Bitcoin and Ethereum

Bitcoin tested but failed to break through previous highs, presenting potential head and shoulders pattern formation. However, more price action is needed before confirming.

Ethereum has shown relative weakness compared to Bitcoin in recent days. There may be potential for a bear flag continuation pattern.

Currencies

The US Dollar Index (Dixie) continues choppy, up and down action. Worth monitoring as a key indicator of cash flows.

GBP/USD produced bottoming tails that could signal an upward resolution with potential implications for stocks.

Commodities

Gold facing both bullish and bearish rejection at key levels. A neutral stance is appropriate until a more apparent trend appears.

Stocks

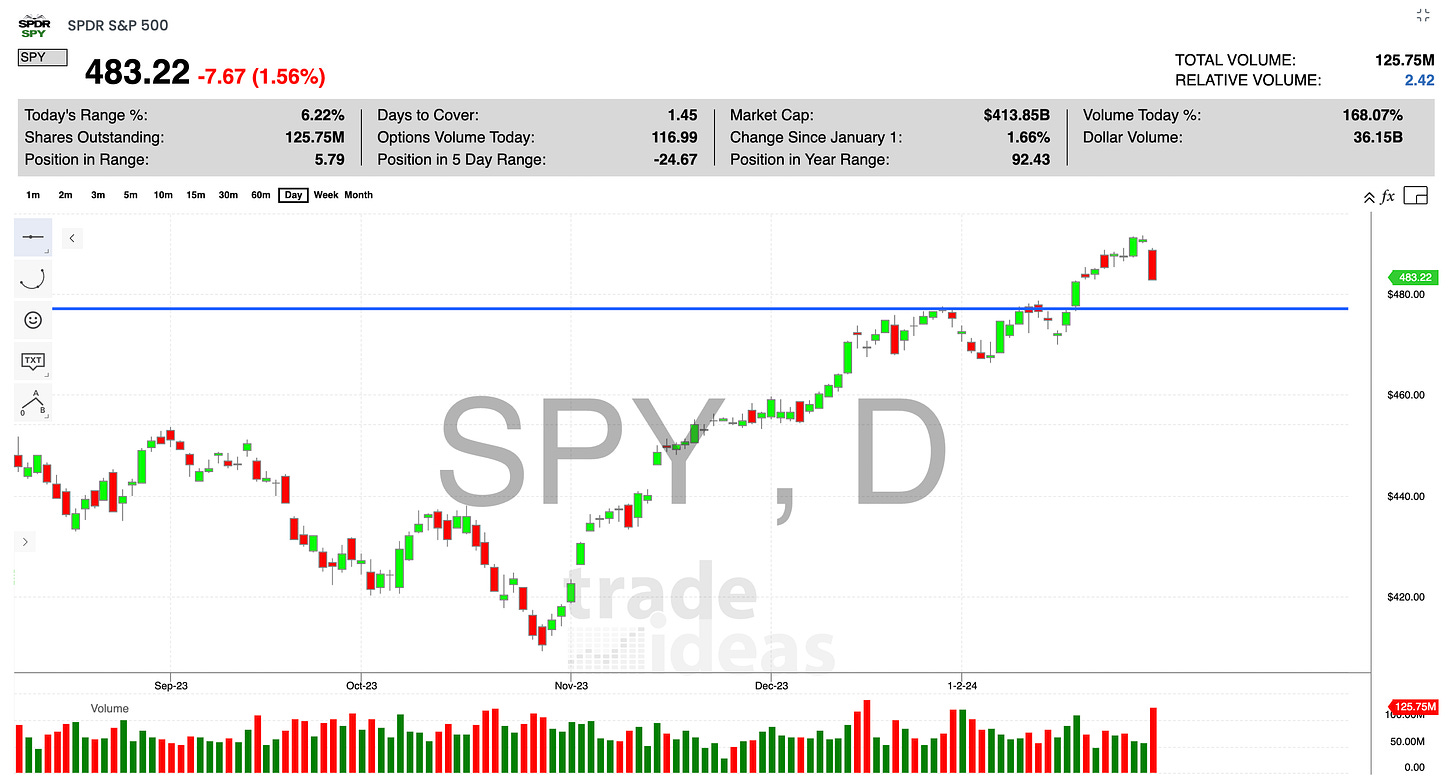

Significant downward movement in stocks across sectors, with bonds notably bucking the trend. This normalcy returns after an extended disconnect.

If the S&P 500 pulls back further to test the 475 support level, it could present a buying opportunity.

Key Takeaways

With the FOMC clarified but much uncertainty remaining a prudent neutral/options approach seems wise until more defined trends emerge. Continued close tracking of key assets is recommended.