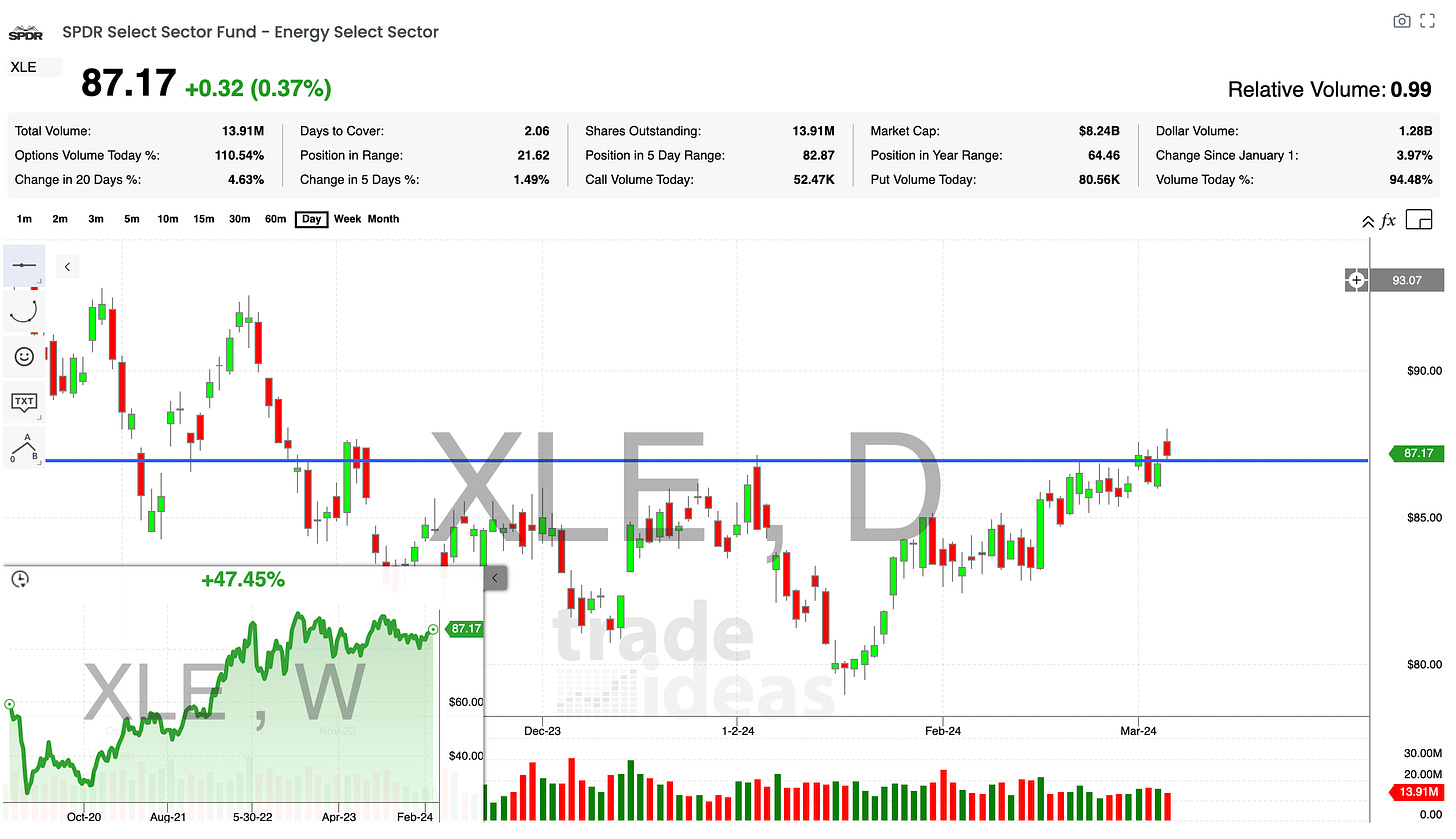

As we analyze the markets during this period of low volatility, individual sectors can offer more intriguing opportunities. The energy sector in particular has shown signs of potential rotation. Let's examine the outlook.

Observing the monthly chart, we see energy has been building a base above a key support level since the shock of negative oil prices. This long period of consolidation suggests a sturdy foundation may be forming.

Zooming into the weekly timeframe, energy recently bounced off prior highs where it had previously faced resistance. The move above key moving averages reinforces the view that overhead resistance has been clearing.

On the daily chart, energy staged a breakout attempt above a zone between $53-55, showing potential for a larger move. While not reliable on their own, chart patterns hint at bullish continuation structures.

If this emerging energy strength sustains, trading the XLE ETF directly offers simple exposure. For added leverage, a 2x or 3x fund could capture outsized sector moves. I'll be analyzing individual energy stocks to find optimal vehicles to ride an extended rally