Bitcoin’s Resilience and Market Position This week, Bitcoin showed signs of settling after reaching crucial resistance levels from previous highs in 2021 and early 2022. Although it’s too soon to commit fully, the cryptocurrency closed the week strongly, hinting at the possibility of breaking into new all-time highs soon. This could potentially activate significant market movements, especially considering the current short positions reported in the latest Commitment of Traders.

Ethereum and Altcoins’ Struggle In contrast to Bitcoin, Ethereum and other altcoins like Ada and Dogecoin haven’t matched up, with Ethereum particularly unable to reach its all-time highs. This disparity highlights Bitcoin’s dominance as the leader in the crypto space, which traders might prefer for bullish strategies.

Gold and Silver’s Rally Turning our attention to commodities, gold is nearing all-time highs after a solid rebound off its support levels. Silver, having surpassed significant resistance, is in a strong position to continue its impressive rally. These movements underscore a broader interest in commodities, with silver potentially eyeing the $50 mark, a significant jump from current levels.

Forex Insights: Euro and the Dollar Index The Euro showed strength against the dollar, marking four consecutive weeks of gains, a reflection of the dollar's weakness after failing to overcome resistance. These movements in the forex market warrant close monitoring, especially with the potential for the dollar to drift lower.

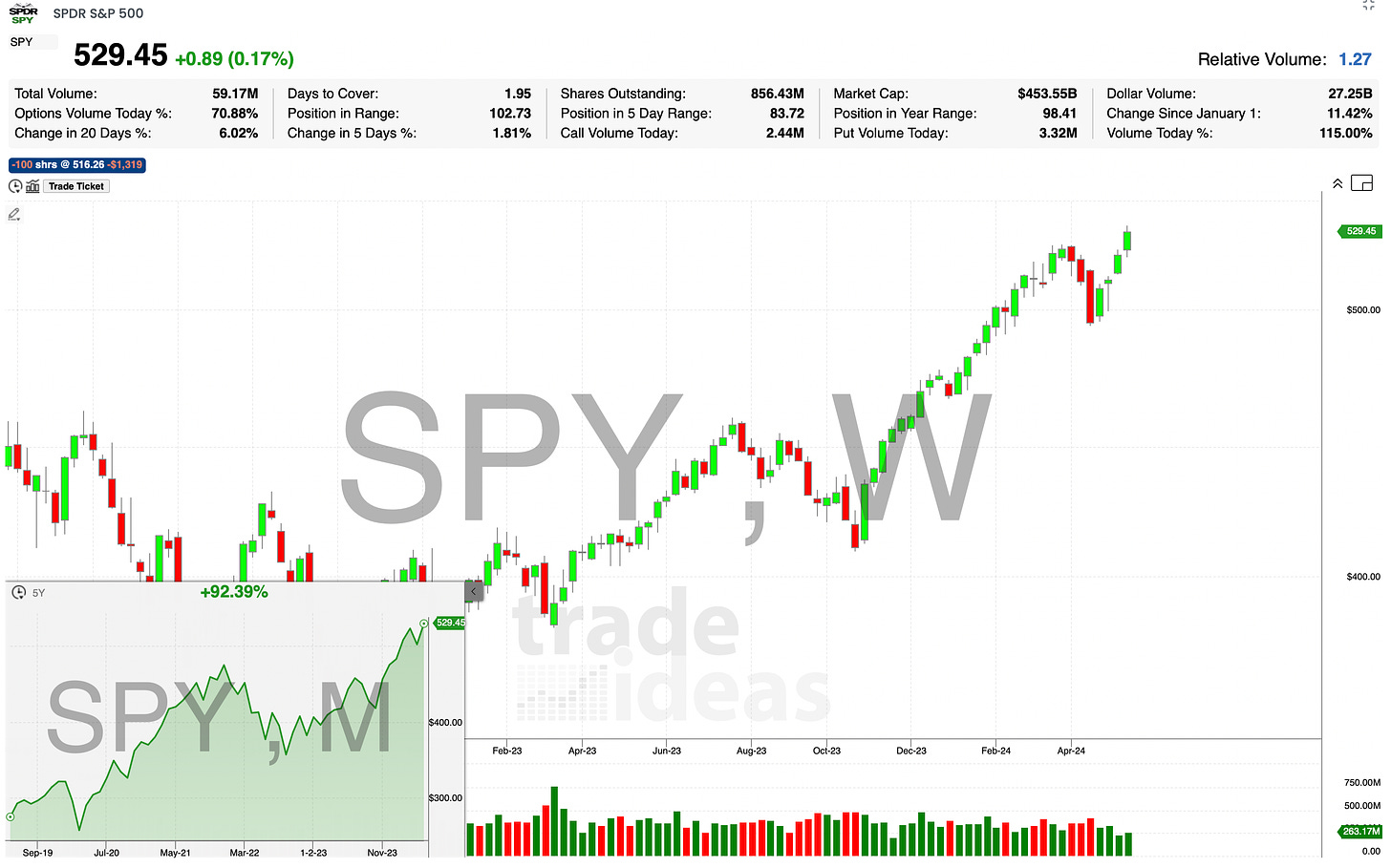

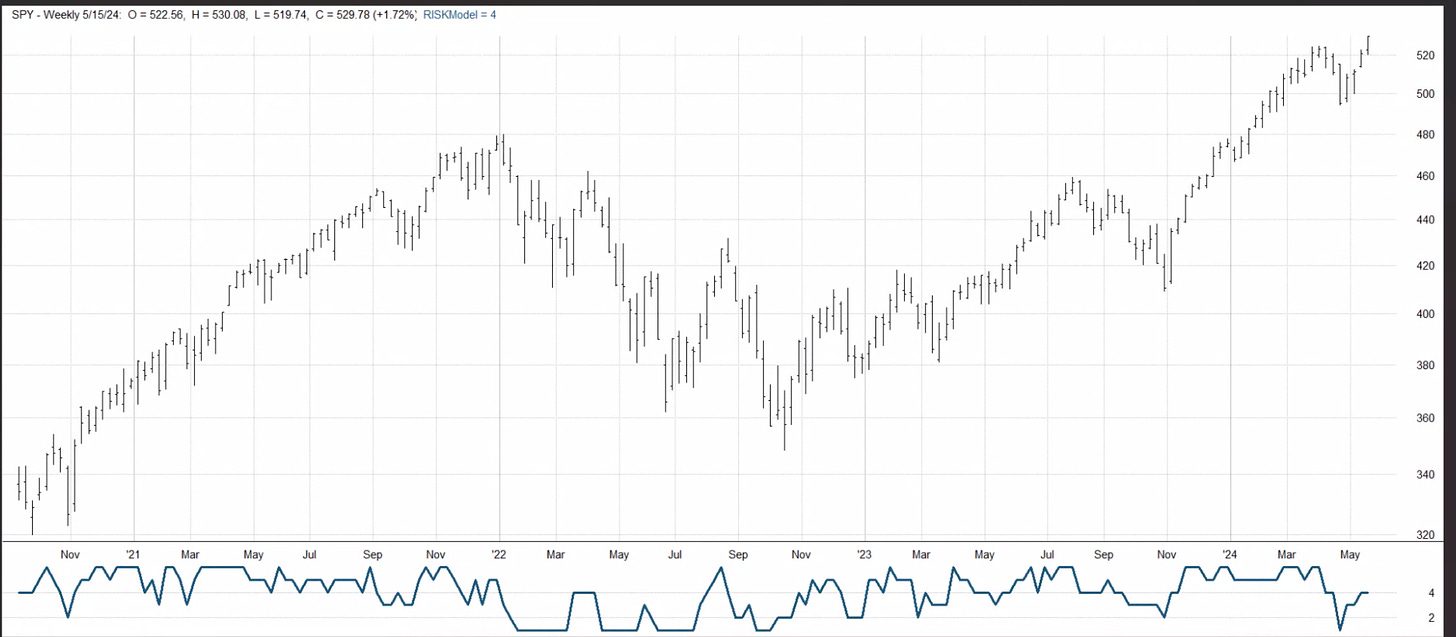

The Equity Market's Performance In the stock market, the S&P 500 exhibited robust performance, breaking out of previous highs and closing the week on a strong note. This bullish momentum across major indices, coupled with the strength seen in commodities, paints a positive picture for the general market environment

Strategic Stock Watch

Occidental Petroleum (OXY): Positioned well after pulling back to a significant support level, which coincides with the 200-day moving average. Given the broader interest in commodities, OXY presents a favorable risk-reward setup.

ImmunityBio (IBRX): With a substantial short float, this stock mirrors the speculative interest seen in other high short-float stocks. Its current positioning near key support levels makes it an interesting watch.

Robinhood Markets (HOOD): Exhibiting potential for a breakout from a prolonged base, suggesting a shift that might attract more bullish interest.

Closing Thoughts This week’s market dynamics offer a blend of continuation patterns and potential breakouts. While the overall market sentiment is bullish, maintaining a cautious approach to risk management is advisable given the mixed signals under the surface. For those looking for deeper insights and exclusive content, be sure to subscribe to our Substack at Statset Trading.