A Deep Dive into Cryptocurrencies Starting with Bitcoin, we observed significant resistance at prior all-time highs, suggesting potential for choppy trading ahead. The key takeaway is to align trades with the current zone—long above, short below, and cautious within. Ethereum shows relative weakness, failing to reach similar highs, indicating it's underperforming compared to Bitcoin.

Exploring other cryptocurrencies like Cardano (ADA) and Monero (XMR), we note ADA's struggle to surpass its anchored VWAP from all-time highs, a sign of potential weakness. Conversely, Dogecoin presents an intriguing case, nearing its anchored VWAP from all-time highs, hinting at possible bullish momentum.

Gold and Silver: The Currency of Commodities In our commodities analysis, gold's breakout reaffirms its upward trajectory, with no immediate signs of reversal. Silver, however, lags, unable to breach its highs, raising concerns about its relative performance. These insights are crucial for traders focusing on precious metals as part of their portfolio.

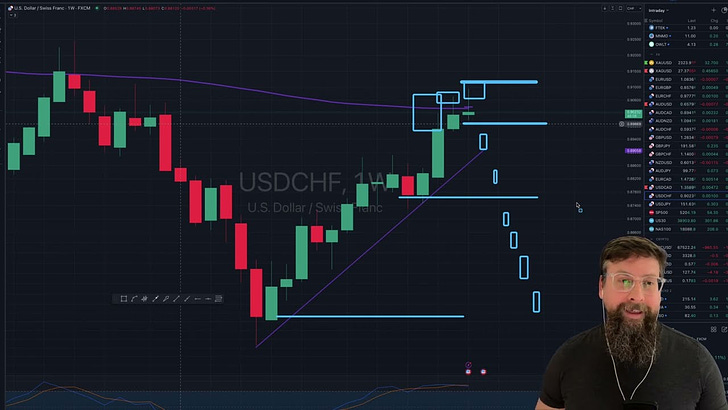

Forex and the Dollar's Dance The Dollar Index (DXY) remains trapped within a range, prompting a cautious approach to forex trading. The Euro shows strength, while the Australian Dollar's position above its anchored VWAP suggests a potential shift if it can clear overhead resistance. The Swiss Franc and Japanese Yen offer setups reflective of broader market sentiment, with the Franc showing signs of a potential downturn against the backdrop of a crowded trade.

Equities and the Commodity Connection Turning to equities, the S&P 500's bearish engulfing week signals caution, with key levels to watch for directional cues. The commodities ETF (DBC) breakout suggests a growing interest in commodities, aligning with our observations of strength in oil and wheat. This shift could indicate a broader market theme favoring commodities.

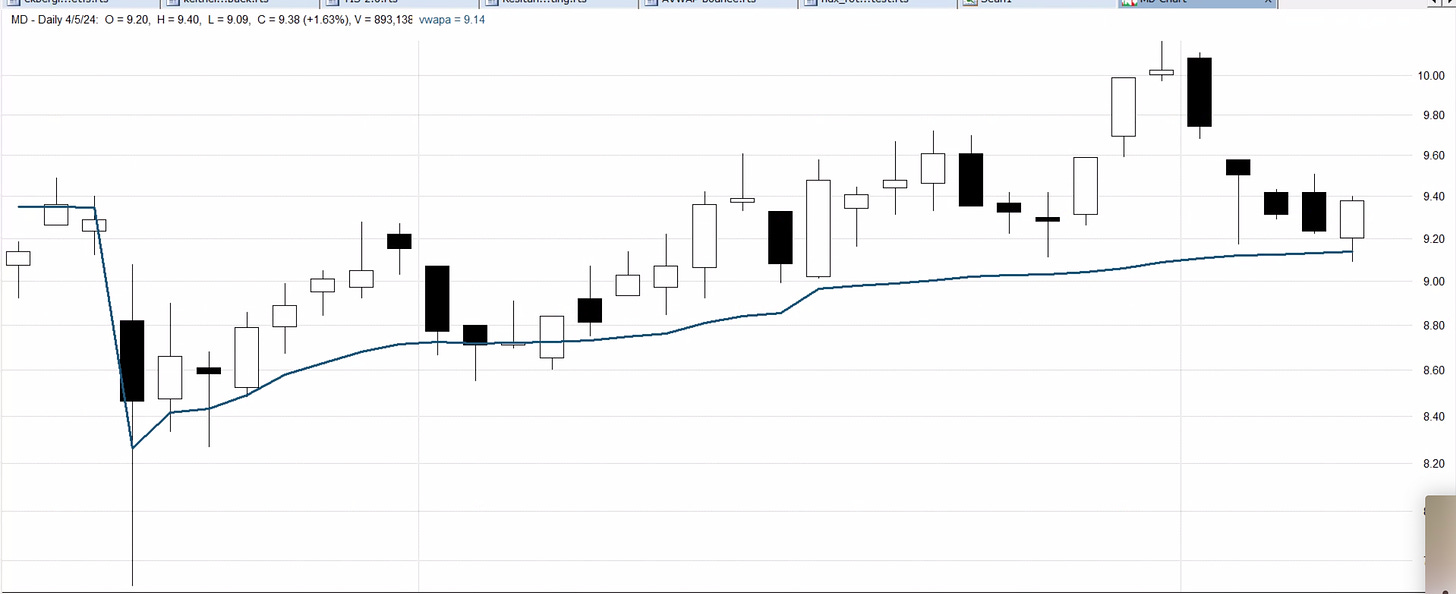

Stock Highlights and Algorithmic Insights We spotlight stocks like MindMed and Mobileye, noting significant movements and potential setups based on anchored VWAP analysis. Our proprietary algorithms highlight stocks like BOC and SMR for their pullback opportunities, demonstrating the value of technical analysis in identifying trade entries.

Closing Thoughts and Future Directions As we conclude this week's analysis, remember to visit statsegetrading.com for more insights, courses, and our upcoming algorithmic trading service. With a baby on the way, content may vary in the coming weeks, but rest assured, valuable market analysis will continue to reach you.

Engagement and Appreciation Thank you for your continued support, likes, comments, and shares. Your engagement fuels our commitment to delivering insightful market analysis. Until next time, step away from the screens and enjoy your weekend.