In what was an incredibly wild week in the markets, I’m grateful to be a systematic trader, and I know many of you who have joined me over at Stats Edge Pro share that sentiment. The power of systematic trading is that we don’t have to guess or react emotionally to market swings; we have a clear, data-driven plan that guides our decisions week by week.

Highlights from This Week

Every weekend, I send out an email to Stats Edge Pro members with a curated list of 20 names generated by two different algorithms (soon to be three!). Each trade idea comes with a detailed plan: if the market does this, we respond like this. It’s all completely systematic, backed by extensive backtesting. You can learn more about how this works at StatsEdgeTrading.com.

Crypto Market Insights:

Bitcoin: After a wild week, Bitcoin managed to recover from a steep drop to $48,000, closing the week near $60,000. This recovery above a critical support level suggests the potential for a bear trap. However, the next week will be pivotal in determining the direction, with key levels to watch around $70,000 and $50,000.

Ethereum: Ethereum showed significant relative weakness, closing below a key level for two consecutive weeks. This underperformance compared to Bitcoin might indicate a risk-off environment.

Solana: Displaying strong relative strength, Solana is holding up better within its range, potentially setting up for a bullish move.

Forex & Commodities:

US Dollar (DXY): The dollar mirrored the wild swings seen in Bitcoin and the broader market, but ultimately, it managed to bounce back from its lows, closing the week relatively flat. This decoupling from traditional stock market correlations is worth noting.

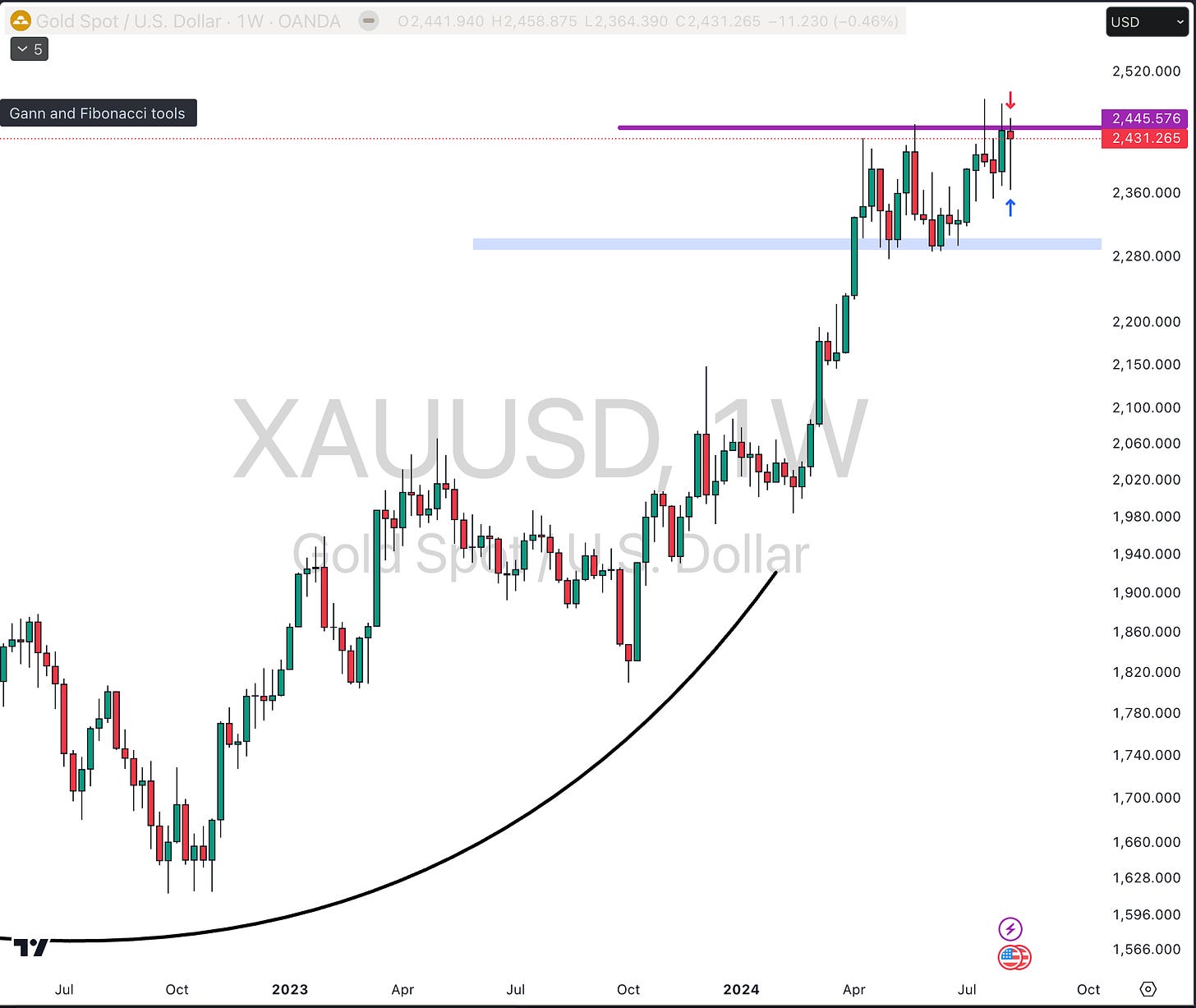

Gold: Gold remains in a strong position, holding above key support levels with a potential breakout on the horizon. I’m watching closely for a continuation move next week

Stock Market Overview:

S&P 500 (SPY): The S&P 500 experienced significant volatility, but despite the noise, it’s still range-bound between key levels. I’m focused on identifying opportunities within this range using pullback algorithms, as this environment favors shorter-term, buy-the-dip strategies.

NASDAQ (QQQ): Despite the chaos, the QQQ closed the week slightly positive. This resilience suggests that the market might not be as weak as it initially appeared.

Sector Highlights: Energy (UNG, USO), Chinese Stocks (KWEB, FXI), and consumer staples (Costco) are holding up well, offering potential buying opportunities if they continue to show strength

.

Why Systematic Trading Matters

This week, I chose to step back and not trade heavily, despite several setups firing from the Stats Edge Pro algorithms. The level of market insanity required a more cautious approach. But the beauty of systematic trading is that it provides clarity and direction even when markets are chaotic. By focusing on data-backed strategies, we can make informed decisions without the stress of guessing where the market will go next.

If you’re struggling with navigating these volatile markets and need a solid plan, I invite you to check out Stats Edge Pro. Our community is growing, and it’s fantastic to see so many traders benefiting from a data-driven, systematic approach.

Looking Ahead

As we head into next week, my focus will remain on the pullback algorithm, which has performed well in these choppy conditions. I’m also working on a mean reversion algorithm to complement our existing strategies. The goal is to be prepared, with a clear plan, no matter what the market throws at us.

Stay tuned for more insights and, as always, happy trading! If you want to learn more about systematic trading and join our community, visit StatsEdgeTrading.com.

P.S. If you haven’t already, check out the free trading course available on the site—it’s a great way to get started on your trading journey.