I had a fun time at the timing research event this morning (full vod here), showing off Trade Ideas (STATSEDGE at checkout for 15% off) and going over charts the users requested. I highlighted some of the ones I found interesting here.

On Uber (UBER)

Recently turned profitable, which is huge, currently consolidating after a big rally

Watching the $30 level on the daily chart as a key support to hold

On AMD (AMD)

Earnings are coming up on 11/1, so be careful around that

Watching the $100 level, which aligns with psychological resistance and rising 200DMA

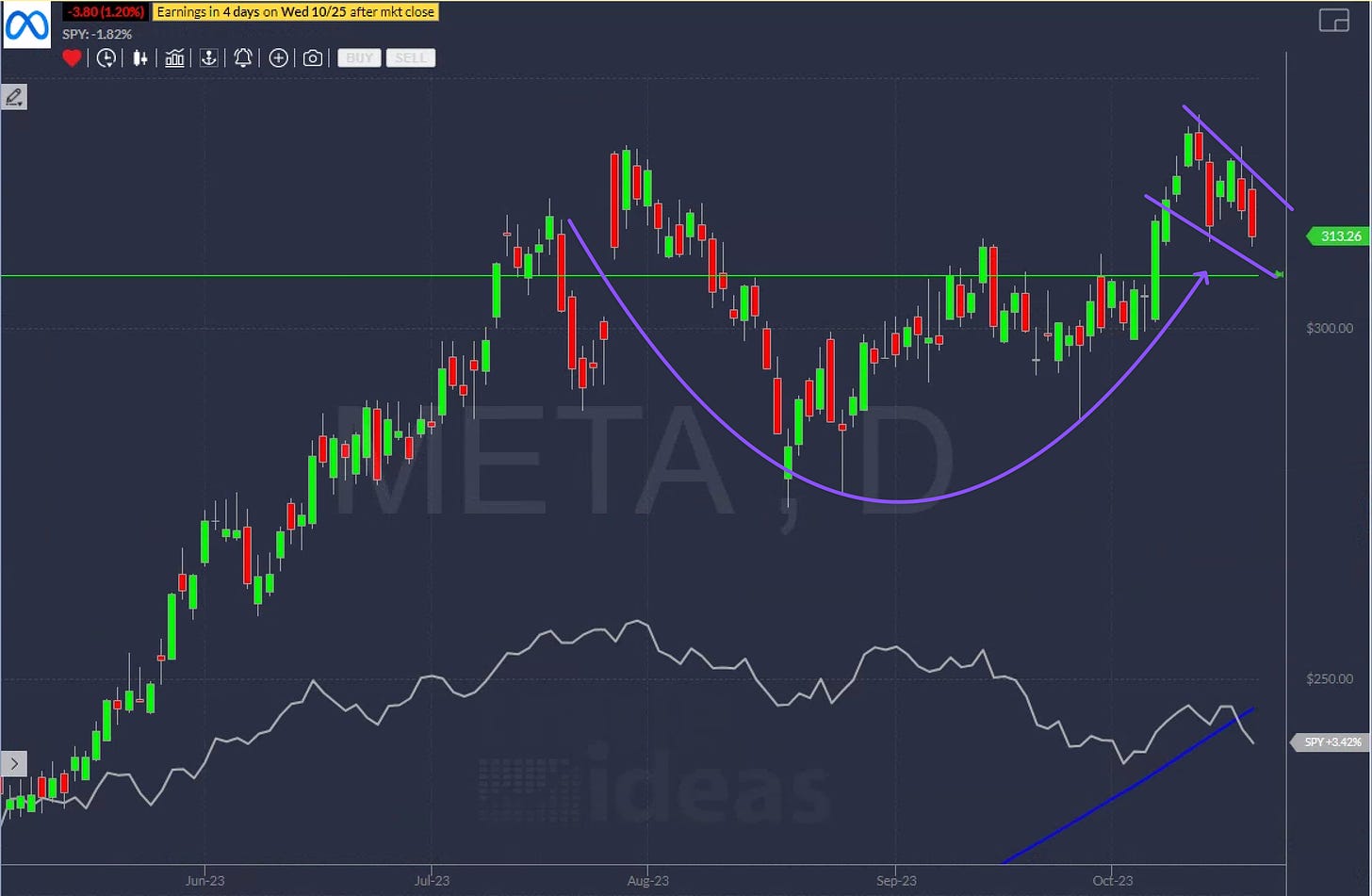

On Meta Platforms (META)

One of the only stocks holding up well during market weakness

Forming a potential "cup and handle" pattern ahead of earnings

...And analysis on several more names. I provided insights into his technical approach throughout:

Focuses on daily/weekly charts for swing trading

Uses simple indicators like 200DMA, anchored VWAP, SPY for context

Identifies and trades in the direction of the overall trend