Bitcoin's Current Landscape:

Bitcoin, the leading cryptocurrency, is approaching a significant Fibonacci retracement zone. This zone, derived from its all-time highs to its bear market lows, is crucial for traders to monitor. While Bitcoin shows promise, Ethereum seems to lag, indicating Bitcoin's dominance in the crypto realm.

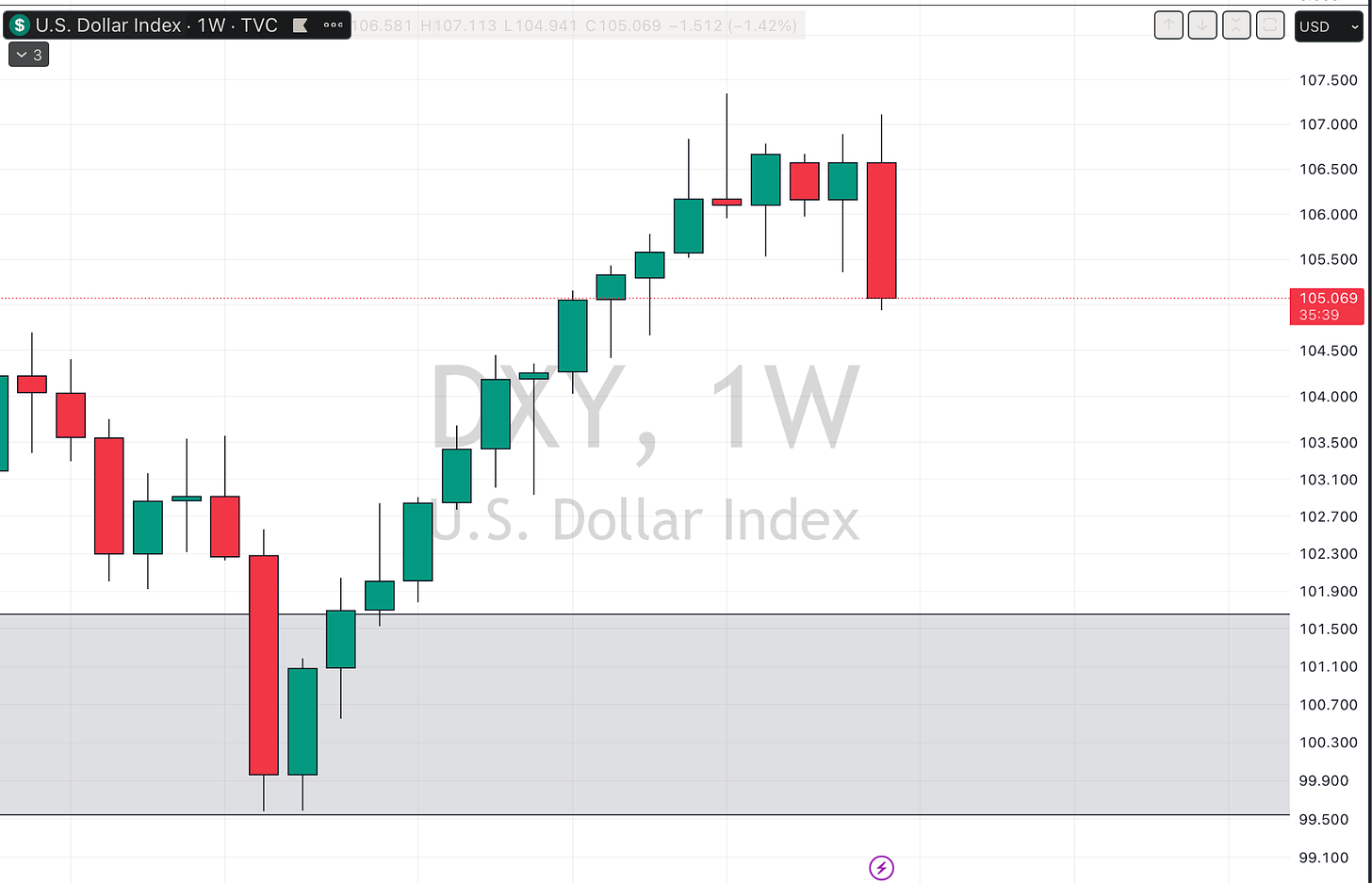

Dollar Index Insights:

The Dollar Index (DXY) offers a unique perspective on global economic trends. After a period of growth, it might be gearing up for a revision. This index, juxtaposing the dollar against major currencies, is pivotal for understanding global financial shifts.

Equities and Their Movements:

The equity market is showcasing intriguing patterns. While some stocks, like the XLF representing financials, hint at potential growth, others like solar stocks (TAN) seem stagnant. Tools like Trade Ideas can be instrumental in identifying these trends and potential investment avenues.

