Gold is up now 3 months in a row. Let’s do a little math to see what’s next.

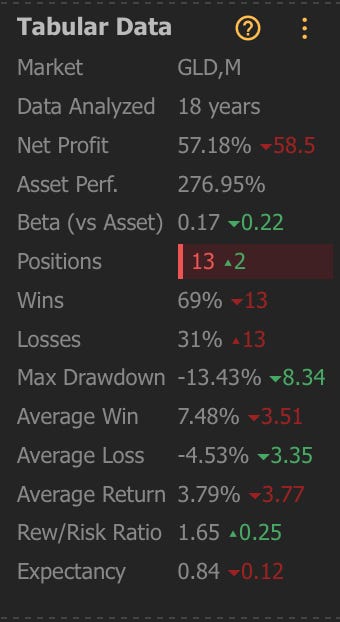

Looking back 18 years after gold was up for three months in a row, there is a 69% shot it’s up more than the close of that 3-month rally by an average of 7.5%

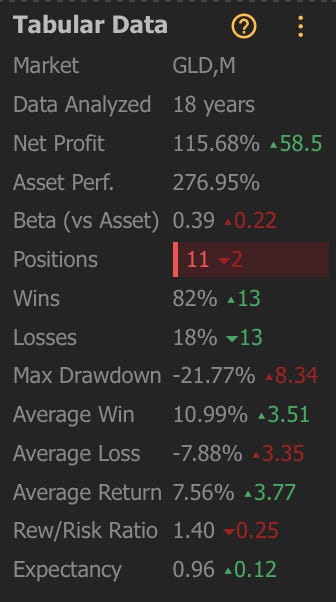

Six months later, that number jumps to 82%, with an average of 10% gained.

