I’m excited to introduce our newest addition to StatsEdge Pro: the Mean Reversion Algorithm! At StatsEdge, we aim to provide traders with robust strategies that are statistically tested and technically validated. With this new algorithm, we’re adding a new layer to our arsenal, alongside our existing trend-following and pullback algorithms.

The Mean Reversion Algorithm Explained

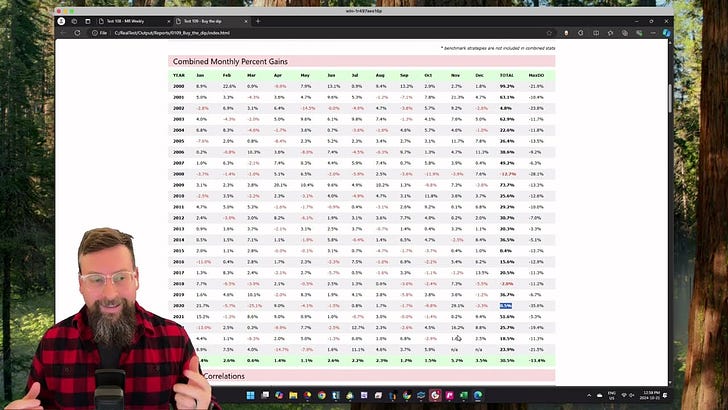

The goal of this new strategy is simple: identify strong stocks that have experienced a temporary pullback. We’re not looking to buy weak stocks or meme stocks with shaky fundamentals. Instead, we focus on high-quality stocks that have pulled back enough to reach statistically significant oversold levels. Like the pullback algorithm, this strategy is short-term in nature, targeting gains within a week.

Key Points:

Statistical Edge: We look for names that have shown strength but are experiencing a temporary pullback.

Short-Term Strategy: Buy with a stop in place, and sell the following week, or adjust your trade based on the price action.

Flexibility: Follow the algorithm as it is, or apply your own discretion to fine-tune entries and exits.

We’re not blindly trading here. Every position we take starts with a solid statistical edge, allowing us to trade confidently. You’ll also have access to the Discord alert bot, which sends you notifications when prices hit key levels.

If you’re a StatsEdge Pro member, you now have access to 30 symbols weekly, alongside the other algorithms we provide. Not a member yet? Check us out at StatsEdgeTrading.com to gain access to these strategies