With the SPY 0.00%↑ overdone and the weaker names nearing resistance I think we could be in for a pause or pullback next week.

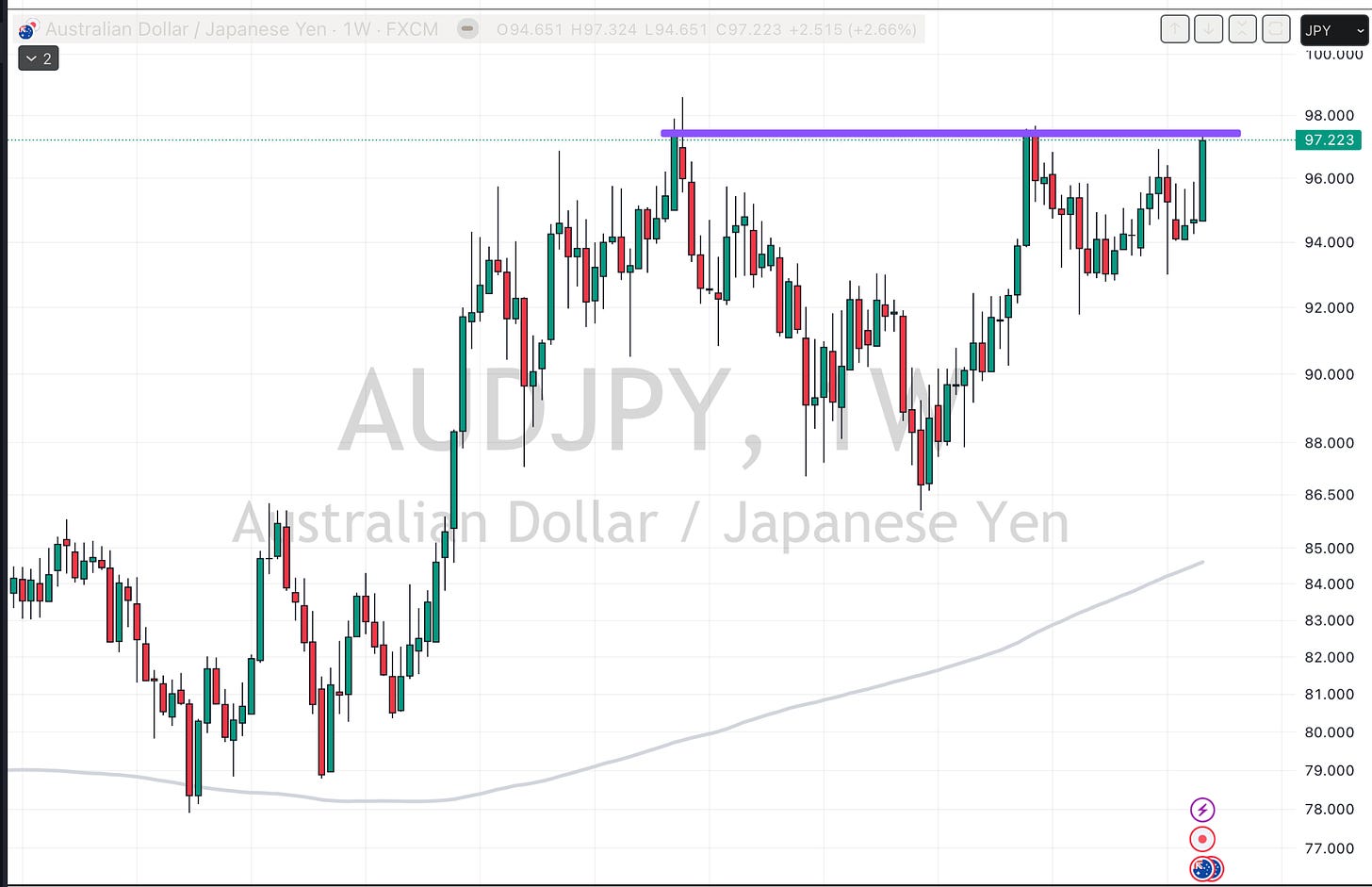

The Strength of Currencies:

The strength of a currency is not just about its performance but also its comparison against others. For instance, while the yen shows strength against the dollar, its performance against other currencies like the pound, paints a different picture.

Bonds and Their Trajectory:

Bonds, especially TLT, have witnessed a significant bounce. However, with overhead resistance looming, it's essential to tread with caution. The market's future trajectory will depend on how these bonds navigate this resistance.

Conclusion:

As a trend trader, I am stuck. Either I buy stuff that is overextended or stuff that is lagging the market. For me, I chose to ride what I had and maybe look for some relatively weak names to short.

Watchlist

Note: Always conduct thorough research and consult with a financial advisor before making any investment decisions.