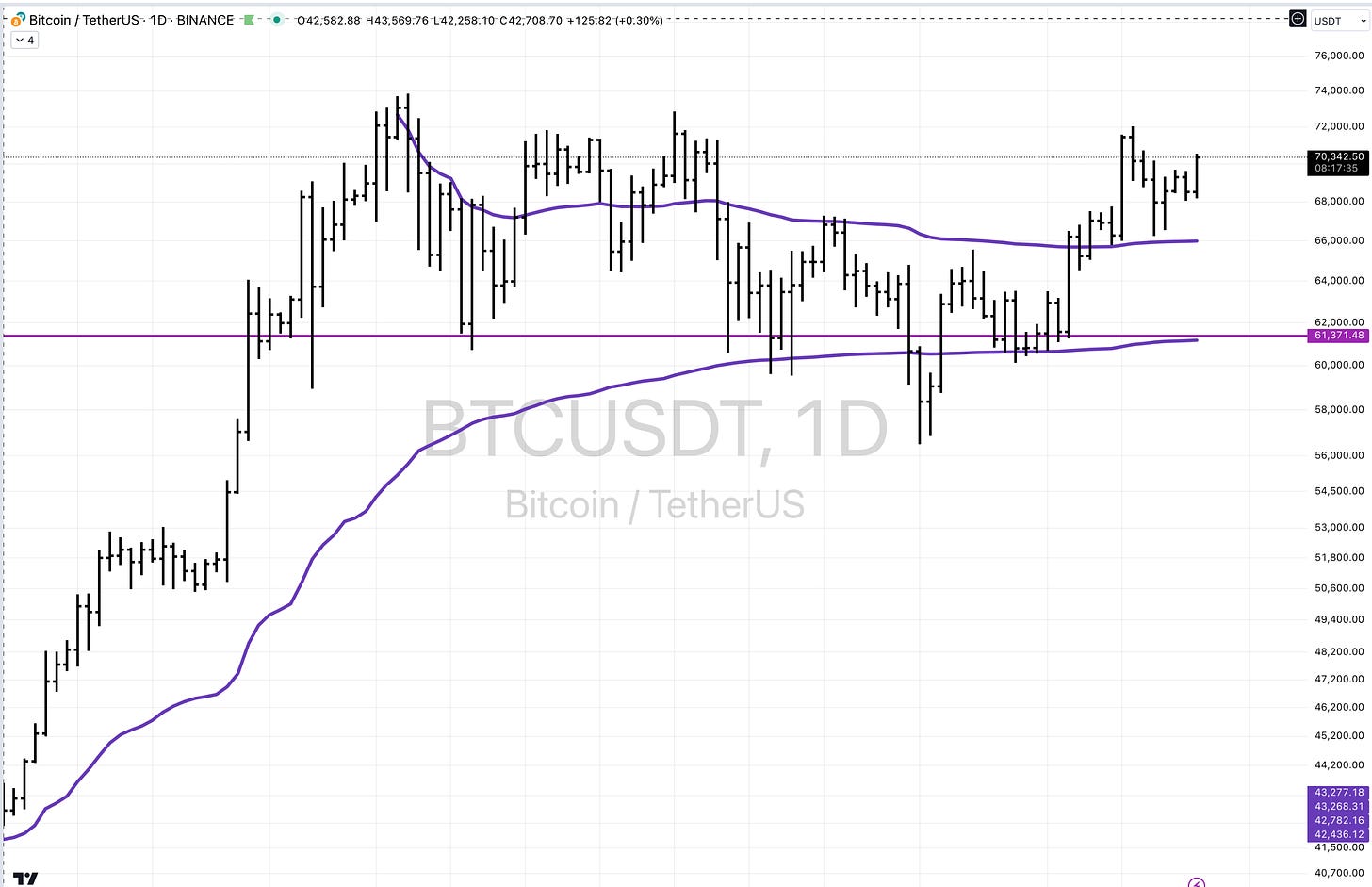

Cryptocurrency Insights This week, Bitcoin and Ethereum showed promising movements. Notably, Ethereum gained traction with the recent ETF approval, although it hasn't reached its previous highs and is still far from all-time highs. In contrast, Bitcoin maintains its dominance, showing potential for an upcoming breakout. The commitment of traders report indicates a stable speculative interest in Bitcoin, with an increase in short positions in Ethereum, which might suggest an upcoming volatility or a potential rally if shorts are squeezed.

Market Divergence in Indices A noticeable trend in the market is the divergence between the NASDAQ and the Dow Jones Industrial Average. While the NASDAQ has experienced gains, indicative of strong tech sector performance, the Dow has seen declines, particularly among industrials and financials. This divergence could signal a need for caution; a tech-led rally, while robust, ideally requires broader market participation to sustain growth.

