In the world of trading and investing, one of the biggest challenges we face is managing drawdowns. These are the inevitable periods where our equity takes a dip—something every trader will experience. However, the key to long-term success isn’t just about minimizing these drawdowns, but about ensuring that when they do happen, they don’t all hit at once. This is where the power of uncorrelated systems comes into play.

The Two Algorithms: Pullback and Trend-Following

Over at StatsEdge, I’ve been running two distinct algorithms that, when combined, have shown a remarkable ability to smooth out equity curves and reduce overall drawdown risk. These are:

Pullback Algorithm: This system thrives during bear markets. It’s designed to capitalize on market dips, buying into strong stocks that have pulled back and then selling quickly as they bounce back. It’s high-touch, nimble, and perfect for those swift, sharp moves in a downward-trending market.

Trend-Following Algorithm: On the other hand, this system excels during bull markets. It’s built to ride the wave of momentum, holding positions longer to capture those strong upward trends. When the market is trending upwards, this is the algorithm you want in your corner.

The Magic of Uncorrelation

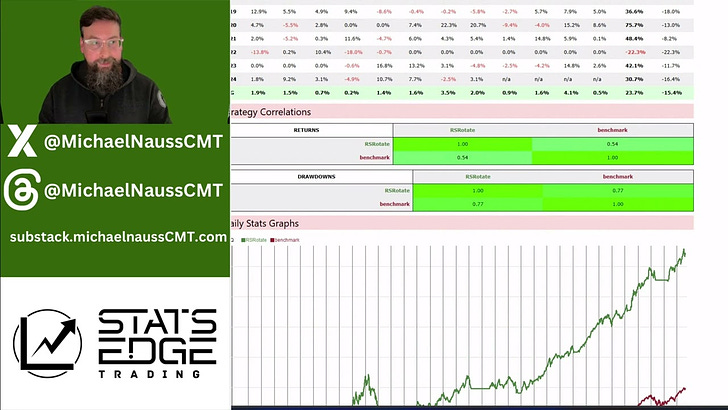

What makes these two systems particularly powerful when combined is their lack of correlation. In statistical terms, the correlation of the drawdowns between these two systems is just 0.04. This near-zero correlation means that when one system experiences a drawdown, the other is not affected by the same factors

For example, during swift downward movements like the ones we saw in 2020, the pullback system can step in and take advantage of those market dips, while the trend-following system steps back, avoiding further losses. Conversely, in a strong bull market, the trend-following system can maximize gains while the pullback system takes a backseat.

This dynamic ensures that your total equity doesn’t experience significant drawdowns at any given time, making your trading experience smoother and less stressful.

Why This Matters

In trading, we often hear about diversification. But diversification isn’t just about holding different assets—it’s about managing the risks associated with those assets. By subscribing to both of these algorithms, you’re essentially diversifying your strategies, ensuring that you’re always in a position to capitalize on the market’s movements, no matter what direction it takes.

Ready to Level Up Your Trading?

Think about your trading. Do you have different styles, and will those styles be affected by the same market conditions? If so, try adding something that might offer some system diversification.