Welcome to our weekend market wrap-up, where we delve into the latest trends across cryptocurrencies, forex, and the stock market, offering insights and forecasts for the upcoming week. This session includes a special experiment that I teased on Twitter, aiming to enhance our trading strategies with new, innovative approaches. Your feedback is invaluable, so don't hesitate to share your thoughts in the comments or connect with me on Twitter.

Cryptocurrency Analysis: Bitcoin's Current Stand

Starting with the cryptocurrency sector, Bitcoin's recent rally to its previous resistance level has been a topic of much discussion. Last week's Doji candle hinted at potential consolidation, which wouldn't be surprising given the rapid ascent. This pattern suggests a period of sideways movement or slight pullback, a natural pause following the significant gains.

Forex Market Insights: The Dollar's Movement

In the forex market, the S&P 500's behavior offers clues about broader market trends, especially when contrasted with the performance of specific sectors like semiconductors. Despite semiconductors not reaching new highs, the S&P 500's advancement to uncharted territory indicates a shift in market leadership, underscoring the importance of sector rotation in sustaining bull market dynamics.

Stock Market Ideas: Watching the Trends

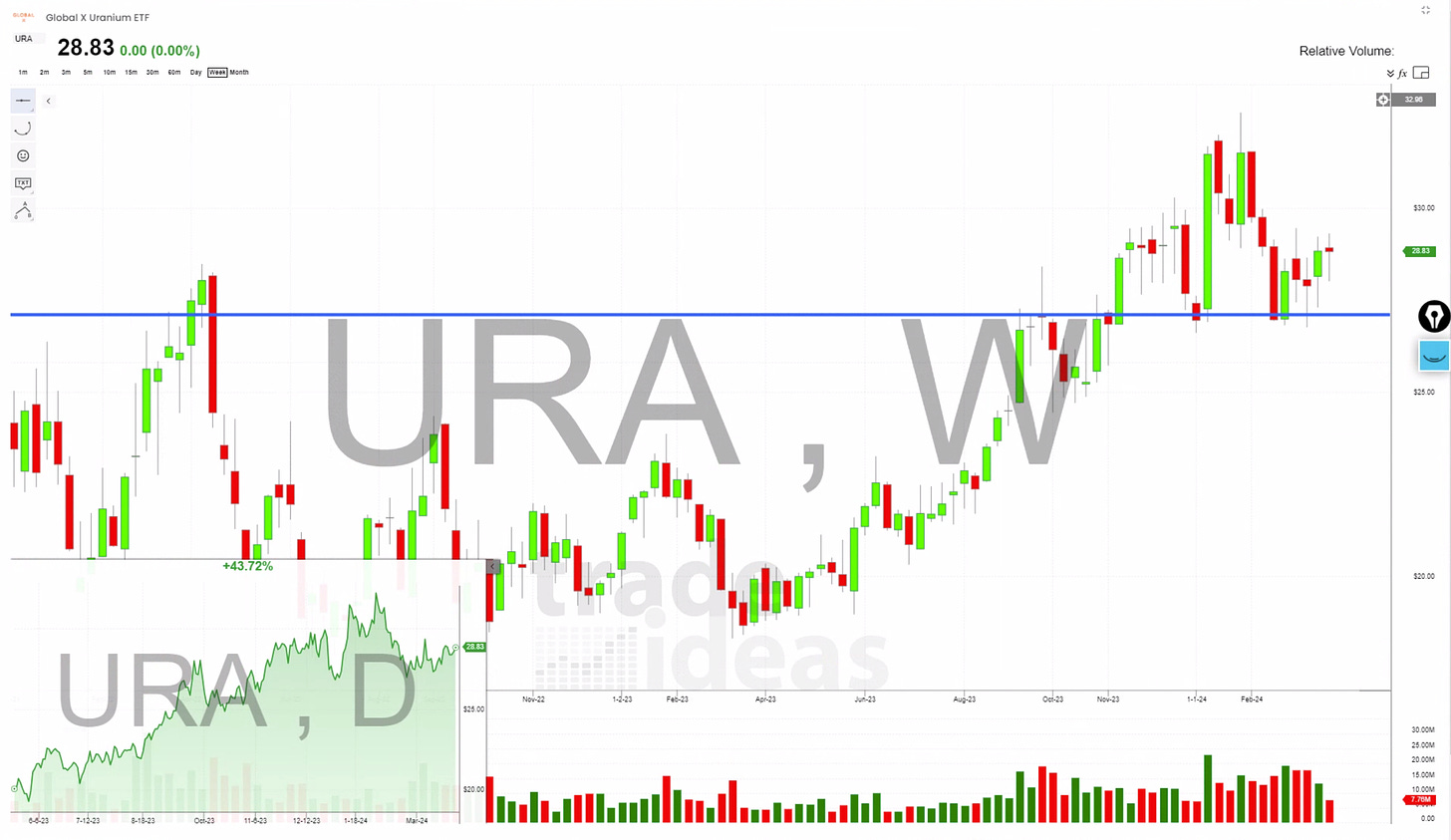

As we explore stock market ideas, it's crucial to identify sectors showing potential for significant movement. Uranium (URA) and metals and miners (XME) are sectors on my radar, displaying signs of breakout potential. Conversely, the oil sector, represented by USO, suggests caution due to recent price action that could indicate short-term weakness.

Experimenting with Algorithmic Insights

The experiment I'm introducing involves leveraging algorithmic analysis to identify promising stock and ETF opportunities. This approach combines quantitative analysis with traditional technical analysis, aiming to uncover high-potential trading candidates. I'm eager to hear your thoughts on this methodology and its potential as a future service offering.

Previewing Next Week's Watchlist

Looking ahead, I've identified several names and sectors that warrant attention based on our algorithmic analysis. These include dividend ETFs showing strong breakout patterns and individual stocks like Wabash National Corporation ($WNC), which exhibits a compelling cup-and-handle formation, signaling potential upside.

Getting Involved

To access the full list of stocks and ETFs under consideration and receive more detailed analysis, ensure you're signed up at statsedgetrading.com. This platform will host all related content, including the outcomes of our algorithmic exploration.

Closing Thoughts

This weekend's analysis highlights the dynamic nature of the markets, emphasizing the need for adaptability in our trading strategies. By staying informed and open to new methodologies, we can navigate the complexities of the market with greater confidence and precision.

Thank you for joining this weekend's market wrap-up. Remember to visit StatsEdgeTrading.com for further insights, educational resources, and to subscribe to our newsletter for the latest updates. Let's prepare for another exciting week in the markets, and as always, take some time to step away from the screens and recharge.

See you next week for more insights and analysis.