Welcome to a new series in which I will give a breakdown of a trade that I am looking at going into tomorrow. These setups are from the algos that I am working on for the Stats Edge premium product I am working on. I plan to post one of these breakdowns each day.

Note, as with everything I do, none of this is advice but just something I am looking to do with my money. These trades always need to trigger and will always have a stop loss.

ASC 0.00%↑ came up in an algo that is looking for stocks to pull back to major AVWAPs. This VWAP is from an earnings day which had a large volume spike.

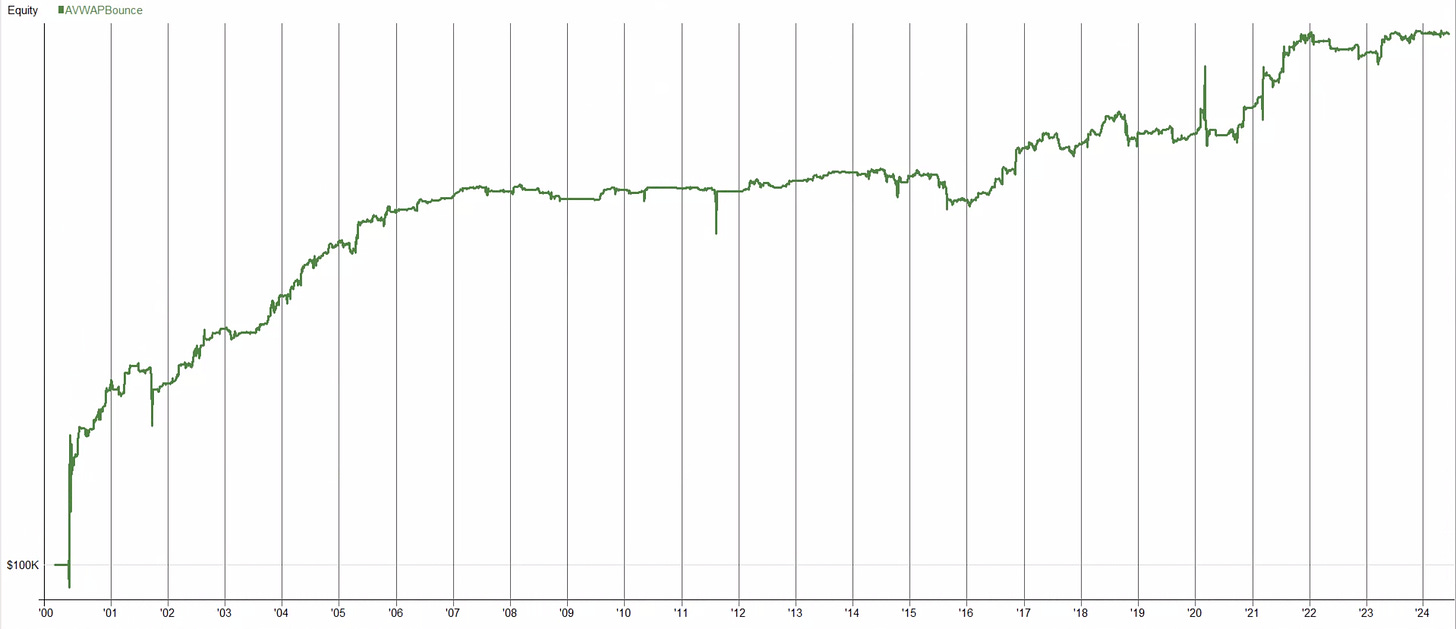

This scan came from the below algo. Which still needs work but prove the idea behind taking these trades.

From all the stocks that came from this algo tonight this one stuck out because of its sector. ASC 0.00%↑ is in the shipping industry so I decided. to look at the ETF that represents it BOAT 0.00%↑ a simple look shows that this name is very strong vs its sector making it a good relative strength name to take a look at.

To recap

ASC 0.00%↑ is holding strong at its AVWAP from a large volume spike.

Its stronger than its over all sector

The pattern looks like it’s putting in a simple bull flag.

Trade Plan

I am going to set out a stop limit order to buy ASC 0.00%↑ if it breaks out of the drawn downtrend line of around $22.5, I will stop out of the position on a close under the avwap around $22.

Ideally, I will be able to sell some at highs of $23.5, representing a 2:1 risk-reward play. Trailing the rest on a daily basis.

Conclusion

Let me know what you guys think of this series as we prepare for statsedge preimum to launch at the end of the month.

Like this new next day call out on possible trades. Looking forward to your premium service. I hope to join... Will you be offering any discounts for your long-term followers as you launch this new service? Hope to become a long term member and friend. Thanks for all the great content..!