Crypto Analysis

Bitcoin (BTC/USD)

Bitcoin pulled back slightly this week but remains in a cup and handle pattern on the weekly chart. As long as we hold current support levels, this is just an orderly pullback.

Ethereum (ETH/USD)

Ethereum is outperforming Bitcoin, with two significant bottoming tails indicating potential accumulation.

---

FX Analysis

Aussie CAD (AUD/CAD)

AUD/CAD continues to test a major resistance level with a potential push lower if support breaks.

US Dollar (DXY)

The dollar index is testing prior highs. Watch for a breakout or rejection.

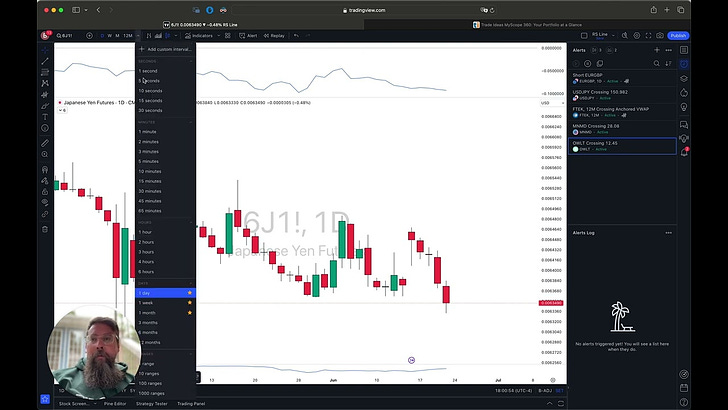

Japanese Yen (JPY)

Volatile due to Bank of Japan intervention, creating potential for a bounce.

---

Commodities Analysis

Gold (XAU/USD)

Gold is consolidating, potentially bullish for an upside break.

Silver (XAG/USD)

Silver shows relative strength and has bounced off prior highs.

---

Stock Market Analysis

SPY

The trend remains intact despite some sideways chop. Focus on long trades.

Midcaps and Small Caps

Midcaps (MDY) and small caps (IWM) are showing strength, indicating potential rotation from large tech stocks.

Sectors to Watch

- XBI (Biotech)

- XLI (Industrials)

- XLV (Healthcare)

---

Trade Ideas

Weekly Breakout Strategy

- Chewy (CHWY): Breaking out post-earnings.

- Ryan (RYAN): Strong breakout.

- Xpro (XPRO): Consistent strength and breakout.

Daily Pullback Strategy

-AI: Anchored VWAP support level.

- PLSE: Pullback to significant support.

Michael, thanks for sharing the June 23 update but I find the Stock Market analysis somewhat superficial and missing the underlying negative action! If digging a little deeper, the suggestion of 'long trade' could be misleading as the volumes and breadths have been declining as viewed on the equal-weighted average indices (e.g., SPEW & QQQE), as well as the only two sectors showing some strength, as expected seasonally, are XLK and XLY (e.g., see RRG graphs at StockCharts last Monday).

In addition, on the short swing trades, SPY is reverting to the mean after breaching its 1-month trading channel last Wednesday, so preference/bias to short (Puts) trades until it pivots under its 1-month channel to the upside, like CME (July Put $190), GS (July Put $435), DE (July Put $360), VLO, MRVL, CEG, CAT, etc. However, there are always some leading stocks pivoting higher (Calls) sooner like TTWO (July Call $165), PVH (July Call $165), ULTA (July Call $145), ZTS, TMUS, etc., but as always caution on counter-trend trades!

GLD & SLV also breached their negatively sloped trading channels last Thursday, so likely some short-term weakness in coming days to weeks! USO also breached the topside of its upward sloping trading channel on Thursday so likely some weakness in coming days, but trend is still positive.

I have other screens that I also run to ferret out opportunities, but the market action is generally thin with the biggies pushing indices higher, so be careful out there eh! Just expressing some non-CMT comments so hoping you don't mind some chatter from the peanut gallery!

Take care and enjoy the journey(s)!

Michael Bryden