Bitcoin and Ethereum Overview Before diving into the Coinbase trade, let's examine Bitcoin and Ethereum as they set the stage for this trade idea.

Bitcoin (BTC/USD): Bitcoin recently tested significant levels marked by anchored VWAPs from the all-time high and a major low. After pulling back, Bitcoin showed some signs of accumulation with bottoming tails forming, indicating potential support at these levels.

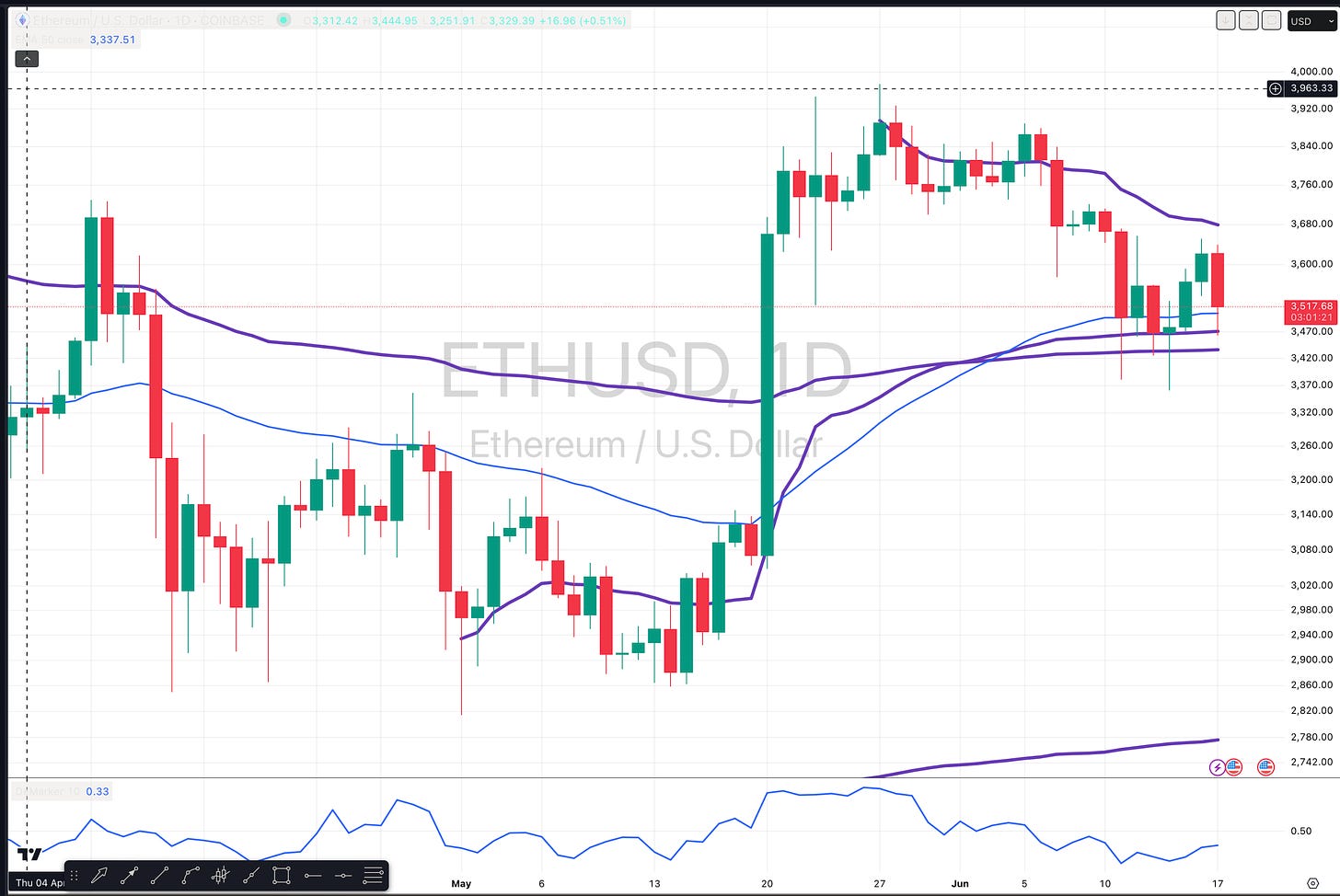

Ethereum (ETH/USD): Ethereum is showing similar patterns with anchored VWAPs from key levels acting as support. Like Bitcoin, Ethereum formed bottoming tails, suggesting possible buying interest at these levels

.

Coinbase (COIN) Trade Setup Given the price action in Bitcoin and Ethereum, Coinbase (COIN) presents an interesting opportunity. Here’s the detailed analysis:

Support Levels: Coinbase's relative strength has been impressive compared to Bitcoin and Ethereum. The stock has support from several technical indicators:

Anchored VWAP from a prior high.

The 50-day exponential moving average.

Anchored VWAP from significant lows.

Price Action: The convergence of these support levels around $250 suggests strong support. If Coinbase can break and hold above $250, it indicates potential for a further move up.

Trade Plan

Entry Point: Look for strength above $250. Use a 30-minute chart to identify clear support/resistance zones. Preferably enter if the price breaks and holds above $250 later in the trading day to avoid early volatility.

Stop Loss: Place a stop loss around $230 to $220, below the 50-day moving average and recent lows. This keeps the stop tight, minimizing potential losses.

Target Price: Aim for a 2:1 risk/reward ratio or better. With an entry around $250 and a stop at $230, you're risking $20 per share. Potential targets include $270 (initial target) and $280 to $300 for a more extended move.

Conclusion This trade hinges on Bitcoin's price action. If Bitcoin continues to show strength and moves higher, it will likely boost Coinbase’s stock price. However, if Bitcoin reverses and drops, this trade may not be viable. Always ensure to manage risk carefully and adjust your strategy based on market conditions.

For more daily trade ideas delivered directly to your inbox, visit Statsedge Trading and sign up for the free email list. Until next time, happy trading!