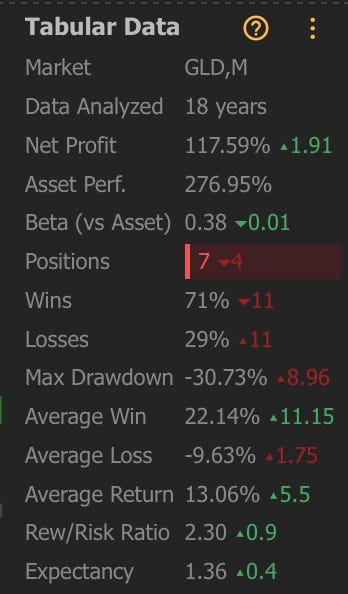

1 year later, still a nice 71% of an up move with a massive 22% gain

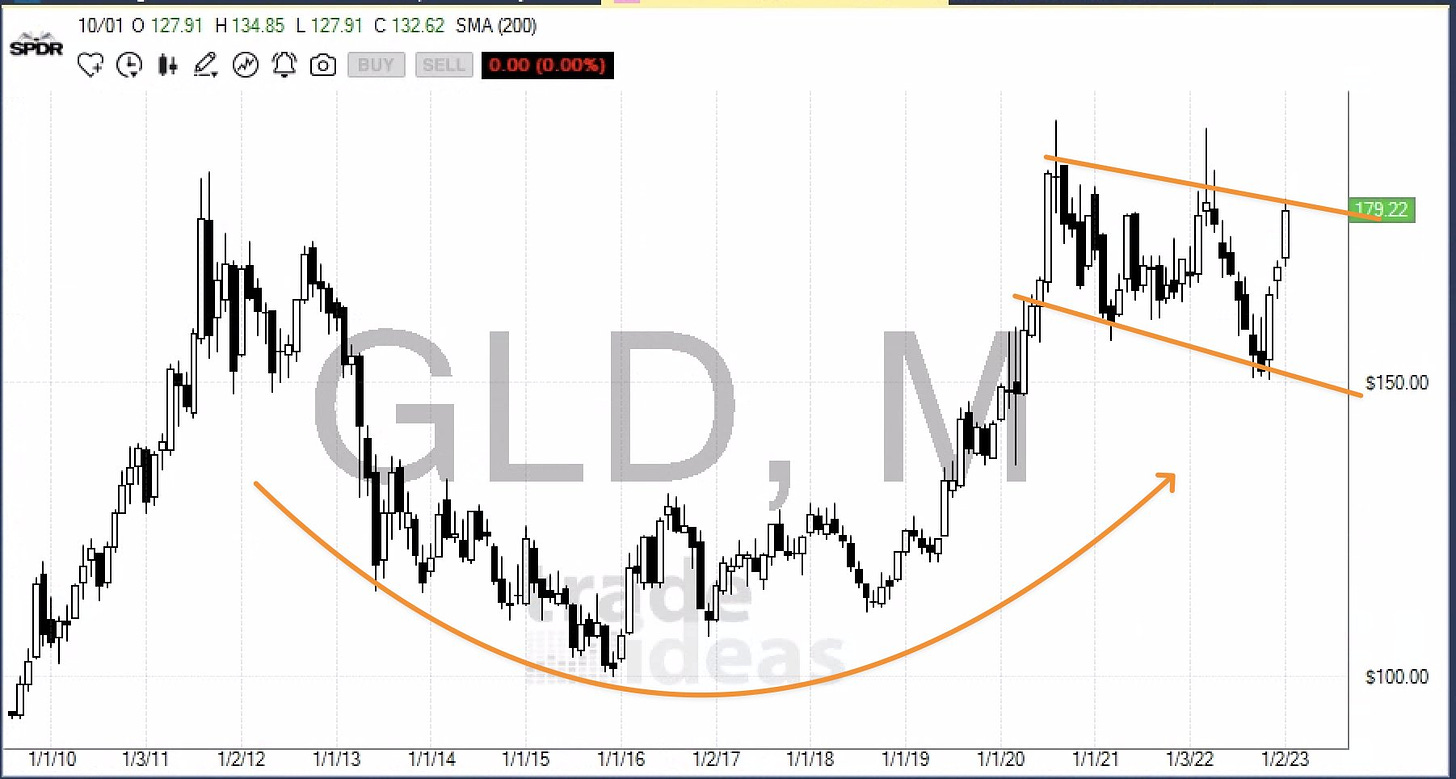

So what do we think now that we know the math? Does it help us confirm the likelihood of this cup and handle resolving to the upside?

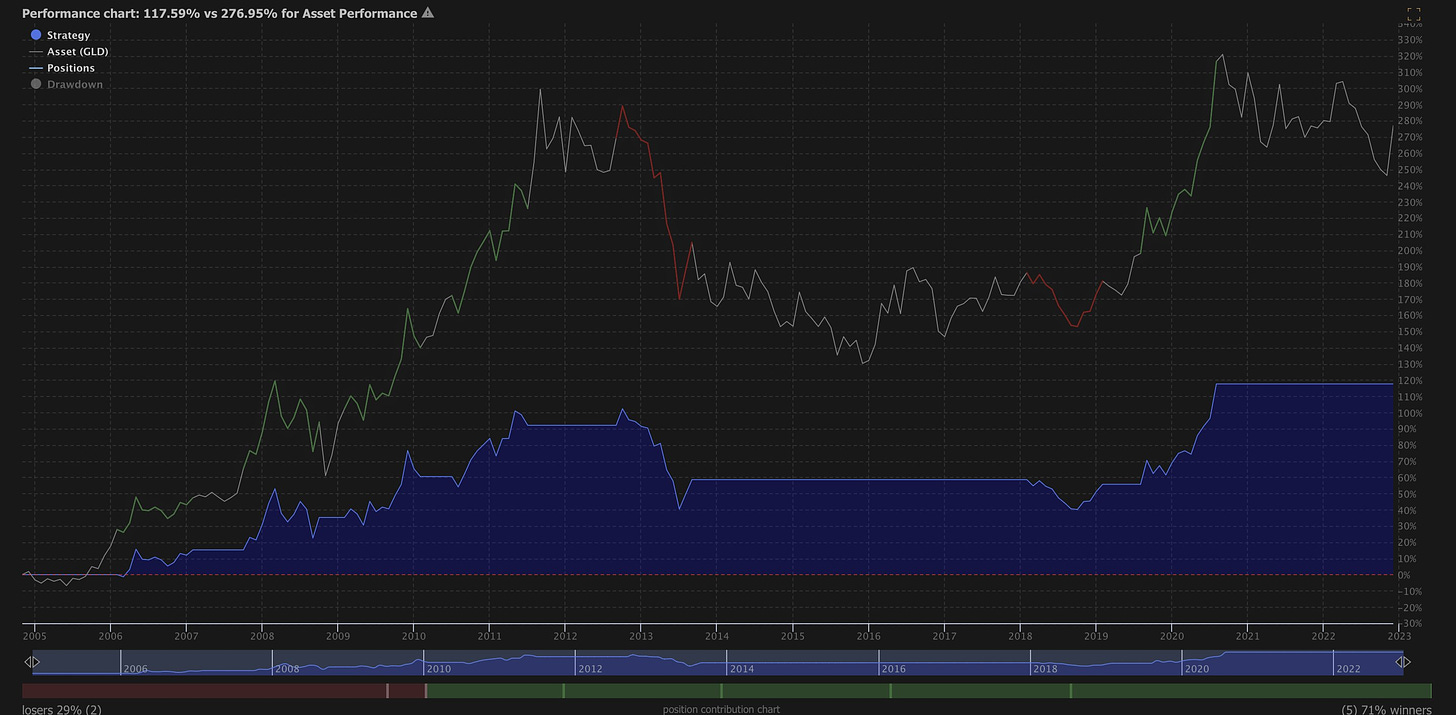

Charts provided by trade-ideas and backtesting by trendspider. Check out both of them here. https://www.statsedgetrading.com/my-trading-tools