See the video here and follow me on X

https://x.com/MichaelNaussCMT/status/1722015909659758960?s=20

Examining the SP 500's Two-day Stagnation

In the past couple of days, we've observed a lacklustre pattern in the SP 500's trading activity. It's almost as if the market's been stuck in a loop, leading to little to no movement.

But while the overall scenario might seem uneventful, there's an exciting development to keep in mind. Remember that gap in the area from 440 that we discussed earlier? Well, it looks like we need to address it soon.

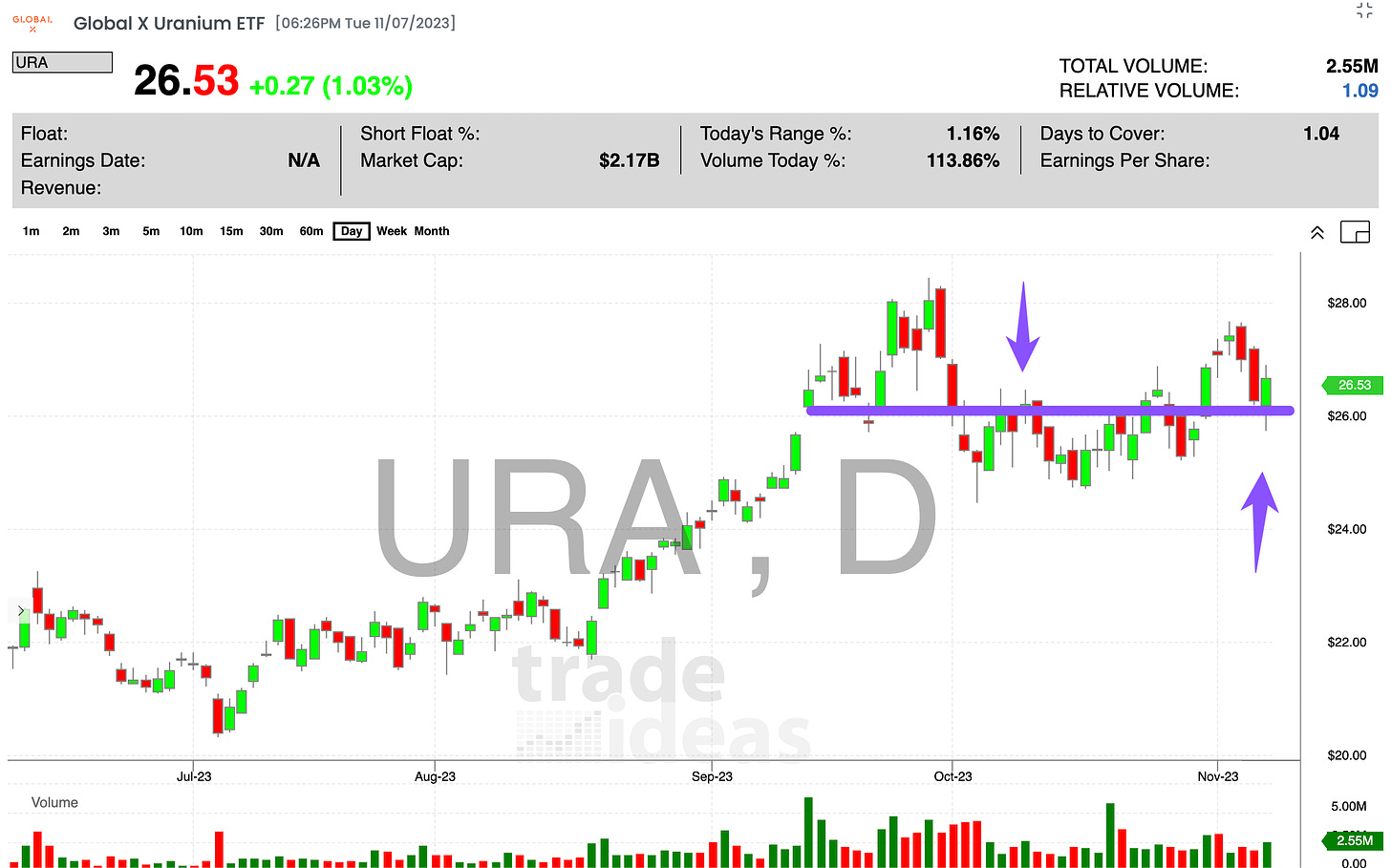

Rediscovering a Familiar Well: Uranium and UEC

Next, let's discuss a trade idea that we've been tapping into this week. It appears that I might be returning to it, and that is UEC (Uranium Energy Corp).

The strength of uranium hasn't skipped a beat, and it continues to be a powerful force in the market. This dynamism has led us to take two or three trades on UEC this year, and I’m thrilled to say that all of them have turned out to be pretty profitable.

Now you must be wondering what points towards the rerun. The answer lies in the recent break out of a specific zone by UEC. After the break, it's pulling back into this same zone. If it's able to hold on and push higher, it could potentially embark on a new run, marking a prospective trade.

"Uranium continues to be incredibly strong. We have now taken I think two or three trades on this this year, all pretty profitable so far. Now we are breaking out of this little zone, pulling back into it. If we can hold this and push higher, we could have a new lag on UEC as a nice uranium play."

So there you have it, traders: a look into the current market scenario, and an intriguing trade idea to follow up on. For more information, and to delve deeper into the markets, do check out our website. Let's master the art of trading together!