The S&P 500 and the Gap

The 'gap' refers to an area on a chart where the price moves sharply up or down with insufficient trading in between. This results in a 'gap' in the normal price pattern, hence the name.

In reality, 'fighting the gap' in the S&P 500 has proven challenging, creating a kind of 'chop fest mode', where the market keeps oscillating without a definite trend. We're all waiting for the day this "gap" resolves!

Adjusting Trading Strategies: Short Exposure

I've been drawn slightly to the short side, meaning I add some short exposure to my portfolio. By shorting, I’m betting that prices will go down by selling borrowed stocks and buying them back later when their prices drop.

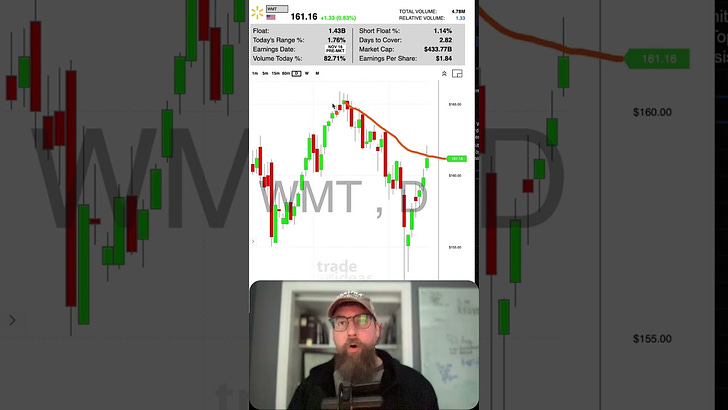

Trading Insights: The Case of Walmart

We noticed a significant volume day for Walmart at the top, with an anchored VWAP acting as resistance. After a rally through the VWAP, Walmart unfortunately failed.

My game plan is simple. If Walmart's price drops below this level tomorrow, I'm considering a short right over this current level.

if tomorrow’s price < today’s price:consider shorting right over this levelConnect with Stats Edge Trading

To get more insights, visit Stats Edge Trading. Sign up for our free email list for helpful trading information!

“In investing, what is comfortable is rarely profitable.” - Robert Arnott

Happy trading!