In today's "Quant Wisdom Wednesday," I want to discuss a crucial aspect of trading that often goes overlooked: the statistical probability of losing streaks, even when you have a solid win rate. Inspired by a tweet from Jeff Sun, CFTe—a must-follow on Twitter—I delved into a simple yet powerful simulation.

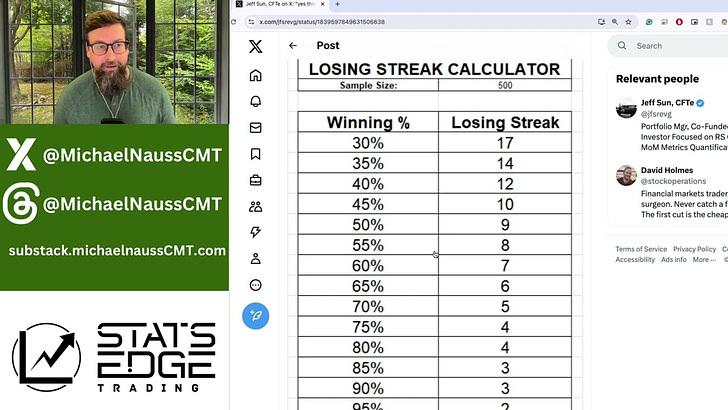

Jeff simulated 500 trades with varying win rates to illustrate the potential losing streaks traders can experience. What stands out is that even with a win rate between 50% and 60%—which is where most traders find themselves—you can expect to lose up to 10 trades in a row at some point. This isn't a rare occurrence; it's a statistical inevitability over a large sample size.

Many traders underestimate the impact of these losing streaks on their capital. If you're risking 1% of your account per trade, a 10-trade losing streak means a 10% drawdown. Are you comfortable with that? If not, it's time to reassess your risk management strategy.

Conversely, winning streaks can also skew perception. A series of wins might tempt you to increase your position size, but remember that both winning and losing streaks are part of the normal distribution. Overconfidence can lead to unnecessary risks.

Key Takeaways:

Record Your Trades: If you're not already doing so, start tracking your trades to analyze your actual win rate.

Understand the Math: Recognize that losing streaks are statistically probable, even with a high win rate.

Manage Your Risk: Adjust your risk per trade to ensure you're comfortable with potential drawdowns.

Stay Disciplined: Don't let winning or losing streaks affect your trading strategy or risk management.

By embracing the statistical realities of trading, you can prepare yourself mentally and financially for the inevitable ups and downs. This awareness is essential for long-term success in quantitative trading.

Shout out to Jeff Sun for the insightful data. Until next time, trade wisely!