Gold and Silver Market Movements Gold has shown some weakness compared to silver, which has seen significant upward movement. However, gold is currently trading below major support levels on the weekly charts, suggesting caution among investors. In contrast, silver's rally suggests a potential for continued bullish behavior in the precious metals sector.t

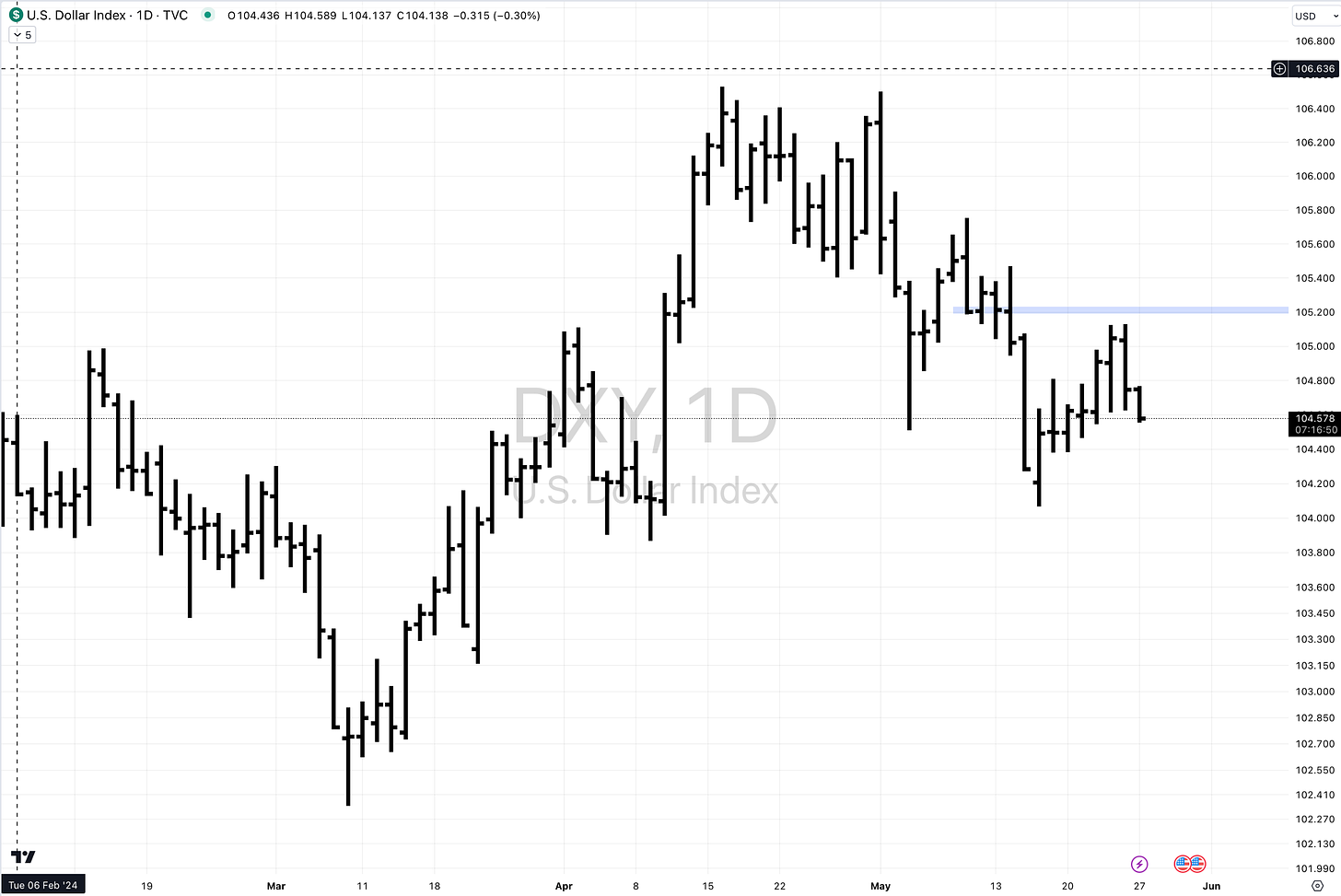

The Forex Front The dollar experienced a relatively uneventful week, with slight declines indicating potential further testing of lower support levels. The forex market remains a critical area to watch for signs of broader economic shifts that could impact other investment areas.

Stock Market Overview The S&P 500 displayed a doji candlestick last week, signaling market indecision. This upcoming week could prove pivotal, as movements on Tuesday may confirm or negate the bearish signals from the previous week’s trading patterns. The mid-cap index (MDY) and other indices like IWM showed muted movements, suggesting a lack of clear direction in the broader market.

Emerging Opportunities in Solar The solar sector, represented by ETFs and specific stocks like Enphase Energy, showed significant strength. This area might offer new opportunities for investors looking for growth outside the traditional tech sector, given the strong rebound off key support levels.

Semiconductors and Market Leaders Not surprisingly, semiconductors, led by Nvidia's recent news, have reached new highs, supporting a bullish outlook for tech stocks. However, this sector's performance needs to be watched closely for signs of overextension.